Author:

Florence Bailey

Date Of Creation:

21 March 2021

Update Date:

1 July 2024

Content

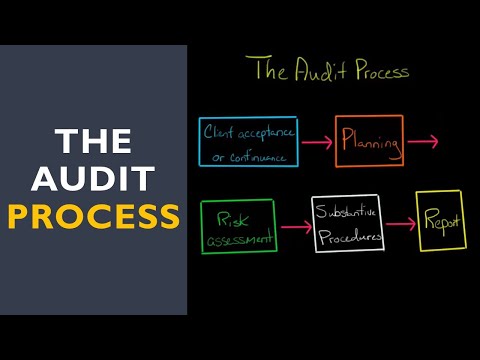

An accounting audit is the process of assessing the financial position of a company to ensure that accounting records are in line with standards, that monetary transactions are correct and that controls are within the firm. Regular audits of public corporations by other firms are required in most countries. However, small businesses do not have such strict reporting and control standards, therefore, auditing is not mandatory for them. However, knowing how to do basic accounting audits in your small business can help you better assess your company's strengths and weaknesses.

Steps

1 Consider the process of submitting financial documents to the accounting department. The first step in the accounting cycle is collecting all financial documents such as invoices, checks and bank statements and submitting them to the accounting department (or accountant) for processing. If this process is slow or unreliable, it will affect the accounting data and become unreliable on its own. You must ensure that information is immediately passed on to your accountant. In a very small business, your financial documents need to be organized and handy so that you can quickly review them.

1 Consider the process of submitting financial documents to the accounting department. The first step in the accounting cycle is collecting all financial documents such as invoices, checks and bank statements and submitting them to the accounting department (or accountant) for processing. If this process is slow or unreliable, it will affect the accounting data and become unreliable on its own. You must ensure that information is immediately passed on to your accountant. In a very small business, your financial documents need to be organized and handy so that you can quickly review them.  2 Pay attention to how you store your financial documents. All financial information must be organized and stored in a safe and secure place. All important data, such as bank statements, paid checks and cash registers, should be kept at least until the end of the reporting period. Keeping this information in an easily accessible place will help you resolve any questions or inaccuracies that arise.

2 Pay attention to how you store your financial documents. All financial information must be organized and stored in a safe and secure place. All important data, such as bank statements, paid checks and cash registers, should be kept at least until the end of the reporting period. Keeping this information in an easily accessible place will help you resolve any questions or inaccuracies that arise.  3 Verify all data in all financial documents of the company. Review all sources of accounting data, including the general ledger, the general ledger, and individual T-accounts. Make sure that all the data converges in all elements of your accounting system, promptly correct any inaccuracies. The account balance should be reviewed regularly, not just before the balance sheet is prepared at the end of the reporting period.

3 Verify all data in all financial documents of the company. Review all sources of accounting data, including the general ledger, the general ledger, and individual T-accounts. Make sure that all the data converges in all elements of your accounting system, promptly correct any inaccuracies. The account balance should be reviewed regularly, not just before the balance sheet is prepared at the end of the reporting period.  4 Keep track of the company's internal controls - actions that help protect against fraud, theft and other violations in the accounting process. Distribute accounting responsibilities as appropriate. For example, it is best not to allow one person to deal with cash and bookkeeping, as it will be easier for him to explain the missing money. Safes should be closed when not in use. Company computers and software must be protected with passwords. Retailers will benefit from installing CCTV cameras.

4 Keep track of the company's internal controls - actions that help protect against fraud, theft and other violations in the accounting process. Distribute accounting responsibilities as appropriate. For example, it is best not to allow one person to deal with cash and bookkeeping, as it will be easier for him to explain the missing money. Safes should be closed when not in use. Company computers and software must be protected with passwords. Retailers will benefit from installing CCTV cameras.  5 Compare internal accounting and external accounting. Check the correctness of your accounting by comparing it with the accounts for external settlements. For example, you can compare purchase receipts from vendors with your own purchase records. Please note that inconsistencies in the process may be due to external errors, such as incorrect counting by a supplier or purchaser.

5 Compare internal accounting and external accounting. Check the correctness of your accounting by comparing it with the accounts for external settlements. For example, you can compare purchase receipts from vendors with your own purchase records. Please note that inconsistencies in the process may be due to external errors, such as incorrect counting by a supplier or purchaser.  6 Check your internal tax records against your tax returns. Review your tax clearances and compare them with your internal tax data and related liabilities.

6 Check your internal tax records against your tax returns. Review your tax clearances and compare them with your internal tax data and related liabilities.

Tips

- You can hire an independent auditing consulting firm to conduct a financial audit of your business. By doing this routinely, you can keep your finger on the pulse of any potential financial shortcomings in your business.