Author:

Florence Bailey

Date Of Creation:

25 March 2021

Update Date:

1 July 2024

Content

A bill of exchange is a written agreement to repay a debt. It is sometimes called a receipt. This document is legally enshrined. Take the time to learn how to write a bill of exchange or receipt to help you collect your debts.

Steps

Method 1 of 1: Write your bill of exchange

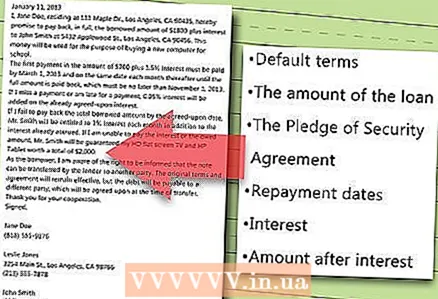

1 A secured bill of exchange must include the following required elements:

1 A secured bill of exchange must include the following required elements:- Basic conditions - what happens if the borrower does not pay on time.

- Loan amount - the amount that is borrowed

- Collateral - list all goods, services, and values used as security for the debt

- Maturity dates - the dates when the borrower must repay the bill

- Interest rate - the amount of interest accrued during the validity of the bill and the terms of missed payments, if any

- Amount after adding interest or PI (loan amount + interest).

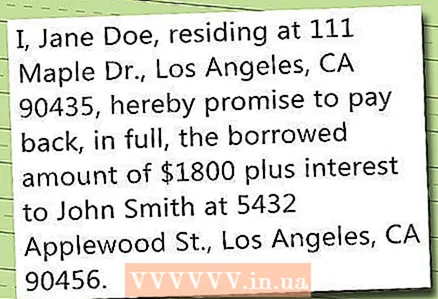

2 Highlight the terms of the agreement between the borrower and the lender. Conditions must include the following:

2 Highlight the terms of the agreement between the borrower and the lender. Conditions must include the following: - Loan principal is the amount borrowed to the borrower.

- Interest rate - the interest rate on the borrowed money. The interest rate is calculated on an annual basis.

- Maturity - the date of the debt maturity

3 Decide whether it is a bill of exchange secured or unsecured.

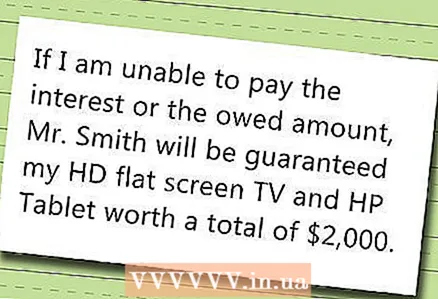

3 Decide whether it is a bill of exchange secured or unsecured.- A secured bill of exchange requires the borrower to provide goods, property, or services as collateral if the borrower fails to pay the debt. The value of the collateral must be equal to or greater than the principal amount of the debt.

- An unsecured bill does not require collateral.

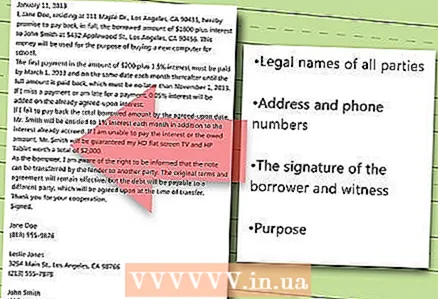

4 Make the bill legally secure. The document must include:

4 Make the bill legally secure. The document must include: - Legal names of all participants interested in the transaction.

- Address and telephone number of each interested party, including the lender.

- Borrower and witness signature. The creditor's signature may or may not be required. Requirements vary by country and by law.

- Target. What will the money be spent on. This may also be optional depending on the country and legislation.

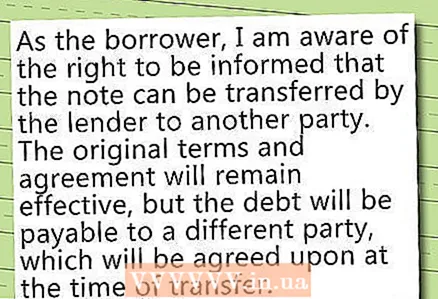

5 Inform the borrower about the right to transfer the bill.

5 Inform the borrower about the right to transfer the bill.- By default, payments on secured debts may result in the forfeiture of the mortgaged property instead of payment.

- The borrower has the right to be informed that the receipt can be transferred by the lender to a third party. The original terms and agreement will remain in effect, but the debt will be paid to the other party.

Tips

- Once a bill of exchange is signed, it becomes a legal document.

Warnings

- The lender should be aware that an unsecured loan is not repaid if the borrower files for bankruptcy.

Additional articles

How to come up with a beautiful signature

How to come up with a beautiful signature  How to write with your left hand

How to write with your left hand  How to come up with a good story

How to come up with a good story  How to restore a dry felt-tip pen

How to restore a dry felt-tip pen  How to change your handwriting

How to change your handwriting  How to design and develop interesting characters

How to design and develop interesting characters  How to develop beautiful handwriting How to improve your handwriting

How to develop beautiful handwriting How to improve your handwriting  How to sign a postcard

How to sign a postcard  How to write from a third person

How to write from a third person  How to renew a ballpoint pen refill

How to renew a ballpoint pen refill  How to keep a diary correctly

How to keep a diary correctly  How to write a friendly letter

How to write a friendly letter  How to get famous on Wattpad

How to get famous on Wattpad