Author:

Eric Farmer

Date Of Creation:

4 March 2021

Update Date:

27 June 2024

Content

Credit card debt can bring you a lot of problems. Credit card debt can grow very quickly and it is very difficult for many to get rid of it. It can be difficult without a good plan to pay off your credit debt. The following step-by-step plan can help you free yourself from debt and get your credit history in order.

Steps

Method 1 of 1: Loan Debt Relief

1 Get rid of your credit cards. First of all, get rid of all your credit cards. If you keep using them, it will be nearly impossible to get rid of debt. You should cut them to prevent further use.

1 Get rid of your credit cards. First of all, get rid of all your credit cards. If you keep using them, it will be nearly impossible to get rid of debt. You should cut them to prevent further use.  2 At the same time, you should not close your accounts until the need arises. Having credit accounts with an available line of credit is a positive mark in your credit history.

2 At the same time, you should not close your accounts until the need arises. Having credit accounts with an available line of credit is a positive mark in your credit history.  3 Collect your credit scores. You need to collect all the recent bills for each of your credit cards. You need bills to understand the total amount of debt in order to develop a plan to get rid of it. If you have lost your account, contact your credit institution for a new copy.

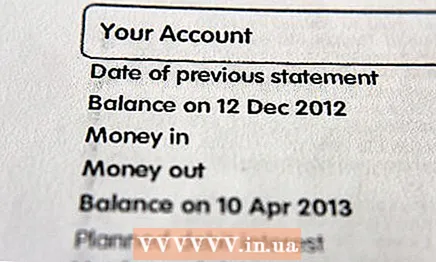

3 Collect your credit scores. You need to collect all the recent bills for each of your credit cards. You need bills to understand the total amount of debt in order to develop a plan to get rid of it. If you have lost your account, contact your credit institution for a new copy.  4 Examine your accounts. Go through each account and make a list of the constituent elements of your debt. In your list, you must include each card, its name, balance, interest rate and the amount of the minimum monthly payment. Also check if the limit on any of the cards has been exceeded, and if there are any additional payments on these accounts.

4 Examine your accounts. Go through each account and make a list of the constituent elements of your debt. In your list, you must include each card, its name, balance, interest rate and the amount of the minimum monthly payment. Also check if the limit on any of the cards has been exceeded, and if there are any additional payments on these accounts.  5 Calculate your total debt. Add up the balances for each card to get the total amount of your debt.

5 Calculate your total debt. Add up the balances for each card to get the total amount of your debt.  6 Create a monthly budget. Now that you know how much you owe, it is time to determine how much you can spend on paying off your debt. You should create a budget that reflects your income and expenses. For now, don't include debt payments in this budget. Subtract your expenses from your income to determine the amount of money per month that you can use to pay off the debt.

6 Create a monthly budget. Now that you know how much you owe, it is time to determine how much you can spend on paying off your debt. You should create a budget that reflects your income and expenses. For now, don't include debt payments in this budget. Subtract your expenses from your income to determine the amount of money per month that you can use to pay off the debt.  7 Create a debt payment plan. Now that you know the amount of debt and the amount of money you need to spend per month to pay off it, you can create a payment plan. There are many debt repayment strategies. Many people prefer to pay off the debts first on the cards with the least amount of debt. Using this method, you will pay out the minimum amount of money.Any free money left over after the monthly payment of all cards should be used to pay out the card with the lowest balance. By following this strategy, you can quickly see the result of your actions. Small payments are paid first and you have a sense of achievement.

7 Create a debt payment plan. Now that you know the amount of debt and the amount of money you need to spend per month to pay off it, you can create a payment plan. There are many debt repayment strategies. Many people prefer to pay off the debts first on the cards with the least amount of debt. Using this method, you will pay out the minimum amount of money.Any free money left over after the monthly payment of all cards should be used to pay out the card with the lowest balance. By following this strategy, you can quickly see the result of your actions. Small payments are paid first and you have a sense of achievement.  8 Recalculate the amount owed monthly. Each month, you should write down the balance of all your cards. If you notice additional payments or anything that appears to be wrong, contact your lending institution right away. Increasing debt is what you least want. Now your task is to pay off the debts in full in order to get rid of them.

8 Recalculate the amount owed monthly. Each month, you should write down the balance of all your cards. If you notice additional payments or anything that appears to be wrong, contact your lending institution right away. Increasing debt is what you least want. Now your task is to pay off the debts in full in order to get rid of them.  9 Create a budget monthly. Your income and expenses may vary from month to month, so it is very important to check your budget on a monthly basis and make any necessary adjustments. This way you can be sure you know what is happening with your money and avoid financial problems that can lead to new debt.

9 Create a budget monthly. Your income and expenses may vary from month to month, so it is very important to check your budget on a monthly basis and make any necessary adjustments. This way you can be sure you know what is happening with your money and avoid financial problems that can lead to new debt.  10 After paying off the debt on the card, stop using it in the future. As soon as you pay off the debt on the card, abandon its further use. This will save you from the emergence of new debts.

10 After paying off the debt on the card, stop using it in the future. As soon as you pay off the debt on the card, abandon its further use. This will save you from the emergence of new debts.  11 Follow the plan. It is very important to follow the set plan. Keep track of your budget and expenses. Stop using plastic cards altogether. Make sure you are in control and always know what is going on with your debts.

11 Follow the plan. It is very important to follow the set plan. Keep track of your budget and expenses. Stop using plastic cards altogether. Make sure you are in control and always know what is going on with your debts.  12 Always try to pay more than the minimum payout. In this case, your debt will be paid off earlier, and the interest on the loan will be significantly lower.

12 Always try to pay more than the minimum payout. In this case, your debt will be paid off earlier, and the interest on the loan will be significantly lower.

Tips

- If your debt seems overwhelming to you, or you cannot pay it in any way, seek professional advice from a specialist company. These companies can help you negotiate with your lending institution and create a payment plan that works in your circumstances.

Warnings

Avoid the temptation to keep your credit card "just in case." If you've started paying off your credit card debt, then you don't want to accumulate more debt. All your calculations must be done in cash.

What do you need

- credit card accounts

- calculator

- monthly bills

- computer

- diligence