Author:

Alice Brown

Date Of Creation:

24 May 2021

Update Date:

1 July 2024

Content

- Steps

- Method 1 of 5: Transferring Funds with PayPal

- Method 2 of 5: Transfer funds via Western Union, MoneyGram or Unistream

- Method 3 of 5: Sending Funds with an Emergency Transfer

- Method 4 of 5: Send money by wire transfer

- Method 5 of 5: Sending money via a prepaid debit card

Do you want to transfer funds to your friends or relatives who are in dire need of money, and do it as quickly as possible? This is one of those questions, to answer which you should definitely take a closer look at the services available and compare them, since transfer fees can vary greatly.

Steps

Method 1 of 5: Transferring Funds with PayPal

1 Make sure the sender and recipient have PayPal accounts. PayPal is one of the easiest and cheapest ways to send money abroad, but both you and the recipient will need to open a PayPal account. If you don't already have a PayPal account, don't worry - it's very easy to set up. For more detailed instructions, see the article "How to open an account with PayPal".

1 Make sure the sender and recipient have PayPal accounts. PayPal is one of the easiest and cheapest ways to send money abroad, but both you and the recipient will need to open a PayPal account. If you don't already have a PayPal account, don't worry - it's very easy to set up. For more detailed instructions, see the article "How to open an account with PayPal".  2 Log in to your account. Enter your PayPal ID (email address provided during registration), password, and then click the "Login" button at the top of the page.

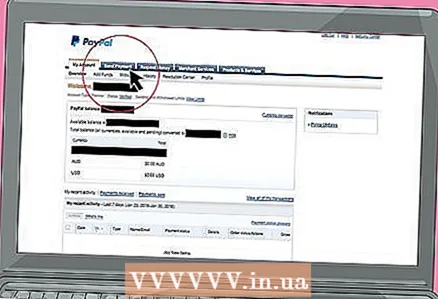

2 Log in to your account. Enter your PayPal ID (email address provided during registration), password, and then click the "Login" button at the top of the page.  3 Go to the required section. When you are logged into your account, you will be on the "Overview" page. Open the "Submit Request" tab at the top of the overview page, or click the "Pay or Send Funds" button below it. Select one of the options, after which you will be taken to a page where you will need to specify who you want to send funds to: a seller or friends and family. Select "Send money to friends or family."

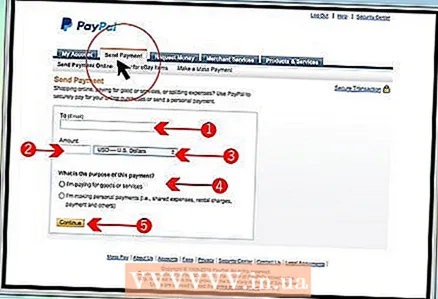

3 Go to the required section. When you are logged into your account, you will be on the "Overview" page. Open the "Submit Request" tab at the top of the overview page, or click the "Pay or Send Funds" button below it. Select one of the options, after which you will be taken to a page where you will need to specify who you want to send funds to: a seller or friends and family. Select "Send money to friends or family."  4 Enter the required information. You will be asked to enter the recipient's PayPal ID and transfer amount.

4 Enter the required information. You will be asked to enter the recipient's PayPal ID and transfer amount. - The commission for sending money abroad depends on the recipient country. Decide who will be charged with the commission and PayPal will calculate the amount to be charged from your account before sending funds. It is worth noting that international transfers via PayPal usually have a relatively small fee.

- International transfers can be made in twenty currencies. For a list of countries where PayPal is available, go to: https://www.paypal.com/en/webapps/mpp/country-worldwide.

- Pay attention to the exchange rate. Although PayPal offers favorable terms for international transfers, their earnings are based on using a slightly lower exchange rate than elsewhere.

Method 2 of 5: Transfer funds via Western Union, MoneyGram or Unistream

1 Consider if you need a physical location for your deposit. If you want to transfer money to a valid location, Western Union and MoneyGram are the way to go. However, as far as Western Union and MoneyGram are concerned, sending a transfer to a physical location will usually cost more than using an online service.

1 Consider if you need a physical location for your deposit. If you want to transfer money to a valid location, Western Union and MoneyGram are the way to go. However, as far as Western Union and MoneyGram are concerned, sending a transfer to a physical location will usually cost more than using an online service. - So, as of September 2015, the MoneyGram commission for a $ 200 money transfer from the United States to Mexico is $ 9.99 versus $ 4 for the same service carried out online.

2 Determine if online deposit is right for you. Transferring funds over the Internet is the easiest and most convenient way to conduct transactions. International money transfer services are provided by all three major transfer companies via internet platforms. Choose the one that suits you.

2 Determine if online deposit is right for you. Transferring funds over the Internet is the easiest and most convenient way to conduct transactions. International money transfer services are provided by all three major transfer companies via internet platforms. Choose the one that suits you. - Unistream also has a wide geography of distribution and a rather dense network of partners. However, if you decide to send money using it, for example, to the United States, then by going to the system's website, find out that this is not possible in every overseas city. Uni Stream also has pretty good rates. The service cost starts from 3.5% of the money transfer amount.

- It usually depends on the country, but both Western Union and MoneyGram offer competitive rates and a wide network of service points.

3 Decide on a payment method. For the recipient, paying with a debit card is the fastest way to receive a money transfer arriving within minutes, but it also charges the highest fees, far exceeding similar services. A direct transfer from a bank account costs significantly less, but the transfer process can take several days.

3 Decide on a payment method. For the recipient, paying with a debit card is the fastest way to receive a money transfer arriving within minutes, but it also charges the highest fees, far exceeding similar services. A direct transfer from a bank account costs significantly less, but the transfer process can take several days. - With MoneyGram, just like Western Union, you can pay in person in cash or with a debit card, or online with a debit card or direct transfer from a bank account.

4 Decide how you want to receive your funds. While it is not unusual to withdraw cash at a point of service, the money can be deposited into the recipient's bank account and, depending on your location, on a debit card, mobile wallet, or delivered in person. Be that as it may, when choosing, take into account possible delays and commissions (including the commission of the recipient's bank).

4 Decide how you want to receive your funds. While it is not unusual to withdraw cash at a point of service, the money can be deposited into the recipient's bank account and, depending on your location, on a debit card, mobile wallet, or delivered in person. Be that as it may, when choosing, take into account possible delays and commissions (including the commission of the recipient's bank).  5 Contact the recipient. When the recipient decides to withdraw funds at a service point, a specific procedure must be followed. After the transfer service has received the money from you, you will be given a code to access the funds at the pick-up location. Contact the specified recipient and tell him the code. When the funds arrive, the recipient must communicate this code to the cashier and receive the money.

5 Contact the recipient. When the recipient decides to withdraw funds at a service point, a specific procedure must be followed. After the transfer service has received the money from you, you will be given a code to access the funds at the pick-up location. Contact the specified recipient and tell him the code. When the funds arrive, the recipient must communicate this code to the cashier and receive the money. - In case you do not know the recipient, the withdrawal code / system has a unique set of vulnerabilities.Money transfer services such as MoneyGram and Western Union often attract the attention of scammers. Make sure you are sending money to someone you trust.

Method 3 of 5: Sending Funds with an Emergency Transfer

1 Find out if this service is available in the recipient's country. Some large banks offer special services for transferring funds abroad at a lower cost than using bank transfer. However, the list of countries of destination is generally narrower than with PayPal or MoneyGram or Western Union money transfer services.

1 Find out if this service is available in the recipient's country. Some large banks offer special services for transferring funds abroad at a lower cost than using bank transfer. However, the list of countries of destination is generally narrower than with PayPal or MoneyGram or Western Union money transfer services.  2 Gather the information you need. Each bank has its own procedure, but as a rule, in order for them to process your request, you will have to provide the bank with certain information. This information may consist of the following data:

2 Gather the information you need. Each bank has its own procedure, but as a rule, in order for them to process your request, you will have to provide the bank with certain information. This information may consist of the following data: - The name, address and phone number of the recipient, as well as the name of the service point where the funds will be withdrawn.

- Specify a physical address, not a post office address.

- Indicate which number you left: from a landline or mobile phone.

- Find out how the recipient is going to receive the funds: in cash or in the form of a deposit. If funds are transferred to an account, you will need to provide the beneficiary's account number.

- The name, address and phone number of the recipient, as well as the name of the service point where the funds will be withdrawn.

3 Send money. Don't forget to tell the recipient what currency the funds will be available in. Some banks, for example, use local currencies for some countries and dollars for others. If the money is transferred in dollars, the recipient may have to pay for currency exchange services.

3 Send money. Don't forget to tell the recipient what currency the funds will be available in. Some banks, for example, use local currencies for some countries and dollars for others. If the money is transferred in dollars, the recipient may have to pay for currency exchange services.

Method 4 of 5: Send money by wire transfer

1 Decide on the amount of funds to be sent. Wire transfer is one of the most expensive ways to transfer money abroad, typically between $ 30 and $ 60, but it can handle much larger amounts of money than most other money transfer methods. Therefore, before making a wire transfer, make sure that the amount of the transferred funds is too high to be sent in another way.

1 Decide on the amount of funds to be sent. Wire transfer is one of the most expensive ways to transfer money abroad, typically between $ 30 and $ 60, but it can handle much larger amounts of money than most other money transfer methods. Therefore, before making a wire transfer, make sure that the amount of the transferred funds is too high to be sent in another way. - Daily limits for money transfer will depend on the bank and the type of service you pay on a regular basis. For example, the average Citibank client has a $ 50,000 limit on international transfers. But for special clients, this limit has been increased to $ 250,000 per day.

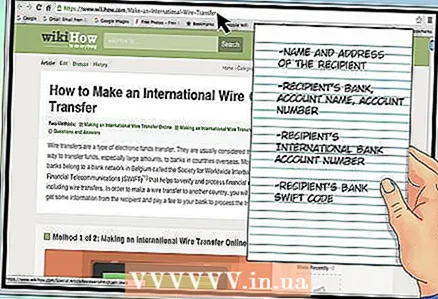

2 Gather all the required paperwork. As a rule, the list of required documentation is fairly standard. You will need the name and address of the beneficiary, the name of the beneficiary's bank, and the name of the account to which the funds will be transferred. In addition to this, you will need the beneficiary's account number or international bank account number and the beneficiary bank's SWIFT code.

2 Gather all the required paperwork. As a rule, the list of required documentation is fairly standard. You will need the name and address of the beneficiary, the name of the beneficiary's bank, and the name of the account to which the funds will be transferred. In addition to this, you will need the beneficiary's account number or international bank account number and the beneficiary bank's SWIFT code.  3 Specify the currency of the transfer. You need to indicate in what currency the recipient should receive the money. Consider the fact that in most cases it will be much more profitable if the recipient receives the money in their national currency. If the exact amount of the transferred funds matters to you, be sure to find out at what rate the funds are exchanged in the bank.

3 Specify the currency of the transfer. You need to indicate in what currency the recipient should receive the money. Consider the fact that in most cases it will be much more profitable if the recipient receives the money in their national currency. If the exact amount of the transferred funds matters to you, be sure to find out at what rate the funds are exchanged in the bank.  4 Inform the recipient of the transfer times. Be sure to ask your bank staff how long the wire transfer will take. As a rule, the transfer takes place within one or two days, but sometimes it can take up to fifteen business days. The exact time will depend on the amount of the transfer, the moment of sending and the country of destination.

4 Inform the recipient of the transfer times. Be sure to ask your bank staff how long the wire transfer will take. As a rule, the transfer takes place within one or two days, but sometimes it can take up to fifteen business days. The exact time will depend on the amount of the transfer, the moment of sending and the country of destination.

Method 5 of 5: Sending money via a prepaid debit card

1 Find a suitable prepaid debit card. Some companies provide their customers with prepaid debit cards with the ability to send money abroad. Each type of debit card has its own fee, but they all necessarily charge an activation fee. In addition, some cards charge fees for deposits and cash withdrawals.

1 Find a suitable prepaid debit card. Some companies provide their customers with prepaid debit cards with the ability to send money abroad. Each type of debit card has its own fee, but they all necessarily charge an activation fee. In addition, some cards charge fees for deposits and cash withdrawals. - You can send money abroad with a debit card in two ways. You can buy an international gift card Visa or Mastercard with a final, non-refundable amount on the account. You can also open a large replenished account on the card, from which users with a subaccount can withdraw money.

2 Add money to the card. The available deposit methods will depend on the type of card used (although they all accept cash). However, some rechargeable cards allow you to transfer money to your card directly from your bank account.

2 Add money to the card. The available deposit methods will depend on the type of card used (although they all accept cash). However, some rechargeable cards allow you to transfer money to your card directly from your bank account.  3 Send the card to the recipient. Whether you are using a prepaid card or a sub-account card, you will need to send it to the recipient or recipients. Use the services of a postal service or a private carrier. Be sure to inquire about the daily limit on cash withdrawals and fees, as there are usually restrictions on the number of transactions per day and cash withdrawals.

3 Send the card to the recipient. Whether you are using a prepaid card or a sub-account card, you will need to send it to the recipient or recipients. Use the services of a postal service or a private carrier. Be sure to inquire about the daily limit on cash withdrawals and fees, as there are usually restrictions on the number of transactions per day and cash withdrawals.