Author:

Peter Berry

Date Of Creation:

15 February 2021

Update Date:

1 July 2024

Content

Losing your wallet can be quite frustrating, embarrassing, and if it falls into the wrong hands, your finances and your honor can be at stake. In the event that you cannot find the wallet, even though you have searched everything, you need to protect your identity and credit card in time to avoid falling into a difficult situation. Read the article below to regain control of your property.

Steps

Part 1 of 3: Dealing with lost wallets

Search for 24 hours before canceling credit cards or getting a new ID. You have 48 hours to report the loss of your card before you have to pay any fees, so make the most of this time. If know exacly If your wallet is lost, you need to proceed to the next step immediately.

- Look carefully in clothes, bags and bags.

- Contact recently visited places, such as restaurants and bars.

- Search indoors systematically, starting from the surrounding radius to the center of the room.

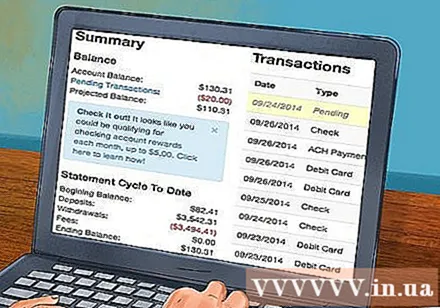

Go online and check illegal money. Check your bank and credit accounts to find out if any purchases have been made since the card was lost. If so, the card was most likely stolen.

Notify your bank of card loss. Contact your bank and report card loss. Offer the full amount of illegal transactions immediately. Record the date and time of the interaction in the event of a dispute.

Cancel credit and debit cards. Contact relevant banks and request a new card. If you have card copies, you should cut them off and destroy them. You will need to provide your bank details to confirm the lost card.- Master Card: 1900.54.54.13

- Visa: 84.8.38246795

- Amex: 84.8.3824 6795

- Discover: 1900.558.868

Contact your credit bureaus to check for fraudulent transactions on your credit card network. This helps prevent serious variations in your credit score. You can be contacted by the following phone numbers:- KVLC: 38257000

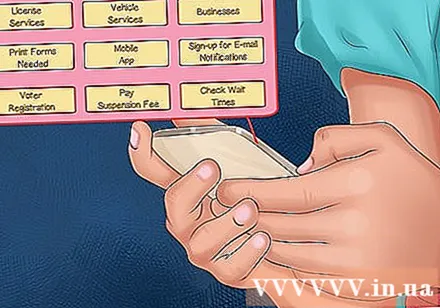

Register as a new identity card. Call, go in person, or go online to check your local policy for new cards. Many regulations allow for a free online replacement.

Contact your insurance company and request a new account number. You should do this for medical, dental, and motorbike insurance to avoid possible identity theft.

Report loss of property to the police. The police will notify you when a problem arises. In addition, notifying the police also helps you resolve disputes arising from your credit or bank card if something goes wrong or your identity card is stolen.

- You need to submit a report to the police, provide a record of operations to the bank when there is a dispute.

Copy the entire tag and identity for later reference. It is easier to dispose of a lost wallet if you have copies of all documents and cards. Do not leave your Social Security card in your wallet or even a copy. advertisement

Part 2 of 3: Find your wallet again

Keep calm, focus, and think. Have you ever been so pissed that you can't find a remote or a cereal box, then get more frustrated that no one in the house has put your things in the right place, and finally calmed down and realized Is the remote or the cereal box in the same place you can't see?

- When we panic over losing things, especially important things like wallets, it's easy to lose focus and ignore obvious clues or even those that lie right in front of us.

- Take a few deep breaths, then relax your mind. Don't think about the possible consequences of not finding your wallet. You should focus on the wallet, what it should be, and where it could be. Then began to search carefully.

Find places where the wallet is likely to be discovered. The first time searching in a panic is often ineffective. Now that you are calmer, you can check the places where you think your wallet is, such as in your trouser pocket on the chair, the bedside table, the work desk, and then catch early search thoroughly.

- Look in areas around a fixed location, such as the floor under the nightstand, other drawers / trouser pockets, etc.

Recall the event that happened. Recall where you last had your wallet in hand, like when you paid for coffee at the shopping mall, took it from your bedside table, etc., and rewind what happened until then.

- Go through all the clothes you have worn during that time period, and look for all pockets and pockets. Also look for it in a jacket and bag.

- Recalling events can help evoke memories, so don't miss any details even if it doesn't seem like the place where you lost your wallet.

- Consider if someone accidentally grabbed your wallet, like a curious kid? Or a friend is trying to help? Contact anyone who accidentally got your wallet inadvertently.

Get in touch with places you've just visited. Do you go to a restaurant, theater, office, or even a friend's house? You can call and ask if they see your wallet or not.

- You need to describe your wallet. Knowing your name on your ID and credit card is enough to prove your wallet, but also describe a family photo or an ice cream card in your wallet.

- Don't expect the business to contact if they find your wallet. Maybe they put the wallet together with the lost belongings but then forget about it, or the place has a no-contact policy for security reasons, such as not disclosing the place you visited without the Allows calls to customers' homes.

Look carefully for places where you don't think your wallet will be. Extend your search further, such as an entire bedroom, second floor, or an entire house.- Look in frequented areas in the home / work place where you rarely leave your wallet, but there may be exceptions in this case, for example the kitchen or the bathroom, etc.

- Search methodically by dividing the room into small areas and then starting to search each zone at a time), or spiraling (searching by the outer perimeter, then back in the center).

- For some search methods, see Finding a Lost Object

Assume that the wallet was stolen if you can't find it within a day or so. Don't rush to make calls to cancel your payment cards, ID cards, etc. without doing a thorough search as it will make you even more frustrating. It is best to look in the pocket of your pants first and then proceed to the next steps. This means a little more caution in case you can't find your wallet again shortly.- Liability for purchases made on stolen debit cards begins after 48 hours (up to VND1 million), and other lost cards also have a deadline for notice. And even if you are not responsible for credit card purchases, you can prevent fraudulent transactions from happening instead of dealing with it after it is done.

- Start submitting information listed in the Relevant Section of this article.

Part 3 of 3: Protect your identity and finances

Contact your bank and report your debit card loss. The laws governing debit and credit cards are usually not fixed, so make a call first and within 48 hours of losing your wallet to protect yourself from fraudulent transactions.- If notified to a financial institution within 48 hours, your maximum debt is VND 1 million; In 60 days, the number could reach 10 million VND; after that time, the debt will be unlimited if someone uses your card.

- The debit card is usually linked to the checking account, and the checking account can be linked to other accounts, so you will receive a new card / debit number and a new account number. In addition, you will also need a new checkbook.

- Remember that automatic payments are made through your debit card or checking account (phone bill, life insurance money, etc.). You need to update the payment information in these fields when you change your account number.

- This may be quite inconvenient, but you should withdraw all the money in your bank account instead of having to go and recover it.

Report loss of credit card. You do not need to cancel them as it will be mandatory to apply for a new card continuously. Upon notification of loss / theft, you will receive a card with a new account number but still be able to maintain the current account status.- The maximum amount owed for fraudulent credit cards is 1 million VND, and 0 VND if you contacted the company before the card was used illegally. However, you should prevent fraudulent transactions early instead of trying to resolve it later.

- Save the credit card company's customer service number (and the bank number) so you can get in touch with them quickly.

- Don't forget store-issued credit cards.

Submit a police report on lost or stolen wallets. Finding a lost wallet may not be their top priority, but applying is a safe way to protect yourself in any case.- When you apply, the police will create an official record regarding the loss of your property and your recovery efforts. This is the best evidence for claiming insurance, resolving debt fraud, identity theft, or other problems that may arise.

- Provide as detailed and accurate information as possible, with specific time frames and locations. Save a copy of the statement for your records.

Call the credit bureau to protect your credit score. In Vietnam, you only need to contact one of the banks or finance companies because they are asked to share information, but if you contact both banks and finance companies, there is no What's the problem.- Fraudulent transaction monitoring will be performed on your account, which means that any request for credit extension will require identity verification.

- Any action to prevent problems from arising that affect credit scores caused by fraud is also worth the time and effort.

- Fraud tracking and multiple payment charges, sometimes available through your credit card, provide immediate notification of fraudulent activity.

Replace with a new identity card. No one wants to go to the police station to get a new card, but don't expect the police to believe the story of a lost wallet (and driver's license) in case you get stopped.- Each locality has different rules and procedures for replacing a lost or stolen license, but you will need to show up and pay the fee for a new card.

- Other types of identification such as student, employee, etc., must also be replaced.

List things in the wallet. Remember as much as you can, and see if there is something that needs to be announced or replaced.

- Don't ignore the discount card or even the library card. These cards may seem insignificant compared to debit and credit cards, but they can contain personal information that you don't want to get into the hands of others.

- Basically, you need to start over to restore even the smallest things in your wallet, related to your finances and identity.

Advice

- Do not keep all cash in your wallet. Use a money clip to keep some, or keep some money in a safe place in the house and carry just the right amount. This way, you will limit the amount of money you will lose in case your wallet gets lost.

- Regularly checking the wallet is still with the person. It only takes a few seconds but will help you find it again if you just lost it. Make it a habit to check it regularly: every time you leave your seat, while walking, etc. by touching your back pocket or quickly glancing at your bag to make sure your wallet is still there.

- If you keep your wallet in the back pocket, you need to make sure the bag is not too loose. The wallet will stay fixed in the pocket if the wallet is not thick and the bag fits tightly.

- Keep your cards separate in your card book. When you lose your wallet, you can still use the card, and when you lose your card / card book, you can still use cash.

- If you are in the habit of keeping your wallet in the back pocket, you should bring pants with buttons in the back pocket and use it to lock.

- Do not leave wallets in your pocket while on the move or in crowded places, unless secured with leashes. This helps limit the likelihood of someone picking up their own pockets or, if you are more careful, use a money belt.

- Write your phone number and a short message on a piece of paper or card and place it in the inner drawer of your wallet. This causes an honest person to return the wallet to you.

- Write down important account numbers before losing your wallet, or check account numbers and contact information in paperwork or phone bills. In the event of a wallet loss, these are important numbers to keep in mind.

- Look for purses in used clothes (pockets, etc.) and tumble dryers.

Warning

- Do not store your pin number, password or Social Security number in your wallet.