Author:

Laura McKinney

Date Of Creation:

2 August 2021

Update Date:

1 July 2024

Content

Knowing how to calculate interest per day can be very helpful in calculating how much money you will earn or pay when you pay off a loan. The method of calculating interest per day is also used in many business applications, such as calculating interest payable from customers or suppliers. Calculating interest in personal finance can help you estimate the cost of closing a mortgage or evaluate options for saving and investing. Here's how to calculate the exact interest per day for a number of different applications.

Steps

Method 1 of 3: Calculate daily interest with a calculator

Gather the necessary information to calculate interest. The required information includes the amount you will invest or save, the term and the recommended interest rate. You can have more variables if you want to compare different options.

- You will have to do a separate problem for each option to be able to compare.

Start the spreadsheet application on your calculator to calculate interest rates. You need to enter the data from Step 1 into specific cells on the worksheet and then formulate a formula. Once you've formulated the formula, you can easily evaluate a variety of options.- Popular spreadsheet programs are Microsoft Excel and iWork Numbers.

- You can also find a free spreadsheet app online like Google Docs or Zoho Sheet.

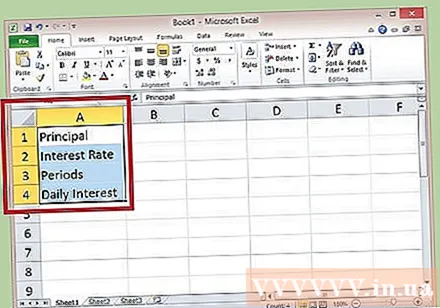

Assign a label to row 1-4 of column A, which is Principal, Interest, Term, and Daily Interest, respectively. You can expand a cell by clicking on the line to the right of the column number, A, B, or C, etc. (the arrow indicates you can perform an action.) But this label is for reference only.

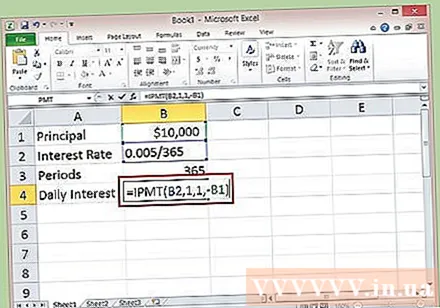

Enter the specific numbers in rows 1-3 of column B to match the label in column A. Convert the percentage rate to decimal form by dividing the percentage rate by 100 by the percentage rate. Temporarily leave cell B4 (Interest per day) blank.- The interest rate is usually calculated annually; So to get the daily rate you need to divide the annual rate by 365.

- For example, if your invested capital is $ 10,000, and this savings earns an interest rate of 0.5%, you would enter "10000" in cell B1 and enter "= 0.005 / 365" in cell B2.

- Maturity determines how long your investment is left untouched, unless interest accruals are added. In this example, we will use a one-year period to calculate, so cell B3 will be entered "365".

In cell B4, create a function that calculates the daily interest at the annual rate. This function is a special formula provided by a spreadsheet designer to help make your calculations easier. To create a function, first click your mouse in cell B4 to select it and then click inside the formula bar.

- Enter "= IPMT (B2,1,1, -B1)" in the formula bar. And then press the Enter key.

- The daily interest earned from the above capital, for the first month, is $ 1,370 / day.

Method 2 of 3: Manually calculate the daily interest

Gather the details needed to calculate interest. The required data includes how much you will invest or save, how long you will invest or save, and the recommended interest rate. You may need several different interest rates if you want to compare multiple options.

Convert interest rates from percentages to decimals. Divide your percentage rate by 100, then divide this number by the number of days in the year, 365 days. The result is the interest rate to replace the formula.

- The annual percentage of 0.5% or 0.005, divided by 365, is 0.00137%, or 0.0000137.

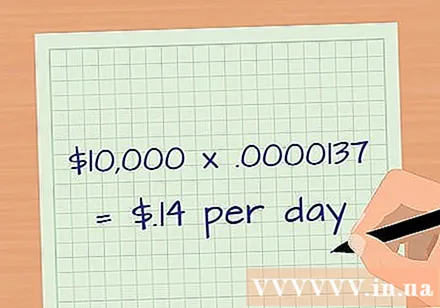

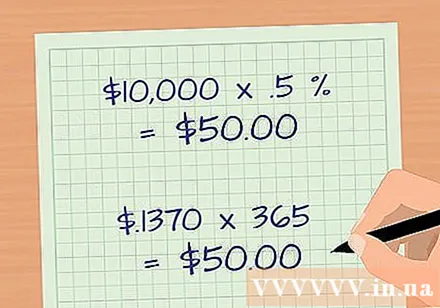

Multiply the principal by the daily interest rate. Also taking the data from the example in Step 1, the principal amount is 10,000 USD, multiplied by 0.0000137, we get 0.1370 USD. After rounding, the amount of interest you earn is about 0.14 USD / day.

Check back your calculations. Multiply the principal amount, $ 10,000, by the annual interest rate as a percentage of 0.5% or 0.005 to manually calculate the interest. The result is 50 USD. Meanwhile, you take the daily interest of $ 0.1370 multiplied by 365 days; also got the result of 50 USD. advertisement

Method 3 of 3: Calculate the daily accrued interest

Gather the necessary information. Unless you withdraw your accrued daily interest, it will be added to your principal, which is a great way to save. To calculate accrued interest, you need your principal amount, annual interest rate, number of accrual periods per year (365 days) and your deposit period.

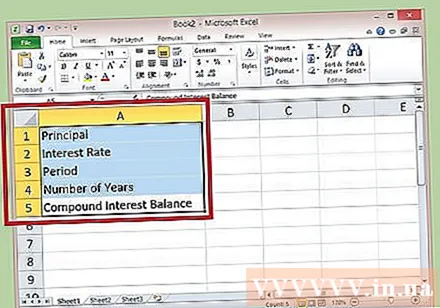

Open your favorite spreadsheets, such as Microsoft Excel. Assign the labels for rows 1-5 in column A as Principal, Interest Rate, Term, Years, and Balance of Interest, respectively. You can expand a cell by clicking on the line to the right of the column number, A, B, C, etc. (the arrow sign indicates that you can perform an action).Note: these labels are for reference only.

Enter detailed numbers for the calculation in rows 1-4 of column B, so that they match the side label. The period is 365 and the number of years is the number of years you want to calculate. Temporarily leave cell B5 blank (box with Accumulated interest).

- For example, principal = 2,000 USD, interest rate = 8% or 0.08, term = 365, and number of years is 5.

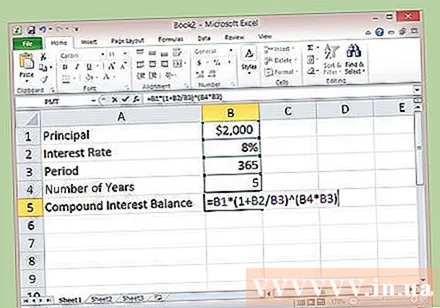

Click in cell B5 to select the cell, and then click inside the formula bar to enter this formula: = B1 * (1 + B2 / B3) ^ (B4 * B3) and press Enter. Total daily principal and interest accrued is $ 2,983.52 after 5 years. Through this, we can see that reinvesting the earned interest is a very good idea.

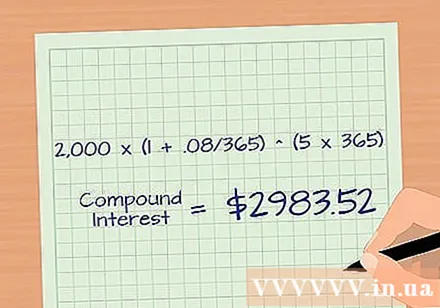

Manually calculate your accrued interest. Apply the formula: Initial investment amount * (1 + Annual interest rate / Cumulative term in the year) ^ (Number of years * Tenor in the year). The ^ here is the power exponent.

- For example, using the data from the example in Step 3, principal: $ 2,000, interest rate: 8% or 0.08, cumulative term: 365 and number of years: 5. Accrual interest = 2,000 * ( 1 + .08 / 365) ^ (5 * 365) = $ 2,983.52.

Advice

- You can use the IPMT function to determine the daily interest on your mortgage. For example, if you sell your home in the middle of the month your final balance will change each day. Your daily interest rate can tell exactly how much your balance is.

- You can also use the IPMT function to determine the daily interest on slow payments of customers.

Warning

- Each country, or each region, state (for the US) has different regulations on interest rate limits and on interest accruals. Therefore, when applying to business, you need to carefully and fully research all the laws of the region or state in which you do business before establishing and incorporating policies to calculate interest rates for slow payment.