Author:

Peter Berry

Date Of Creation:

15 February 2021

Update Date:

2 July 2024

Content

Salary increases can take many forms. Maybe you get a raise, a promotion, or accept a completely new and higher-paid job. Regardless, you should know how to calculate a specific percentage increase based on your old salary. Since inflation and cost of living statistics are also often expressed as a percentage, calculating a percentage of wage increase can help you compare increases with other factors, such as inflation. Learn how to calculate a percentage of salary increase will also help you compare your salary against others in the same industry.

Steps

Part 1 of 2: Calculate percentage of salary increase

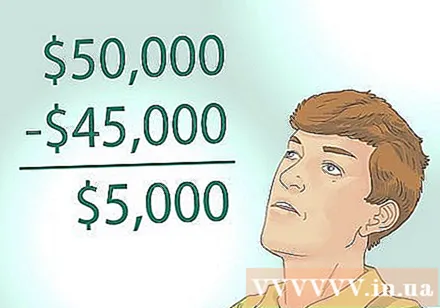

Subtract the old salary from the new salary. Let's say you make $ 45,000 a year at your old job and you accept a new position with an income of $ 50,000 a year. This means that you will subtract $ 45,000 from $ 50,000. We have, $ 50,000 - $ 45,000 = $ 5,000.- If you receive an hourly wage and don't know your total annual income, simply subtract your old hourly salary from your new hourly salary. For example, if the old hourly wage is $ 14 / hour and the new salary is $ 16 / hour, then you have $ 16 - $ 14 = $ 2.

Divide the difference by the old salary. To calculate an increment as a percentage, you must first calculate a decimal number. To get a decimal, divide the difference calculated in Step 1 by the old salary.- Using the example in Step 1, divide $ 5,000 by $ 45,000. We have, $ 5,000 / $ 45,000 = 0.111.

- If you are calculating the percentage of your hourly wage increase, use the same method. Taking the hourly wage increase above for example, we have $ 2 / $ 14 = 0.143

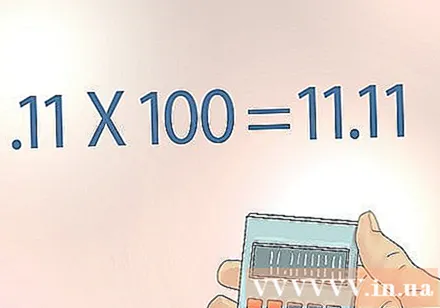

Multiply the decimal number by 100. To convert the decimal to a percentage, simply multiply it by 100. In the example above, you would multiply 0.111 by 100. We have, 0.11 x 100 = 11.1% Which means the new salary of $ 50,000 increases. about 111.1% of your old salary of $ 45,000, or in other words an 11.1% increase in your salary.- For the hourly wage example, you also multiply the decimal by 100. We have, 0.143 x 100 = 14.3%.

- To double check the calculation, multiply the old salary or the old hourly rate by the percentage increase. For example, $ 45,000 x 1,111 equals $ 49,995, rounded to $ 50,000. Similarly, we have $ 14 x 1,143 = $ 16,002.

Consider additional benefits, if any. If you're comparing a job at a new company instead of a raise or a promotion at your current one, pay is only part of the overall suite of benefits you need to consider. You will have to consider many other factors that primarily determine your incremental benefits. Here are a few important factors:

- Insurance benefits / premiums - If both jobs support employee coverage, you will need to compare plan benefits. You will also need to calculate how much insurance (if any) is deducted from your salary when making the decision. Assuming an increase of $ 100 / month in payments to $ 200 / month on benefits with the same benefits will be partially deducted from your pay rise. You also need to consider coverage (does dental or vision costs include?), Total annual policy coverage for which you must pay, etc.

- Bonuses or commissions - Even if this is not part of the base salary, be sure to add bonuses and / or commissions in the calculation. A new salary may bring you a higher income, but assuming your current job has a quarterly bonus, does a high salary still make sense? Keep in mind that the bonus amount is not stable because it depends on your performance and / or the performance of the company.

- Retirement Plan - Most US companies support the 401k Retirement Plan, which allows you to put some of your unpaid wages into a super. Based on employee dedication, many companies support a certain percentage of their 401k Pension. If your current company does not support that amount while the new company does 6%, you will definitely have to consider the amount added to that fund.

- Benefits - You also need to consider certain jobs that have a pension policy for their employees as they continue to work for certain years. If your current job has attractive pensions after 25 years of service, but your new job doesn't have that amount, consider this as well. A higher annual salary gives you more money up front, but it's also worth considering how much long-term income each job brings. However, keep in mind that benefits are not that common these days. They still exist, but people don't always pay as expected. In some cases, pensions are poorly managed and have little or nothing left for retirees.

Part 2 of 2: Determining the relationship between wage growth and inflation

Understanding inflation. Inflation is an increase in the prices of goods and services, thereby affecting the cost of living. High inflation usually means an increase in the prices of food, public services, and gasoline. People tend to shop less during periods of high inflation because the prices rise higher.

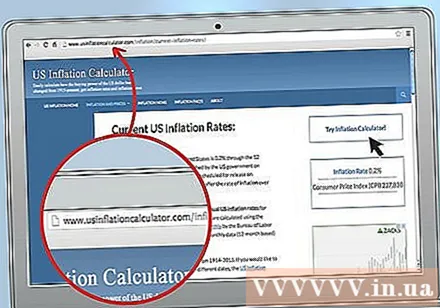

Look up inflation. A series of factors determines the level of monetary inflation. In the US, the Bureau of Labor Statistics of the United States Department of Labor publishes a monthly report that tracks and calculates inflation. You can find monthly breakdown of US inflation rates over the past 15 years here.

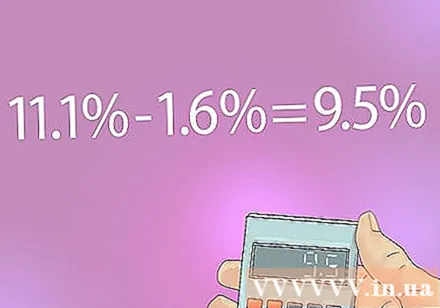

Subtract the percentage of your salary increase from the inflation rate. To determine the effect of inflation on wage growth, simply subtract the percentage of wage increase calculated in Section 1. For example, the 2014 average inflation rate is 1.6%. With the 11.1% percentage of wage increases calculated in Part 1, you can define the effect of inflation on wages as follows: 11.1% - 1.6% = 9.5%. This means that once you have included the increase in the price of goods and services due to inflation, the increase is only 9.5% because the monetary value is 1.6% lower than the value of the previous year. .

- In other words, you need to spend 1.6% more of the monetary value in 2014 to buy the same product in 2013.

Relate the consequences of inflation to purchasing power. Purchasing power refers to the comparative prices of goods and services over time. For example, you have a salary of $ 50,000 a year according to the example in Part 1. Suppose the inflation rate is 0% for the year in which you get a raise, but the following year it rises to 1.6% in when you don't get a raise. This means that you will have to spend 1.6% more to buy the same basic goods and services. To calculate 1.6% of $ 50,000, we have 0.016 x 50,000 = $ 800. Your overall purchasing power based on an inflation rate decreased by $ 800 from the year before.

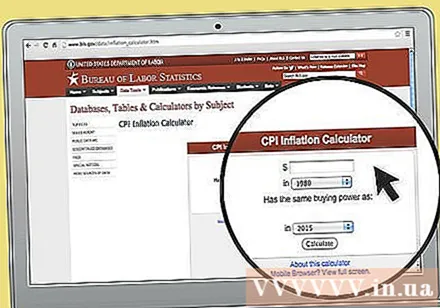

- The Bureau of Labor Statistics has an easy way to compare purchasing power across years. You can visit this website: http://www.bls.gov/data/inflation_calculator.htm

Advice

- You can use some online calculation software to quickly calculate your salary increase percentage.

- The examples above are also used exactly when you use other currencies.

What you need

- A computer