Author:

Monica Porter

Date Of Creation:

19 March 2021

Update Date:

1 July 2024

Content

Personal financial management is a subject that is rarely taught in school but is a skill that almost everyone will face in life later. Statistics show that about 58% of Americans do not plan to retire and manage their finances in old age. Most people think they need $ 300,000 to live in retirement, but the average American only has $ 25,000 in savings when it's time to retire. The average American family's card debt is at a worryingly $ 15,204. If the above figures startle you and want to reverse this trend, you should carefully read the following specific and targeted tips to prepare for a better future.

Steps

Part 1 of 4: Budgeting

Keep track of every expense in a month. You don't have to limit your spending, just know what you have spent in a month. Keep all your bills, keep a record of how much cash you need to spend as well as how much money you paid by credit card, and work out how much is left until the next month.

After the first month, review all your spending. Do not include friends want Expenditures, only include the items you have really spent. Sort shopping items so that they make sense. A simple monthly expense list might look like this:- Monthly income: $ 3,000

- Expenses:

- Rent / installment: $ 800

- Utilities cost (electricity / water / TV cable, etc.): $ 125

- Food: $ 300

- Restaurant: $ 125

- Gasoline: $ 100

- Sudden medical expenses: $ 200

- Discretionary spending: $ 400

- Savings: $ 900

Next is the budgeting step. Based on your actual expenses for a month and your spending habits, divide the income amount by each category each month.If you prefer, you can use an online budgeting app, like Mint.com, to do this step.- In the budget table, you should separate columns for budgets expected and budget reality. A budget is how much you're planning to spend on an item; This amount will be fixed for several months and can be calculated at the beginning of the month. Actual budget is the amount you spent; This amount fluctuates from month to month and is only calculated at the end of the month.

- Many people put a large amount of their budget into savings. You don't have to put any savings on your budget, but it's a good idea. Professional financial planners often advise clients to set aside at least 10% to 15% of their total income for savings.

Be honest with yourself about your budget. This is your money - you don't have to lie to yourself about how much money you spend in budgeting. By doing so, the loser is you. On the other hand, if you don't know how you spend your money, it may take a few months to budget. Don't write down the estimates until you know the actual number.- Let's say your intention is to set aside $ 500 for your monthly savings, but if you know that it is difficult to achieve this goal, don't write it down. You need to write down your actual number, then go back to your budget to see if you can cut any expenses and include that money in savings.

Keep track of your budget for a while. The hardest part about budgeting is that the expenses can change from month to month. The best part is that you keep track of these changes and know exactly where your money is spent in a year.- A budget table will help you see how much money you normally spend if you are confused. Many people after making a budget find that they have spent a lot of money on miscellaneous items. This will help them adjust their spending habits and prioritize more important items.

- Plan for unexpected expenses. When you create a budget, you'll also find that you never know when to pay for unexpected expenses - but these expenses are predictable. Obviously you don't expected Whether your car will fail or your child needs to see a doctor, but planning and preparing money for these unexpected expenses will help when the problem occurs.

Part 2 of 4: Smart spending

Don't buy when you can borrow or rent. How many times have you bought DVDs just to keep them covered with dust for years and not use them? Books, magazines, DVDs, equipment, party equipment and gym equipment can all be rented for less. You will not have to worry about maintenance, no need to find storage space, in general you will handle your items better if you rent rather than buy.- Don't blindly hire. If something is used often, it's best to go buy it. You can do a simple cost calculation to see which option is more profitable between renting and buying.

If you have enough money, you should pay a large amount when buying a home on installments. For many people, buying a home is the biggest and most important expense in life. For this reason, you need to know how to make your installment payments wisely. Your goal is to minimize interest and fees payable and balance the rest of your budget.

- Early payment in advance. The installment interest rate for the first 5-7 years is usually the highest. If possible, use your tax refund to pay a portion of the mortgage. Early payments will help increase your capital amount by reducing interest.

- Check if you can pay every two weeks instead of once a month. Instead of paying 12 installments each year, try to see if you can pay in 26 installments. This option could save you thousands of dollars, provided there is no associated fee. Some banks charge a fairly high fee ($ 300 to $ 400) for this preference, even only allowing monthly payments.

- Talk to your lender about refinancing. For example, if you can refinance your debt from 6.7% to 5.7% and the installments remain the same, you should do so. There is a chance you can reduce it many years installment.

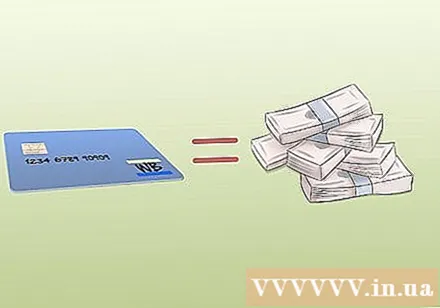

Understand that owning a credit card can be very important in creating creditworthiness. A credit score of 750 or higher can give you significantly lower interest rates and the opportunity to borrow new loans - a benefit that shouldn't be taken lightly. Even if you rarely use it, credit is still an important means. If you don't trust yourself, just put your credit card in the drawer and lock it.

- Keep your credit cards like cash - that's right. Some people consider credit cards as limitless cash machines, spending beyond their ability to pay and paying a minimum monthly amount. If you are going to spend money this way, prepare a large sum of money to pay interest and fees.

- Try to keep your credit usage rate low. A low credit rating means that the amount owed on your credit card is below your card usage limit. Simply put, if you have an average monthly balance of $ 200 on a $ 2,000 credit card, your ratio of use to the credit line is very low, only about 1:10. If the average monthly balance on your credit card is $ 200, but your usage limit is only $ 400, your rate of use will rise to the ceiling, around 1: 2.

Spend the money you have, not based on how much you hope to make. You may think you have a high income, but if the money you have does not prove this, then you are on the line. Rule Firstly and key in spending is: Except in the case of force majeure, target the amount of money available, not spend the amount planned to earn. This will help you stay out of debt and have a solid plan for your future. advertisement

Part 3 of 4: Smart investment

Learn about different investment options. As we get older, we realize that the financial world is much more complex than we imagined as children. There are items virtual be bought and sold in the right way; there are futures contracts that bet on things that haven't happened yet; there are complex groups of securities. The more you know about financial instruments and opportunities, the better you'll be at investing, even if that knowledge is just knowing when you should step back.

Take advantage of every retirement program your employer offers. Typically, employees can choose to join a 401 (k) retirement plan. Under this program, part of your salary will automatically go to your savings account. This is a great way to save money, because these payments are taken from your salary before taxes; many people do not even pay attention to these.

- Talk to your HR manager at your company about the employer's respective donation program. Some large companies have welfare programs that will give you an additional amount of money that you put into a 401 (k) super fund, helping you to double your investment. So, if you decide to put $ 1,000 into your fund for each paycheck, the company can add $ 1,000 in addition to a total investment of $ 2,000 for each paycheck.

If you're going to invest in the stock market, don't bet on it. Many people try to trade every day on the stock market and bet on small gains and losses every day. While this can be an effective way to make money for experienced investors, it is extremely risky, and more like a game of chance than investing. If you want to invest safely in the stock market, invest in the long term, That means you should leave the investment for 10, 20, 30 years or more.

- Look at the company's fundamentals (how much cash they have, what the history of their products are, how they rate their employees, and who their strategic alliances are) when choosing which stocks to invest in.In essence, you are betting that the price of the security is low and will go up in the future.

- To be more secure, consider mutual funds when buying securities. A mutual fund is a group of stocks that are grouped together to minimize risk. Think of it like this: If you invested all your money in a security and the stock price plummeted, you would be dizzy when this happens; But if your money is invested in 100 different stocks, even many stocks can fail completely, you won't be affected much. In essence, this is how mutual funds help reduce risk.

Buy the right insurance. It is said that wise people always anticipate surprises. You never know when you will need large sums of money in an emergency. A good policy can really help get you through a crisis. Discuss with your family the different types of insurance you can buy in case something goes wrong:

- Life insurance (if you or your spouse dies unexpectedly)

- Medical insurance (if you have to pay for hospital fees and / or physician fees)

- Homeowner insurance (if there is a sudden incident that damages or destroys your home)

- Disaster insurance (for hurricanes, earthquakes, floods, fires, etc.)

Consider joining a Roth IRA personal retirement account. In addition to the traditional 401 (k) superannuation fund, or perhaps instead of this fund (usually an employee retirement plan that varies slightly from person to person) talk to your counselor. Financial details for participating in Roth IRA personal retirement accounts. Roth IRAs are retirement programs that allow you to invest a certain amount and will be withdrawn tax free when you turn 60. (59 and a half to be exact).

- The Roth IRAs are sometimes invested in the stocks, stocks and bonds, mutual funds and annuity lines, opening up significant capital gains opportunities over a period of years. If you invest early in your IRA, the compound interest (interest on interest) you receive can significantly increase your investment amount over time.

- Ask your insurance advisor about income guarantee products. With this program, you will receive an annual retirement guarantee that is guaranteed for a lifetime. This will prevent you from running out of money when you retire. Sometimes payments will continue to go through to your spouse after your death.

Part 4 of 4: Creating savings

Start by setting aside your disposable income (excess) as much as possible. You need to prioritize savings. Even if your budget is tight, you should try to save more than 10% of your total income.- Think of it this way: If you try to save $ 10,000 per year - less than $ 1,000 per month - in 15 years, you will have $ 150,000 plus interest. That is enough money for a child to finish college now, but not in the future if your baby is just born. So start saving, and later on you'll have a lot of money to take care of your kids or buy your dream home.

- Saving at a young age. Saving is always important, even when you are in school. Thrifty people often see this as a virtue rather than compulsory employment. If you save early and invest your savings wisely, your small amounts start to grow. You will be rewarded with long-term thinking.

Set up an emergency backup fund. Saving in fact is keeping any money available can be wasted. Having money available means there is no debt. No debt means money for unexpected incidents. So an uncertain contingency fund will be very helpful.- Think about it: Your car suddenly broke down and you need to spend $ 2,000. Since you did not plan for this, you have to borrow. Your credit rating is low, so you pay pretty high interest. Immediately after that you have to pay 6-7% interest on the loan, resulting in you not able to save money for the next half year.

- If you have an emergency fund, you can avoid debt and interest in the first place. It is really helpful to prepare in advance.

- Think about it: Your car suddenly broke down and you need to spend $ 2,000. Since you did not plan for this, you have to borrow. Your credit rating is low, so you pay pretty high interest. Immediately after that you have to pay 6-7% interest on the loan, resulting in you not able to save money for the next half year.

When you start saving for retirement and putting money into an emergency fund, try to set aside enough money for 3-6 months. Again, being frugal is preparing for uncertainty. If you suddenly lose your job or the company cuts down on the workload, you probably don't want to take out a loan to help you with your life. A savings enough to spend for 3, 6 or even 9 months will save you from debt, even in the event of a disaster.

Start paying off when you settle down. Whether you owe your credit card or how much you owe on your mortgage, you can have a significant effect on your savings. Start with debt with the highest interest rates. (If you take out a mortgage, pay off large sums of money in it, but first focus on non-mortgage loans first.) Then move on to the second highest rate loan, and start paying off gradually. Continue doing so in descending order until you pay off all your loans.

Start to ramp up retirement savings. If you're getting to middle age (45-50) and haven't started saving for retirement, get started now. Maximum contributions to IRA individual retirement accounts ($ 5,000) and 401 (k) ($ 16,500) per year; if you are over 50, you can make a so-called “extra contribution” to increase your retirement savings.

- Prioritize retirement savings — even over the cost of your children's education. You can always borrow money for education, but not to borrow money to support your super fund.

- If you are completely ignorant of how much you should save, you can use the online retirement savings calculator - a great Kiplinger tool here - to help.

- Get advice from a financial planner. If you want to maximize your retirement savings account but don't know how to get started, talk to a professional consultant. Financial counselors are trained to help you invest your money wisely, and they often have a track record of return on investment (ROI). You will have to pay service fees, but pay to make money. This idea is not bad either.

Advice

- When the number of foreclosures is increasing, it is not the best time to buy a home, because the law of supply and demand will push house prices down further as banks push to sell these assets.

- Then, when the confiscated assets are sold out by banks, the law of supply and demand will push house prices up again.

- In a time when there aren't many foreclosures, keep your property, as house prices will rise.

- Improve. Take the time to hone your knowledge and skills so that you have an edge over the competition. This will help you improve your earning power in the future.

- The debit card is not a good alternative to a credit card. The debit card gives others direct access to your account without going through the credit card-issuing bank as an intermediary. In addition, money held by the merchant temporarily will prevent you from using your money, even if you end up buying nothing. (For example, some gas stations will keep $ 100 in your account as soon as you insert the card, no matter how much gas you buy. transaction account).

- Use economical jars. Divide your total income into 6 bottles by the following expenses: necessities, entertainment, charity, savings, investment, education. Allocate a percentage of total monthly income to the jars. For example, 60% for essential living expenses, 10% for savings, 10% for entertainment, 10% for investments, 5% for charity and 5% for education. Use these jars to classify daily expenses and record them. (You can use real jars or online savings accounts).

- The 7% rule can also help. If you multiply your retirement savings by 7%, the result is how much money you can spend without running out of money in your retirement account.So $ 300,000 x.07 (7%) = $ 21,000 is the amount you can spend each year subtracting taxes on that income plus other things like social benefits. If your budget gets bigger, or your expenses fluctuate, or the interest rate you enjoy drops, $ 300,000 won't be enough to keep you going.

Warning

- When your bank calls to get a credit card, don't accept their offer and increase your debt, no matter how tempting it sounds. There's nothing more frustrating than being asked by a bank to pay off an overdue debt that you can't afford.