Author:

Robert Simon

Date Of Creation:

18 June 2021

Update Date:

1 July 2024

Content

Currently, the market allows mid-range investors to buy and sell many different currencies around the world. Most transactions are done via Forex - the online forex market - which is open for trading 5 days a week, and 24 hours a day. With enough knowledge of the market and a little luck, you can trade forex and make money.

Steps

Method 1 of 2: Learn about Forex Trading

Check the exchange rate of the currency you want to buy against the currency you want to sell. Observe the degree of volatility in that currency pair over a period of time.

- The exchange rate will be quoted according to each currency pair. Based on the exchange rate, you can see how many units of currency you can exchange from the currency you want to sell. For example, a USD / EUR exchange rate of 0.91 means that when you sell 1 USD you will receive 0.91 EUR.

- Monetary value fluctuates frequently. Any political instability or natural disaster can cause currency volatility. You must make sure you understand that the rates between currencies are constantly changing.

Business strategy development. To make a profit in your trade, you will buy the currency in which you expect its value to go up (base currency) with the currency in which you expect its value to go down (quote currency). . For example, if currency A is currently at $ 1.50 and you think the coin will go up, you could buy a buy contract, called a "call contract," with a certain amount of investment. If the value of coin A increases to 1.75 USD, you will gain.- Evaluate the likelihood of large fluctuations in monetary value. The better the economy of that country, the more likely that the currency of that country will remain stable or rise against that of another country.

- Several factors affect the value of money such as interest rates, inflation rates, public debt, and political stability.

- Some changes in economics such as the Consumer Price Index and the Purchasing Managers Index of a country can signal a change in its own currency.

- For more information, you can visit the Trade Forex website.

Perception of risk. Buying and selling foreign currency is a risky playing field, even for professional investors. Many investors use financial leverage, take the borrowed money to buy more currency. For example, if you want to exchange 10,000 USD, you will be able to borrow with a leverage ratio of 200: 1. You can deposit as little as $ 100 into your margin account. However, if you lose money, you may not only lose your capital, but also owe the broker much more than it is in stocks or futures.- In addition, it is quite difficult to determine how much money you should buy or sell or when to do transactions. Currency values can fluctuate up or down rapidly, sometimes within hours.

- For example, within 24 hours in 2011, the US dollar fell 4% to a record low against the Japanese yen and then turned around 7.5%.

- So only about 30% of "odd" transactions - the kind of transactions that individual currency investors do - are profitable.

Sign up for a demo account and test some trades to learn more about the trading mechanics.- Some websites like FXCM allow you to do money testing and practice trading with virtual currencies.

- Only execute trades on the real market when you are continuously making profits on the demo account.

Method 2 of 2: Buy and Sell Foreign Currency

Cash exchange according to your local currency. You must have cash to convert to another currency.

- You can get cash by selling other assets. Consider selling stocks, bonds, or mutual funds, or withdraw money from a savings or checking account.

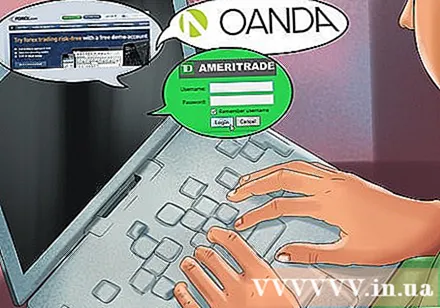

Find a foreign exchange broker. Mostly, private investors are using brokerage services to place foreign currency transactions.

- Online broker OANDA will often provide a user-friendly retail platform, called fxUnity for beginners to buy and sell foreign currencies.

- Forex.com and TDAmeritrade also allow you to trade on the Forex market.

Find a broker with the difference between the sell and buy prices low. Forex brokers do not charge any commission or other fees. Instead, the firm profits from the difference between the bid and ask, which is the difference between the currency of the sale and the currency of the buy-in.

- The higher the difference between the ask and buy price, the more you will pay the broker. For example, a broker who will buy 1 USD for 0.8 EUR but sell 1 USD at the price of 0.95 EUR, the difference between the bid and ask price is 0.15 EUR.

- Before signing up for a broker account, you should check the website or the website of the broker's parent company and make sure it is registered with the Merchant Futures Commission and is regulated by the Commission. Futures translation (If the company is in the US).

Start placing currency transactions with a broker. You will be able to track the progress of your investment with intuitive software or other resources. Don't "buy too much" money at once. Experts recommend that you only invest 5% to 10% of your total account balance in any forex trade.

- Pay attention to currency interest rate trends before making a transaction. You have a better chance of making money if you trade in the direction of the trend than against the interest rate trend.

- For example, when the US dollar value increases steadily against the euro. Unless you have a good reason, you should just choose to sell euros and buy US dollars.

Place a semi-automatic order. The semi-automatic order is an important part of currency trading. A semi-automatic order automatically exits a position - that is, allows to sell automatically when the trade hits a certain level. With this order, you can limit the amount of your loss if the currency you buy starts to depreciate.

- For example, if you buy Japanese Yen for US Dollar and currently 1 USD is for 120 yen, you can place an auto sell order at a certain price threshold, such as when 1 USD can only buy 115 yen. .

- The opposite of this is a "take profit" order, which is set up to automatically sell out when you reach a certain profit. For example, you can place a "take profit" order that automatically withdraws your money when 1 USD hits 125 ¥. This order will ensure that you profit by leaving at that time.

Save the profit in the transaction. In many countries, you will need to keep this information in order to file income tax annually.

- Record the price you pay for the currency, the price you sold, the date it bought and the date the currency was sold.

- Most major brokers will send you an annual report containing information if you don't save it yourself.

Should not invest too big. In general, because currency trading is risky, experts advise you to limit the amount of money you invest in forex trading, the amount of investment should only make up a small part of your total portfolio. .

- If you fail - like about 70% of private currency transactions - then limiting the level of investment, as well as the percentage of forex transactions in your portfolio, will limit your portfolio. losses.

Warning

- Avoid trading with the unwarranted paranoia of a currency's crash. If you have reliable information about the future trend, it can help you create a strategy to buy or sell foreign currency to make a profit. However, people who trade on hunches or emotions tend to lose money.

- Never invest in Forex more than you can afford to lose. Remember that the Forex trading platform is a gamble, even if you have very good information and a solid investment strategy. No one can predict with certainty how the market will play out.