Author:

Robert Simon

Date Of Creation:

20 June 2021

Update Date:

1 July 2024

Content

Thanks to smartphones and the popularity of credit and debit cards, you can easily access your bank accounts. However, this can also mean your balance drops faster. It's a good idea to regularly check your bank balance and review recent credits and debits in your account in case something goes wrong. You can use an ATM machine, a banking website, a banking app, or go in person to check your balance.

Steps

Method 1 of 4: Check the Balance of a Bank Account with an ATM

Receive ATM / debit card. Make sure you activate your card and know your personal identification number (PIN) before going to the ATM. In some cases, this card will activate the first time you put it in an ATM.

Insert the ATM card into the ATM machine. It is recommended that you use the ATMs of the bank you register your card for to avoid fees, but most ATMs allow free checking of your account balance.

Enter the PIN into the device. "PIN" represents the four-digit personal identification number that is set up when opening an account. Then look for the menu of options. Scroll through the options until you find an item titled "balance".

Click this option to view your balance. You will then be able to go back and choose to withdraw or print a statement of that balance.

Choose to withdraw money from an ATM. You should request a receipt printed. Your balance will be printed on the receipt so you can save it. advertisement

Method 2 of 4: Check online bank balance

Visit your bank's website. You can find your bank's website by typing the name of your bank or credit union into a search engine. Click on official website.- Make sure you are logged in through a secure computer. There are several computers that save your account information or keep logged in to your website.

Search for an entry to online banking. Click on "Login" (Log in or Sign on).

Enter your username and password. If you have never visited this site before, you can log in with your ATM or credit card number. You will then be asked to choose a username, password and security questions to use later.

Click on “Accounts”(Account). Choose a trading account, savings account or investment account.

View your recent debts or credits on the account. Most websites have an electronic statement that you can download.

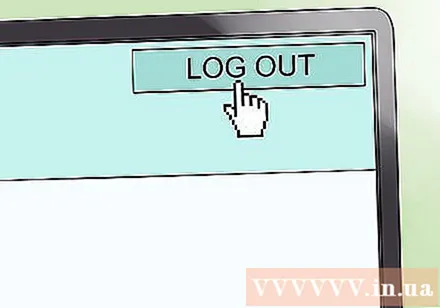

Log out of the website when leaving. Go to the history section of your browser and clear the cache if you're on a public computer. This will help increase the security of your online banking. advertisement

Method 3 of 4: Check the bank balance with the app

Call your bank's customer care number or search your smartphone to check if your bank has an online banking app. The customer service number is usually listed on the back of your debit card.

Go to the App Store or Google Play and enter a bank name. Download the free app to your phone.

Install the app, then open it up. Enter the username and password associated with your online banking account. See how to check your online bank balance to learn how to create a new login account.

Wait for the information to load. The account information and account balance will be listed. You will remain logged into this account in some cases, so please protect your phone carefully at all times. advertisement

Method 4 of 4: Check the bank balance at the Bank

Go to a bank branch.

Request to check your account balance. Provide a government-issued photo ID and your debit card. You can simply provide your ID card and account password.

Wait for the staff to print the receipt, it is quite small and looks like the one received at an ATM.

Ask your staff about signing up for monthly statements of account by mail. There are many trading accounts that require you to sign up in order to receive your statement, as mailing statements usually costs paper and postage. You should check back to make sure there are no charges for your statement. advertisement

Things you need:

- ATM / debit card

- Smartphone

- Copy of identity card

- Paper Report