Author:

Lewis Jackson

Date Of Creation:

9 May 2021

Update Date:

1 July 2024

Content

Carrying jewelry on a pawnshop is often not the best way to get a loan, as pawnshops often charge high interest rates and will accept jewelry for only a fraction of its true value. However, if you are in urgent need of money, holding jewelry may be the only option. By pricing your jewelry, comparing places to find the best loan and paying off your debt on time, you can get the money you need and still get your jewelry back!

Steps

Part 1 of 3: Deciding what jewelry to take

Calculate the amount you need to borrow. The pawnshop is a place of business, so they will only lend you an amount equal to 60% to 70% of the actual value of the jewelry. Therefore, you should not carry jewelry of a value more than is necessary, especially if you cannot afford to repay the debt.

- Knowing the amount to borrow will help you choose the minimum amount of jewelry in your jewelry box to take away.

Consider which jewelry should be a priority. Try to choose jewelry that you don't regret leaving. A family treasure can make you regret it later, but the engagement ring of your old love will make it easier for you to give away.

Get jewelry for pricing. Pawn shops are usually only interested in pure metal items such as gold or silver, and diamonds. They often refuse to hold gilded or imitation jewelry. Please bring your jewelry to an expert or jeweler to have them evaluate its content and value.

- You can find a jewelry examiner or jewelry store near you online.

- Remember that pawnbrokers generally won't accept jewelry at its true value, but it's a good idea to know how much your jewelry is worth, as you can get an estimate of the amount of the bucks. items will be lent (about 60% to 70% of the real value).

Keep some jewelry for yourself. If possible, don't bring all your jewelry at once. Keep at least one or two precious items in case you can't pay your debts on time. That way, you can take it again if you want to extend the time so you don't lose ownership of the item. advertisement

Part 2 of 3: Finding the right pawnshop

Estimate how long it will take you to pay off your debt. The pawnshop will set a deadline for repayment. If you do not pay your debt in time, the pawnshop will take ownership of your jewelry. To ensure the best possible redemption of an item, you must calculate the exact time it can be repaid.- Remember to take into account the backup time. Maybe you should plan a few more weeks when calculating your repayment timeframe, in case something goes wrong that leaves you with no money on time.

Check out local and online pawnshops. Not all pawnshops are alike. Some places offer higher loan amounts with lower value collateral, others lower interest rates or longer repayment periods. Check online first to find the best condition pawnshops based on your needs.

- Online pawnshops can give you better loans and longer repayment periods, but they're also harder to negotiate, especially if you're planning to pick up a rare piece of jewelry.

Bring jewelry to some pawnshop around your area for a comparison. Pawn shops often compete with each other, so if you decide to pawn at local brands, you should go to several different stores to make sure you choose the best grip.

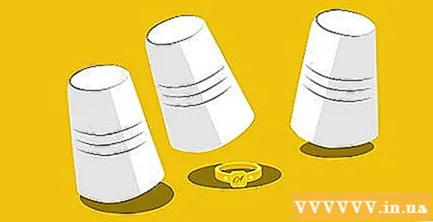

Be careful. Pawnshops can swap your jewelry with a cheaper item when you're not looking, so never take your eyes off the jewelry. If you have not priced your jewelry before, bring a scale to show them the weight of the jewelry. Don't trust the pawnshop scale.

- Don't let the pawnshop devalue or price your jewelry on your own.

Part 3 of 3: Holding jewelry

Negotiate with the pawnshop. Once you have found the right pawnshop for your needs, do not hesitate to negotiate for the most benefit. The pawnshop staff can always say no or haggle with you, so there's nothing to lose when trying to negotiate.

- When negotiating, let the pawnshop set the price first.

- You can negotiate the value of the jewelry, the interest rate on the loan, and the repayment period.

- Be willing to leave if the pawnshop worker disagrees with your terms.

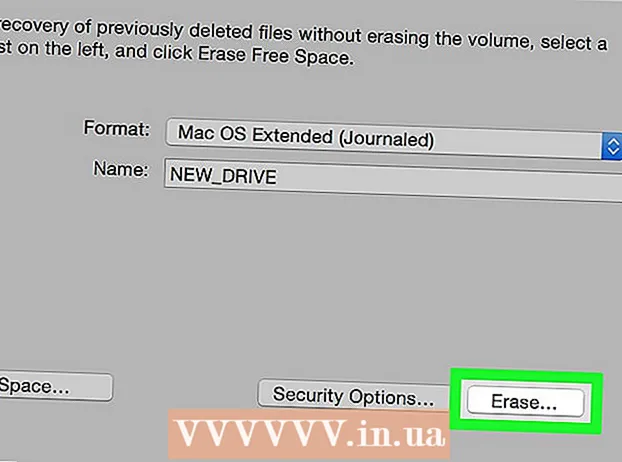

Sign the agreement. Don't trust the pawnshops that won't make loan agreements or deals. Ensure that the terms of the loan amount, interest rate and repayment period are clearly stated in the agreement. Remember that the agreement must also include a description of the jewelry.

- Take a photo of the jewelry placed next to the contract at the pawnshop in case there are future disputes.

Pay the debt on time. Paying your debts on time is really important so that you can safely redeem your items. Pawn shops cannot resell every piece of jewelry that customers bring, so they often melt them down and sell them at market prices. They will do this as soon as they have possession of the jewelry.

- Therefore, the best chance for you to get your jewelry back is to repay the loan on the date and time stated in the agreement.