Author:

Frank Hunt

Date Of Creation:

11 March 2021

Update Date:

1 July 2024

Content

- To step

- Part 1 of 3: Assess your spending habits

- Part 2 of 3: Adjusting your spending habits

- Part 3 of 3: Getting help

Do you find yourself using up your salary or pocket money as soon as you get it? Once you start splitting up, it can be hard to stop. But spending too much can lead to stacks of bills and zero savings. Keeping yourself from spending money can be difficult, but with the right approach, it is possible to stop spending money and start saving money instead.

To step

Part 1 of 3: Assess your spending habits

What non-essential things do you spend a lot of money on? If you do not work out with your available budget, you will first have to check which things are not really necessary. Unlike fixed costs (necessary things like rent, gas / water / electricity and other costs) that stay the same every month, arbitrary expenses are not necessarily necessary and easier to cut back.

What non-essential things do you spend a lot of money on? If you do not work out with your available budget, you will first have to check which things are not really necessary. Unlike fixed costs (necessary things like rent, gas / water / electricity and other costs) that stay the same every month, arbitrary expenses are not necessarily necessary and easier to cut back. - Ask yourself: Am I spending too much money on these random things? Do you find it difficult to pay bills for a vacation, for example? Or do you really need those brand shoes or that new game console?

- Check if there are things you don't use. This could be a subscription for a gaming platform that you haven't used in months, a gym that you don't go to, and / or a cable subscription, while still watching everything online.

- Admittedly, there are a few gray areas, such as a gym or a fancy wardrobe that may be necessary for your professional career. You may not have to leave this one out, but it is worth investigating.

View your expenses for the past quarter (three-month period). Check your credit card and bank statements, as well as cash spending, to see where your money is spent. Take note of even little things like a cup of coffee, a stamp or a meal on the go.

View your expenses for the past quarter (three-month period). Check your credit card and bank statements, as well as cash spending, to see where your money is spent. Take note of even little things like a cup of coffee, a stamp or a meal on the go. - You may be surprised by how much you end up spending each week or month.

- If possible, view your data from the past year. Most financial planners will review an entire year's expenditures before making recommendations.

- Arbitrary expenses can eventually make up a large percentage of your wages or pocket money. By keeping track of these you will get a better feeling that you can cut back on.

- Pay attention to how much you spend on what you want versus what you need (e.g. drinks in a bar versus the weekly groceries).

- See which percentage of your expenses are fixed and which are random. Fixed costs stay the same every month, while arbitrary expenses are variable.

Keep your receipts. This is a great way to keep track of how much you spend on certain things each day. Instead of throwing out your receipts, keep them so you can keep track of exactly how much you spend on a thing or a meal. This way, if you find yourself exceeding your budget for the month, you can pinpoint exactly when and where you spent your money.

Keep your receipts. This is a great way to keep track of how much you spend on certain things each day. Instead of throwing out your receipts, keep them so you can keep track of exactly how much you spend on a thing or a meal. This way, if you find yourself exceeding your budget for the month, you can pinpoint exactly when and where you spent your money. - Try to pay less in cash and more with your credit or debit card as it can be tracked. Credit card balances should be paid in full every month if possible.

Use a budget planner to assess your expenses. A budget planner is a program that calculates how much you spend per year and how much income you will receive in that year. This indicates how much you can spend in a given year, based on your expenses.

Use a budget planner to assess your expenses. A budget planner is a program that calculates how much you spend per year and how much income you will receive in that year. This indicates how much you can spend in a given year, based on your expenses. - Ask yourself: Am I spending more than I earn? If you use your savings to pay your rent each month or use your credit card to pay for your buying disease each month, you are spending more than you earn. This only leads to more debt and less savings. So, be honest about your spending every month and make sure you only spend what you earn. This means budgeting money every month for expenses and savings.

- You can also use budgeting apps to help you keep track of your day-to-day expenses. Download a budgeting app on your phone and track your expenses right after you make them.

Part 2 of 3: Adjusting your spending habits

Make a budget and stick to it. Calculate the total of your basic expenses for each month to make sure you don't spend money that you don't have. These include:

Make a budget and stick to it. Calculate the total of your basic expenses for each month to make sure you don't spend money that you don't have. These include: - Rent and water / gas / electricity. Depending on your living situation, you may share these costs with a roommate or partner. Your landlord may also pay for your heat supply, or you may pay for electricity consumption every month.

- Transport. Do you walk to work every day? By bike? With the bus? Carpooling?

- Food and drink. Calculate the average amount per week for meals for a month.

- Healthcare. It is important to have health insurance in the event of an incident or accident, as paying out of pocket is likely to be more expensive than health insurance. Do some research online to find the cheapest insurance.

- Miscellaneous expenses. If you have a pet, determine how much food it gets each month. If you and your partner go out a night every month, consider this an expense as well. Take into account every expense you can think of so that you don't spend money without knowing exactly where it went.

- If you have to pay off debts, add these obligations to your budget under the item necessary expenses.

Go shopping with a purpose. One goal could be: new socks to replace your old ones that are full of holes. Or, to replace your broken mobile. Having a goal while shopping, especially when it comes to discretionary items, stops impulse shopping. By focusing on one essential item when shopping, you have a clear budget for your shopping trip.

Go shopping with a purpose. One goal could be: new socks to replace your old ones that are full of holes. Or, to replace your broken mobile. Having a goal while shopping, especially when it comes to discretionary items, stops impulse shopping. By focusing on one essential item when shopping, you have a clear budget for your shopping trip. - When you go shopping, come up with recipes in advance and make a grocery list. This way you can stick to the list while doing the grocery shopping, and know exactly how you're going to use each ingredient you buy.

- If you find it difficult to stick to a grocery list, shop online. This allows you to keep a running total of your purchases and be aware of exactly what you are spending.

Don't lose yourself in the sale. Ah, the irresistible appeal of an offer! Retailers count on their customers to be attracted to the bargain shelves. It's important to resist the temptation to justify a purchase just because it's on sale. Even big discounts can mean big expenses. Instead, your only two shopping considerations should be: Do I need this? Does this fit my budget?

Don't lose yourself in the sale. Ah, the irresistible appeal of an offer! Retailers count on their customers to be attracted to the bargain shelves. It's important to resist the temptation to justify a purchase just because it's on sale. Even big discounts can mean big expenses. Instead, your only two shopping considerations should be: Do I need this? Does this fit my budget? - If the answer to these questions is no, then you better leave the item in the store and save your money for an item you need, rather than want, even if it is on sale.

Leave your credit cards at home. Only bring the money you need, based on your budget, to get through the week. That way, you won't be able to make unnecessary purchases, because you've already spent all your cash.

Leave your credit cards at home. Only bring the money you need, based on your budget, to get through the week. That way, you won't be able to make unnecessary purchases, because you've already spent all your cash. - If you do bring your credit card, treat it like a debit card. In this way, every cent you spent with your credit card feels like money that you will have to pay back every month. Thinking of your credit card as a debit card ensures that you are not so rushed to pull it out with every purchase.

Eat at home and bring your lunch. Eating out can get very expensive, especially if you spend $ 10- $ 15 a day 3-4 times a week. Limit your eating to once a week and then gradually to once a month. You should notice how much money you save when you run errands and cook for yourself. You will also enjoy eating out a lot more for a special occasion.

Eat at home and bring your lunch. Eating out can get very expensive, especially if you spend $ 10- $ 15 a day 3-4 times a week. Limit your eating to once a week and then gradually to once a month. You should notice how much money you save when you run errands and cook for yourself. You will also enjoy eating out a lot more for a special occasion. - Take your lunch with you to work every day, instead of paying for lunch. Schedule 10 minutes before bed or in the morning before going to work every night to prepare a sandwich and snack to take with you. You will find yourself saving a lot of money every week just by bringing your lunch.

Make a spending freeze. Test your spending habits by buying only what you need in a 30-day or one-month period. See how little you can spend in a month by focusing on buying things you need, rather than things you want.

Make a spending freeze. Test your spending habits by buying only what you need in a 30-day or one-month period. See how little you can spend in a month by focusing on buying things you need, rather than things you want. - This will help you determine what is necessary and what is nice to have. In addition to the obvious necessities of life, such as rent and food, it is arguable that joining a gym is necessary to keep you fit and because it makes you feel good. Or that a weekly massage will help you with the pain in your back. As long as these needs are within your budget and you can afford them, you can spend money on them.

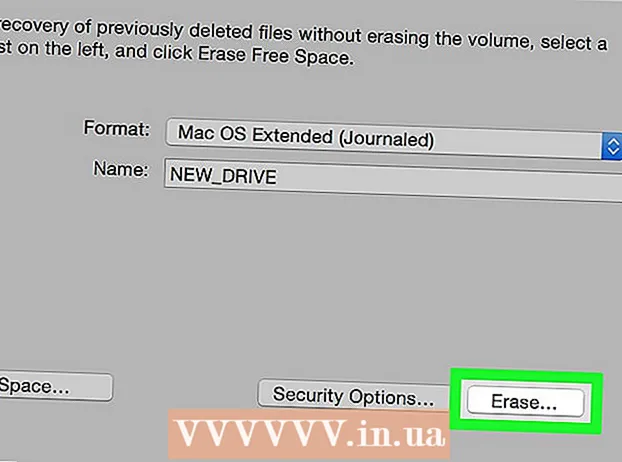

Do it yourself. Fixing things yourself is a great way to learn new skills and save money. There are many books and blogs about repairing or making things yourself, with which you can create expensive things with a limited budget. Instead of spending your money on an expensive work of art or a decorative item, make your own. With this you make something unique and you stay within your budget.

Do it yourself. Fixing things yourself is a great way to learn new skills and save money. There are many books and blogs about repairing or making things yourself, with which you can create expensive things with a limited budget. Instead of spending your money on an expensive work of art or a decorative item, make your own. With this you make something unique and you stay within your budget. - Websites like Pinterest, ispydiy, and A Beautiful Mess all have great DIY ideas for household items. You can also learn how to reuse items you already own to turn them into something new, instead of spending money on a new item.

- Do household chores and activities yourself. Clean the path in the front yard yourself, instead of paying someone else to do it. Involve the whole family in outdoor chores, such as mowing the lawn or cleaning the pool.

- Make your own household cleaning supplies and beauty products. Most of these products are made from basic products that you can buy at the supermarket or health food store. Detergents, household cleaners and even soap can all be made yourself and much cheaper than those in the store.

Set money aside for a life purpose. Work toward a life goal, such as a trip to South America or buying a house, by putting a certain amount of money aside in your savings account each month. Remind yourself that the money you save (by not spending it on clothes or going out every week) will go toward a greater life purpose.

Set money aside for a life purpose. Work toward a life goal, such as a trip to South America or buying a house, by putting a certain amount of money aside in your savings account each month. Remind yourself that the money you save (by not spending it on clothes or going out every week) will go toward a greater life purpose.

Part 3 of 3: Getting help

Recognize the characteristics of compulsive shopping. Compulsive shoppers often have no control over their spending and spend for emotional reasons. They "shop till they drop" and then they go on shopping. But compulsive shopping and spending generally makes a person feel more terrible about themselves, rather than better.

Recognize the characteristics of compulsive shopping. Compulsive shoppers often have no control over their spending and spend for emotional reasons. They "shop till they drop" and then they go on shopping. But compulsive shopping and spending generally makes a person feel more terrible about themselves, rather than better. - Compulsive shopping is generally more common among women than men. Women who shop compulsively usually have racks of clothes at home that still have price tags on them. She goes to the store with the intention of buying one item and comes home with bags full of clothes.

- Compulsive shopping can be a periodic balm for depression, anxiety, and loneliness during the holiday season. It can also occur when a person is feeling angry, depressed, or lonely.

Recognize the signs of compulsive shopping. Do you indulge in buying sickness on weekends? Are you constantly spending more than you can afford?

Recognize the signs of compulsive shopping. Do you indulge in buying sickness on weekends? Are you constantly spending more than you can afford? - Do you get into a certain haze when you go shopping and buy things you don't need? In a way, you can feel "high" if you buy a lot of things every week.

- Notice if you have major debts on your credit card or if you have multiple credit cards.

- You can also hide your purchases from family members or partners who are concerned about it. Or you can try to cover up your expenses by taking a part-time job to fund your spending habits.

- Individuals who compulsively spend money are likely in denial and often find it difficult to admit that they have a problem.

Talk to a therapist. Compulsive shopping is considered an addiction. Thus, either a professional therapist or a discussion group for compulsive shoppers can be important ways to address the problem and work towards a solution.

Talk to a therapist. Compulsive shopping is considered an addiction. Thus, either a professional therapist or a discussion group for compulsive shoppers can be important ways to address the problem and work towards a solution. - During therapy, you can identify the underlying problems of your compulsive spending and the dangers of spending more than you have. Therapy can also provide healthy alternative ways to deal with your emotional problems.