Author:

Sara Rhodes

Date Of Creation:

12 February 2021

Update Date:

2 July 2024

Content

In a divorce case, the house is the most common asset a couple shares. Sometimes, when they have a lot of other property, the court awards the house to one person, the rest of the equal property to another. However, in many cases, the court divides the value of the house in half, 50 to 50. Often, the couple sells the house and split the money received in half. But if you are going to continue living in your home, you can buy out your spouse's share. You can do this in several ways.

Steps

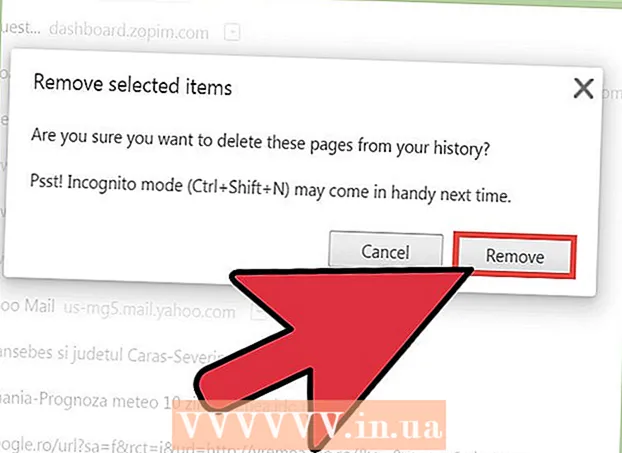

1 Talk to a divorce attorney if you haven't already consulted with him. A lawyer will advise you on how best to deal with all aspects of a divorce, including the division of property.

1 Talk to a divorce attorney if you haven't already consulted with him. A lawyer will advise you on how best to deal with all aspects of a divorce, including the division of property.  2 Get an appraiser to rate your home for the current market. Your lender or local real estate agent can help you. The value of a home is calculated as the market value, minus the interest on the mortgage, minus the projected costs.

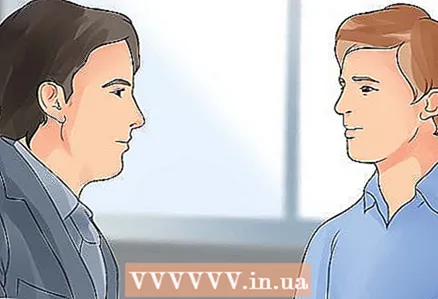

2 Get an appraiser to rate your home for the current market. Your lender or local real estate agent can help you. The value of a home is calculated as the market value, minus the interest on the mortgage, minus the projected costs.  3 Discuss financial matters with your spouse if you are speaking.

3 Discuss financial matters with your spouse if you are speaking.- You can agree to pay off the debt to your spouse very quickly, or you can agree to pay alimony instead of paying for the house. If you have settled everything, and both parties have signed the documents, then let the lawyer draw up the documents.

- Some ex-spouses decide that both will continue to maintain the house until the agreed time. Both continue to pay mortgages, taxes and other expenses in half, but only one of them continues to live in the house. This consistency is common in families with teenagers. You can set a date right after the youngest child finishes school and sell the house or buy it out from a spouse.

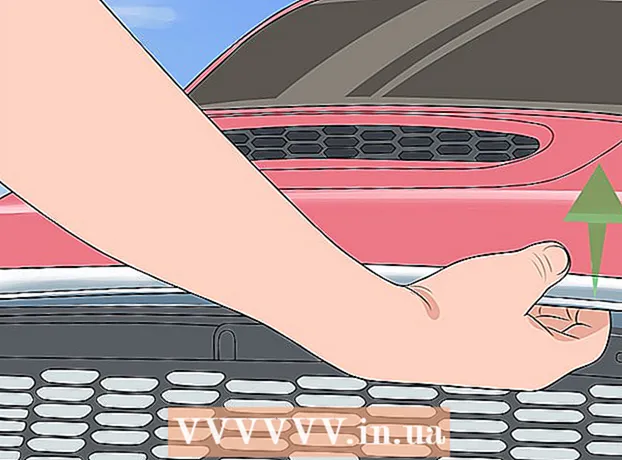

4 Contact the mortgage lender to discuss your rights if you are buying out a spouse's share. The lender will require proof of your income to support the financing option you have chosen.

4 Contact the mortgage lender to discuss your rights if you are buying out a spouse's share. The lender will require proof of your income to support the financing option you have chosen. - Fund your mortgage additionally so you have enough money to pay off half of your spouse. This will increase the balance of your mortgage with the amount you pay your spouse and remove the spouse's name from the new mortgage.

- Take out a second mortgage or home loan instead of additional financing, so you will save on costs. You will take a new loan in your name. Talk to the lender about the requirements for removing your spouse's name from your original mortgage.

- Ask your lender about the terms and conditions of the loan for both financing options, then compare the short-term and long-term costs and decide which method is best for you.

Tips

- Have your lawyer refer to the Disclaimer Act to remove your spouse's name from the name of the house after you buy it out. This will guarantee that when you are gone, the house will go to your heirs, and not to your ex-spouse.

Warnings

- Co-ownership of a home with an ex-spouse can be difficult for many couples. Since you and your ex-spouse have your own personal life, shared finances are a whole problem. Therefore, experts advise that you only agree to joint ownership when the termination date is set earlier than 3 years after the divorce.

- If you have a property order that obliges you to pay your spouse, pay attention to the due date and interest rates for late payments. To avoid a penalty, you must set a payment deadline before the deadline.