Author:

Janice Evans

Date Of Creation:

23 July 2021

Update Date:

1 July 2024

Content

There are many reasons why you need to obtain an estimate for the value of your home. Most homeowners ask for an appraised home value when they want to sell it. You may need an appraised value for insurance purposes or when you are trying to refinance your home or take out a secured home loan. The appraisal will show how much your home is worth in the real estate market. Get an appraisal through inspection by a qualified and licensed appraiser by providing all the information and documentation you need about your property.

Steps

Method 1 of 2: Find an Appraiser

1 Get a referral from your real estate agent. If your goal is to sell a home, the agent must provide you with an appraiser.

1 Get a referral from your real estate agent. If your goal is to sell a home, the agent must provide you with an appraiser.  2 Choose an appraiser who is licensed by the state in which your property is located. This will provide you with a certified assessment. Many insurance companies and government agencies will not accept an assessment that is not certified.

2 Choose an appraiser who is licensed by the state in which your property is located. This will provide you with a certified assessment. Many insurance companies and government agencies will not accept an assessment that is not certified. - When scheduling an appointment, explain your purpose to the evaluator. If the evaluator knows that his report will be used by courts, lawyers, tax or other government agencies, he will be confident that this information and the format of the assessment is just a routine job.

3 Find a qualified appraiser in your area using the resources of the American Appraisers Society (www.appraisers.org). You can search for appraiser contact information using your zip code.

3 Find a qualified appraiser in your area using the resources of the American Appraisers Society (www.appraisers.org). You can search for appraiser contact information using your zip code.  4 Use the services of an appraiser provided by an agency that asks for an appraisal of your home. For example, if HUD wants an appraised value for your home, they can provide their appraiser.

4 Use the services of an appraiser provided by an agency that asks for an appraisal of your home. For example, if HUD wants an appraised value for your home, they can provide their appraiser.

Method 2 of 2: Prepare for Assessment

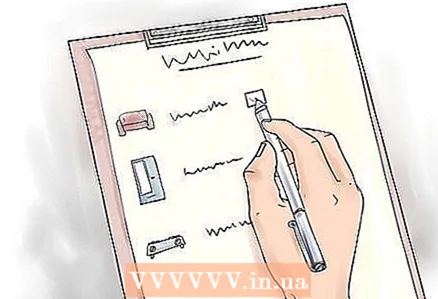

1 Prepare all documentation to help the appraiser determine the value of the home during the inspection.

1 Prepare all documentation to help the appraiser determine the value of the home during the inspection.- Provide the latest property tax invoices, a house and plot plan, and any recent checks or pest reports.

2 Show any written agreements, such as a homeowners association agreement, a maintenance agreement (for example, if you have a common road), or police reports of outbuildings or other intrusions.

2 Show any written agreements, such as a homeowners association agreement, a maintenance agreement (for example, if you have a common road), or police reports of outbuildings or other intrusions. 3 Please provide any agreements or documents before making an appraisal of the home for the purpose of onward sale.

3 Please provide any agreements or documents before making an appraisal of the home for the purpose of onward sale.- Add a document that the agents call a "commendation sheet." This is a list of improvements or upgrades that have recently been made that may affect the value of your home.

- Include a list of equipment and personal belongings that will be sold with the home. For example, if you are selling a house with a sink, dryer, refrigerator, dishwasher, your home score may be higher.

4 Clean up the house. A little clutter won't bother the appraiser, but still make sure your home looks its best. A well-kept home will be rated higher than one that no one cares about.

4 Clean up the house. A little clutter won't bother the appraiser, but still make sure your home looks its best. A well-kept home will be rated higher than one that no one cares about.  5 Let every corner of your home be accessible for inspection. The appraiser will need to inspect the basement and attic, as well as other hard-to-reach areas.

5 Let every corner of your home be accessible for inspection. The appraiser will need to inspect the basement and attic, as well as other hard-to-reach areas.  6 Pay attention to the points of maintenance. Repair leaking taps, smoke detectors, and loose door handles before checking.

6 Pay attention to the points of maintenance. Repair leaking taps, smoke detectors, and loose door handles before checking.

Tips

- Make sure you receive a complete copy of the assessment report. The evaluator is legally bound to provide you with a copy of the final report. This will usually take several days.

- Check your home's appraisal before getting one from an appraiser. You can use a site such as Zillow (www.zillow..com) to get an estimate of the value of your home. Remember that this is not the same as a certified grading, but it will give you a rough estimate before you go to a real grader.

Warnings

- Remember that peer review is different from regular review. The inspector simply reports the condition of the house based on the inspection. The appraiser makes an inspection of the house and also determines its market value based on this inspection.