Author:

Gregory Harris

Date Of Creation:

11 August 2021

Update Date:

1 July 2024

Content

The calculation of the annual investment income is done with one purpose: to find out the accrued rate of return earned during the period of the package investment of securities. While the various formulas used to calculate the annual investment income may seem daunting, it’s actually quite easy for you to calculate it once you become familiar with a few basic concepts.

Steps

Part 1 of 2: Laying the Foundation

1 Become familiar with the key concepts. When looking at annual investment returns, you will repeatedly come across several key terms to know. They are outlined below:

1 Become familiar with the key concepts. When looking at annual investment returns, you will repeatedly come across several key terms to know. They are outlined below: - Annual Return: The total return on investment for one calendar year, including dividends, interest and profits earned.

- Annualized Income: The annual rate of return obtained by processing data for periods that lasted less than or more than one calendar year.

- Average income: The average income earned over a period of time, obtained by calculating the total income earned over a longer period and spreading it evenly over (shorter) periods.

- Accrued income: income that includes interest reinvested, dividends and profits earned.

- Period: A specific period of time - the day, month, quarter, or year over which the income received is measured.

- Recurrent income: The total return on an investment that is measured over a specified period of time.

2 Become familiar with the principle of calculating compound interest. Compound interest is an increase in the profit you already have. The longer the compound interest is accrued on your deposits, the faster they will grow, and you will receive large returns on an annualized basis. (Imagine a snowball rolling down a hill that grows in size as speed increases.)

2 Become familiar with the principle of calculating compound interest. Compound interest is an increase in the profit you already have. The longer the compound interest is accrued on your deposits, the faster they will grow, and you will receive large returns on an annualized basis. (Imagine a snowball rolling down a hill that grows in size as speed increases.) - Imagine that in the first year you invested $ 100 and earned 100%, that is, at the end of the first year, you have $ 200. If in the second year you receive only 10% of the profit, then by the end of the second year, another 20 will be added to your 200 dollars.

- But if you imagine that during the first year you earned only 50%, then at the beginning of the second year you will have $ 150. The same 10% profit in the second year will bring you not $ 20, but $ 15.That's a whopping 33% less than the $ 20 you got in the first example.

- As an additional example, let's say that in the first year you lost 50% and you have $ 50 left. Then you will have to make a profit of 100% just to restore the original amount (100% of $ 50 = $ 50, and 50 + 50 = $ 100).

- The size of the profit and the timing of its receipt play a large role in calculating the accrued income and studying their impact on income on an annualized basis. That is, income on an annualized basis cannot be considered a reliable indicator of income received or losses incurred. However, annualized revenues are useful when comparing different types of investments.

3 Use the time-weighted rate of return to calculate your rate of return adjusted for reinvestment. For example, to find out the arithmetic average of daily rainfall or weight loss over several months, you can use the arithmetic average. You may have learned this method in school. However, the arithmetic mean will not help you in explaining the impact of recurring income on other types of income or on the timing of their receipt. To find out, we can use time-weighted geometric returns. (Don't worry, we'll teach you how to apply this formula!)

3 Use the time-weighted rate of return to calculate your rate of return adjusted for reinvestment. For example, to find out the arithmetic average of daily rainfall or weight loss over several months, you can use the arithmetic average. You may have learned this method in school. However, the arithmetic mean will not help you in explaining the impact of recurring income on other types of income or on the timing of their receipt. To find out, we can use time-weighted geometric returns. (Don't worry, we'll teach you how to apply this formula!) - You won't be able to use the arithmetic mean here, since all periodic incomes depend on each other.

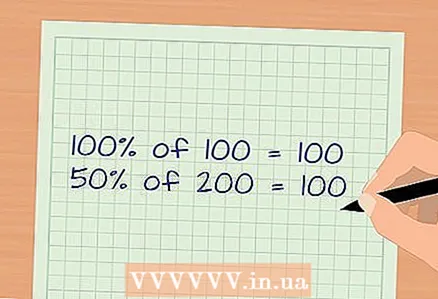

- For example, imagine that you want to calculate the average income of $ 100 over two years. In the first year, you earned $ 100, that is, by the end of the first year, you have $ 200 (100% of 100 = 100). You lost 50% in the second year - that is, by the end of the second year, you have $ 100 (50% of 200 = 100). This is the same number you started with at the beginning of the first year.

- When calculating the arithmetic mean, you would add both incomes and divide them by the number of periods, that is, two years. As a result, you would find that your average income was 25% per year. But when you compare the two incomes, you can see that you haven't actually earned anything. The years have mutually balanced each other.

4 Calculate your total income. First, you should calculate your total income for the entire period of the considered time. For the sake of clarity, we use an example in which there were no transactions in the form of deposits or withdrawals from the account. To calculate your total income, you need two numbers: the starting and ending value of your portfolio.

4 Calculate your total income. First, you should calculate your total income for the entire period of the considered time. For the sake of clarity, we use an example in which there were no transactions in the form of deposits or withdrawals from the account. To calculate your total income, you need two numbers: the starting and ending value of your portfolio. - Subtract the initial cost from the final cost.

- Divide the resulting number by the starting cost. The resulting number will be considered profit.

- If during the period in question you incurred losses, subtract the balance at the end of the period from the original balance. Then divide the resulting number by the original balance, and you end up with a negative value. (The last step is required in order not to add a negative number to the answer).

- Subtract first, then divide. Then you will get the total profit percentage.

5 Learn to use Excel formulas for calculations like this. The formula for calculating the total income ratio = (the final value of the securities portfolio - the initial value of the securities portfolio) / the initial value of the securities portfolio. The formula for calculating the accrued income ratio = degree ((1 + total income ratio), (1 / years)) - 1.

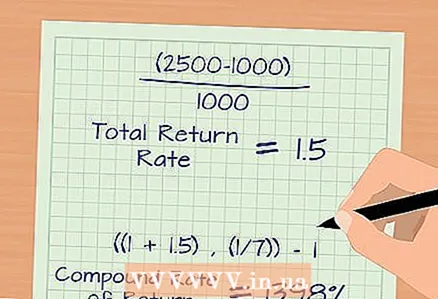

5 Learn to use Excel formulas for calculations like this. The formula for calculating the total income ratio = (the final value of the securities portfolio - the initial value of the securities portfolio) / the initial value of the securities portfolio. The formula for calculating the accrued income ratio = degree ((1 + total income ratio), (1 / years)) - 1. - For example, if the initial value of the portfolio was $ 1,000 and the final value seven years later was $ 2,500, the calculation would look like this:

- Total income ratio = (2500-1000) / 1000 = 1.5.

- Accrued income ratio = degree ((1 + 1.5), (1/7)) - 1 = .1398 = 13.98%.

- For example, if the initial value of the portfolio was $ 1,000 and the final value seven years later was $ 2,500, the calculation would look like this:

Part 2 of 2: Calculate Your Annual Income

1 Calculate your annual income. After calculating the total income (see above), insert the result into this equation: Annual income = (1+ income) -1 After solving this equation, you will get a number that corresponds to your annual income for the entire time period.

1 Calculate your annual income. After calculating the total income (see above), insert the result into this equation: Annual income = (1+ income) -1 After solving this equation, you will get a number that corresponds to your annual income for the entire time period. - The number "1" in the exponent (a small number outside the brackets) denotes the unit we are measuring, that is, 1 year. If you want a more accurate answer, you can use 365 to find out your daily income.

- "K" stands for the number of periods we measure. Thus, if you are calculating your income for 7 years, you should enter the number “7” instead of “K”.

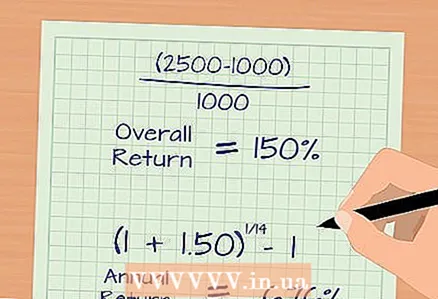

- For example, suppose your securities have grown in value between $ 1,000 and $ 2,500 over a seven-year period.

- First, calculate your total income: (2500-1000) / 1000 = 1.50 (income from 150%).

- Then calculate your annual income: (1 + 1.50) -1 = 0.1399 = 13.99% annual income. That's all!

- Use the usual order of solving math problems: first follow the steps in parentheses, then work with the exponent, then subtract.

2 Calculate your semi-annual income. Now, let's say you want to calculate semi-annual income (income received twice a year, every six months) over a seven-year period. The calculation formula is the same; you only have to change the number of measured periods. As a result, you will receive a semi-annual income.

2 Calculate your semi-annual income. Now, let's say you want to calculate semi-annual income (income received twice a year, every six months) over a seven-year period. The calculation formula is the same; you only have to change the number of measured periods. As a result, you will receive a semi-annual income. - In this case, you will have 14 half-year periods - two a year for seven years.

- First, calculate your total income (2500-1000) / 1000 = 1.50 (income from 150%).

- Then calculate your annualized rate of return: (1 + 1.50) -1 = 6.76%.

- You can convert it to annual income by simply multiplying it by 2: 6.76% x 2 = 13.52%.

3 Calculate the annual equivalent. You can also calculate the annual equivalent over shorter periods. For example, imagine that you have only half-year income and want to know its annual equivalent. We remind you that the calculation formula is the same.

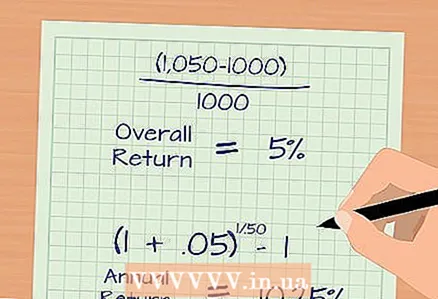

3 Calculate the annual equivalent. You can also calculate the annual equivalent over shorter periods. For example, imagine that you have only half-year income and want to know its annual equivalent. We remind you that the calculation formula is the same. - In six months, the value of your securities has increased from $ 1,000 to $ 1,050.

- Start by calculating your total income: (1050-1000) /1000=.05 (5% income for six months).

- Now, if you want to know what the annual equivalent would look like (assuming the rate of return and accruals remain the same), you should follow these steps: (1 + .05) -1 = 10.25% annual return.

- Regardless of the length of the period, if you follow the above formula, you can always translate your result into annual income.

Tips

- It is important to understand and be able to calculate the annual returns on securities, as you will use your annual income to compare with other depositors, as well as to compare their performance indicators. Thus, you will become familiar with the possible exchange risks, and, more importantly, you will be able to identify the weaknesses of your investment strategies.

- Practice doing these kinds of calculations so that you can easily solve such equations. With practice, you will be able to do these calculations quickly and easily.

- The paradox, which was mentioned at the very beginning of this article, is the recognition of the fact that the result of an investment, as a rule, is evaluated by the results of other contributions. In other words, a little damage incurred as a result of price surges in the market is better than a small but risky profit. Everything is relative.

Warnings

- Be sure to perform arithmetic operations in the exact order, otherwise you will get the wrong result. Therefore, it is better to double-check your work after performing these operations.