Author:

Sara Rhodes

Date Of Creation:

17 February 2021

Update Date:

1 July 2024

Content

Interest expense is a major factor in business applications, as it directly reduces a company's bottom line and reduces the value of monetary assets. Individuals may also be interested in interest expense, especially for mortgages and mortgages, where the interest expense can be deducted from taxable income. Although many lending institutions provide quarterly or annual reports with the amount of interest on the loan that you paid during a given period, the ability to calculate these numbers yourself will be very useful for you.

Steps

Method 1 of 2: Interest Paid

1 Summarize each loan or credit account for which you need to determine the interest expense.

1 Summarize each loan or credit account for which you need to determine the interest expense. 2 Collect the relevant statements for each account and highlight the opening and closing balances, interest rate, and payment amounts.

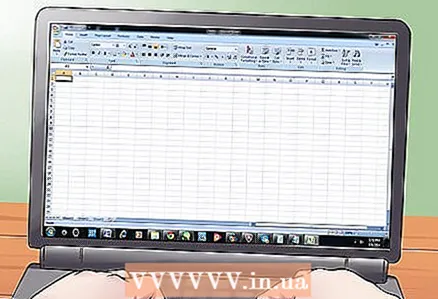

2 Collect the relevant statements for each account and highlight the opening and closing balances, interest rate, and payment amounts. 3 Start your spreadsheet program.

3 Start your spreadsheet program.- You can use almost any spreadsheet application that supports mathematical calculations on the data in cells.

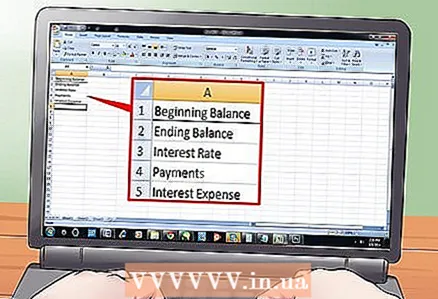

4 Write the names of the cells in column A, lines 1-5, as follows: Starting Balance, Ending Balance, Interest Rate, Payments, Interest Paid.

4 Write the names of the cells in column A, lines 1-5, as follows: Starting Balance, Ending Balance, Interest Rate, Payments, Interest Paid. - For example, let's say your starting balance was $ 9,000, your ending balance is now $ 8,700, and you made a payment of $ 350. Your interest rate is 6%.

- Write "9000" in cell A1 and "8000" in cell A2.

- In cell A3, write the formula "= .6 / 12" - it will convert your annual interest rate to monthly.

- In cell A4, write down "350."

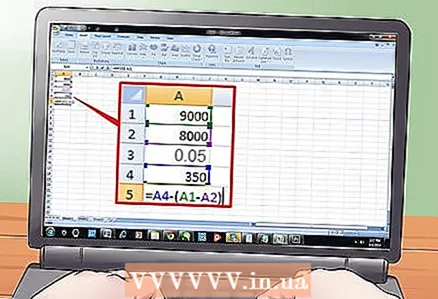

5 Write = A4- (A1-A2) in cell A5 and press Enter.

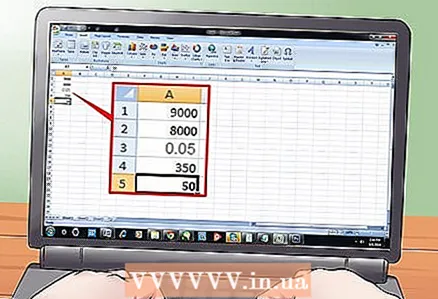

5 Write = A4- (A1-A2) in cell A5 and press Enter.- Cell A5 should display the number "50.00."

- Test your calculations by typing "= A1 * A3" in the adjacent cell and pressing Enter. The result should be very similar, if not accurate.

- Your interest expense is the portion of your payment amount that does not reduce the body of the loan.

6 Record the accounting entries for business by debiting the interest expense account for cell A5 and crediting the cash account from which the payment was made.

6 Record the accounting entries for business by debiting the interest expense account for cell A5 and crediting the cash account from which the payment was made.- This entry is usually made when interest has been paid. However, if the total payment was debited to the accounts payable account, you can correct this by debiting the interest expense account and crediting the accounts payable account.

Method 2 of 2: Rolling interest

1 Gather the details of the account for which you want to calculate the interest debt.

1 Gather the details of the account for which you want to calculate the interest debt.- You will need the interest rate and the most recent final balance of the loan body.

2 Start your spreadsheet program.

2 Start your spreadsheet program.- You can use almost any spreadsheet application that supports mathematical calculations on the data in cells.

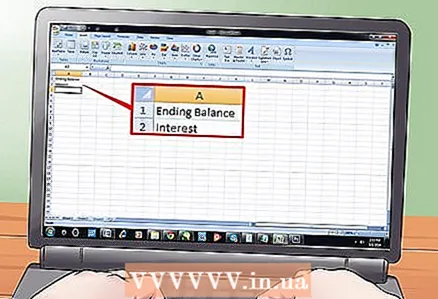

3 Write down the names of the cells in column A, lines 1 and 2, for the final balance and interest rate.

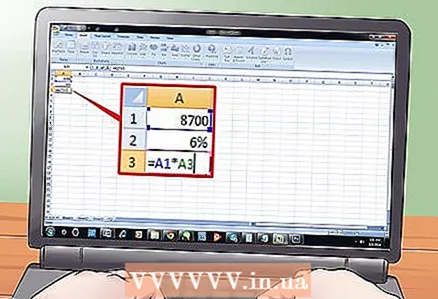

3 Write down the names of the cells in column A, lines 1 and 2, for the final balance and interest rate.- Enter the final balance amount in cell A1.

- Let's say your interest rate is 6%. Click in cell A2 and write "= .06 / 12." Hit Enter. This will give you the ability to get the monthly interest rate of the current balance.

- If you should get a different number, correct cell A2. Writing ".06 / 4" in the cell will give you the quarterly amount.

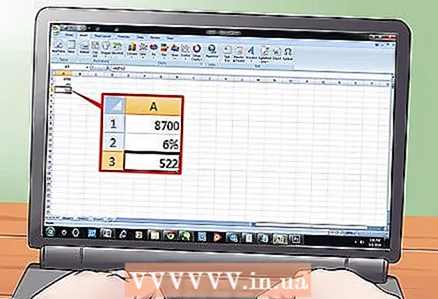

4 Calculate the interest arrears in cell A3.

4 Calculate the interest arrears in cell A3.- Write in the cell the formula "= A1 * A2," then press Enter.

5 Write this figure in the debit of the interest expense account and credit of the interest payable account.

5 Write this figure in the debit of the interest expense account and credit of the interest payable account.- The bulk of the loan payment has already been recorded in the accounts payable account. No more entries need to be made until the payment is made.

Tips

- Small businesses may use cash accounting instead of accrual accounting. Records in the cash book are entered upon payment and do not increase.

- Your business may have multiple interest expense accounts for each loan or credit account. We recommend working with your accountant to understand specific policies and procedures. Also, interest payable to government agencies must be kept in a separate account.