Author:

Randy Alexander

Date Of Creation:

24 April 2021

Update Date:

1 July 2024

Content

Becoming a small business owner presents challenges with the size and function of the business. Small business owners must master the revenue, shipping, financial, management, and growing challenges of their business with little or no staff. It is most important to maintain interest from stakeholders: customers, suppliers, and teams working to build forces in the short term. Running a small business makes a lot of sense both personally and financially.

Steps

Method 1 of 4: Drafting an Appropriate Business Plan

Sketch your ideas on paper. The most important thing is to form the idea on paper. Successful businesses often offer a new product or service or support an existing area in the market. Whatever the purpose, you will need to write a plan in writing.

- You can write many drafts of plans and choose the best one.

- Business planning is detailed. Thinking deeply about the details is in your favor rather than ignoring them.

- You can add questions to the draft plan. Verifying what you don't know is just as important as making a list of the things you are sure of. You do not want to present a plan with open questions to potential investors, including related questions in the draft will help you determine the right answer to the final business plan.

Meet your local Small Business Development Center (SBDC). SBDC will assist you in the process of running your business. They can help you with your business plan to reach out to investors and give advice completely free of charge.

Identify sources of customers. In your plan, you need to identify who will buy your product or use your service. Why do they need or want to use your product or service? The answer will help you decide on many aspects of the business.

- This is the time to ask questions about a service or product. For example, if you want to ask the question, will my product / service appeal to the young or the elderly? Is my product / service suitable for low-income people or high-end? Will my products / services appeal to customers in any particular environment? You can't sell ski wheels in Hawaii or sell towels in Alaska, so be realistic about the product's appeal.

Budgeting. In the plan, you need to address the key question of your business delegation.- How profitable will your product / service be? How much money will they make? How much does it cost to manufacture the product or service? How do you intend to pay the costs and wages? These are the most important questions you need to answer in your business financial plan.

Project development. All successful small businesses need to develop customer base and product capabilities from the outset. You need to determine your business's ability to respond to the growth potential.- Reality with growth potential. Keep in mind that growing your business is always accompanied by capital development. A project thriving in a short period of time could lose potential investors quickly.

Method 2 of 4: Creating Good Financial Habits

Choose the right bank. Run a small business with good finance by researching the full range of small business owners' offers and choosing the right bank to execute your financial plan. Many financial institutions offer low-cost accounts, low-interest loans or free deposit programs for small business owners. Working with the organization that provides the best deal so every penny you spend isn't wasted.

- Take the option of one bank to tell the other bank to mobilize the largest source of capital with the lowest interest rate. For example, if a bank lends you VND200 million at a 4% interest rate, you can tell the other bank if they can provide you with more capital at a lower interest rate. are not.

Loan or investment security. Successful businesses need investment capital. You need to arrange and secure sufficient financial backing for the business, production processes, and marketing costs until the business reaches a position that can sustain and operate on its own profits.

- Need to find out about the different interest rates for small business loans.

Guaranteed collection method. You need to explain the invoice revenue and the company's outstanding balance. A successful business needs a stable source of money.Not accepting customer payments or giving credit will ruin your business.

- You need to decide whether to accept cash, credit card, check or a combination of options for your customers.

- Cash transactions are easiest to do, but hard to review after a long time. At the same time, receiving cash is also difficult to ensure the safety of the company's revenue because workers can steal money from safes.

- Paying a check can prevent an internal thief from within the company, but checks can be returned leaving you with great problems on the bank.

- Credit cards and international debit cards are the safest form of payment, but paying the card issuer a fee depends on the size of the business, and that's a bit of a waste.

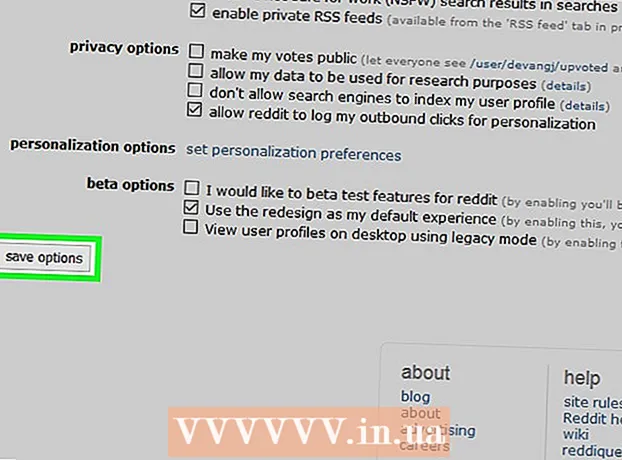

Consider using a credit control app. There are many applications to help small businesses improve their cash flow with clear management of daily revenues and control of customer credit payments. The app allows you to add new customers or keep track of existing ones, track bill payments or make money transfers more securely. Many vendors can help you in management like iKMC, you can try their software.

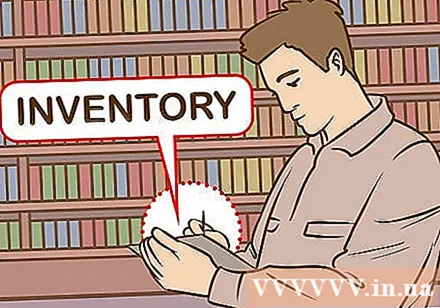

Efficient inventory management. Inventory management can make or break a small retail business, so it's important to manage it carefully so every penny is worth it. First, check your inventory and keep track of how many are sold. Regularly organize your inventory to get rid of hard-to-sell items and replace them with new ones.

- Inventory management is often determined by the "longevity" of the product you sell. For example, if you sell perishable products, you need to first remove the oldest product out of stock to maximize the profitability of the business.

Consider hiring a financial professional. This is a valuable investment when it comes to recruiting qualified staff to manage your small business's finances. Accounting can help you identify areas of business that are underperforming from a financial standpoint, helping you maximize profits.

- You don't need to hire full-time employees to manage your finances. For example, if you master inventory and money management, you only need the CPA (Certified Public Accountant) when calculating tax payments.

Method 3 of 4: Small Business Management

Apply for a permit. Remember to register and apply for a business license for small businesses at the specified facility in your industry. This is an important step towards ensuring the operation of your business is legal and in compliance with industry regulations. Remember to apply for licenses in relation to services you provide such as home repairs or tax preparation, they also require registration and documentation. You cannot hire good employees if the business operates without a license.

- Not all businesses need to apply for a license. Check with your local small business administrator if your business is one of them.

Employee Authentication. Recruit individuals with qualifications related to the field of business such as certified certified accounting or electrical engineering repairs. Qualified employees are highly skilled and increase client confidence.

Always arrange. Organizing your time, labor, finance, and inventory is the key to running your business successfully. Spreadsheet creation helps you check important details so you don't have to keep them in mind, review everything every week.

- Schedule meetings with employees weekly, two weeks, or monthly to ensure everyone is productive and to avoid wasting time when team members are overlapping work. The meeting also helps analyze who has not done a good job assigned.

Delegate responsibility. You can't do everything yourself, so leave some things to good staff. Small businesses require employees to do many things beyond their expertise.

- You can divide the business activities into many specific areas and then delegate them to many employees or team members.

- At the same time when delegating responsibilities, you need to supervise when assigning specific tasks to employees. For example, you might not want an accountant to handle legal matters on your behalf or a lawyer to organize the financial records. Think of each function in this way to identify a need in the job ad.

Participate together. After deciding who to delegate responsibility to, you need to continue to closely follow the work to ensure the employee is capable of performing the assigned task. At the same time, you need to be responsible for the needs of your customers. Be aware of the needs and feedback of customers, do not neglect customer care even when it is assigned to employees.

- From time to time, you need to hire and fire employees. You need to master the laws to deal with problems that arise when hiring or firing employees.

- Letting employees handle strict customer feedback is a risky tactic. Employees will be more beneficial if they only convey to you positive feedback from customers, which will lead to lax in company management. For example, employees need to provide evidence when reflecting business. This is your company and you need to put yourself at risk, so be proactive in monitoring business results.

Method 4 of 4: Customer Resource Development

Create promotional and marketing campaigns. This is an important step in promoting the company. Make sure that the advertising money is used appropriately according to the demographic research. This will help you to plan your promotions and marketing effectively.

- Think about appropriate advertising and marketing campaigns for your business. Playing ads on national television isn't a good choice if your business is only operating locally.

- Think about who will be interested in your product and why. For example, if you're selling dentures, putting young people in the category of marketing doesn't make sense.

Network links. Seek support from local small businesses by contacting the business owner. Join small business associations and community events to boost your business' reputation. Participate in many community events to reach out to potential customers.

Understand your business. Always keep up with news and trends to increase the competitiveness of businesses in the industry. Subscribe to the newsletter periodically or online for the latest events in your industry. Staying up to date with the latest and greatest in your business will help you attract customers from competing companies.

Provide references. Prepare a list of satisfied customers as a reference for potential customers. This helps new customers assess your work and customer service.

Stay connected. Make sure your customers can contact you and the company whenever they need it. The best way to develop a reputation is to be accountable to the needs of your customers.

- It is difficult for a large business to respond to all of its customers and it will lose a number of customers over time. Small businesses can't. As a small business owner, you can connect with potential customers. This may require you to provide your customers with cell phone numbers and email addresses if you want to grow your business.

Fulfill a promise. A small business needs to offer a product or service of some sort to be successful. However, if you grow your business by growing your customer base, you are not only giving your customers what they want, but what you promise. If your product or service does not match the advertisement, you will have difficulty developing customer base.

- Delivering what you promise starts with adjusting your outreach revenue. If you and the sales team give or promise too much, customers will be disappointed when they receive the product or use the service, which will lead to many negative comments and bad word of mouth about the business. your business. Remember, good sales tactics should focus on identifying and understanding customers' needs, making them realize the benefits that the product brings, not deceiving customers with the potential of the product. Products.