Author:

John Stephens

Date Of Creation:

27 January 2021

Update Date:

4 July 2024

Content

There are many real world situations that require us to know how to calculate interest. Here you will learn how to calculate simple and compound interest.

Steps

Method 1 of 2: Calculate simple interest

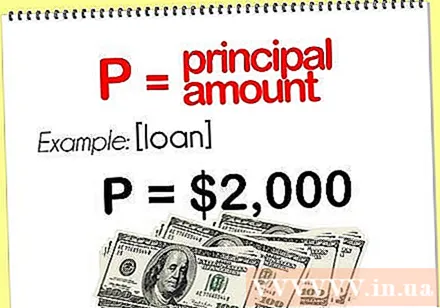

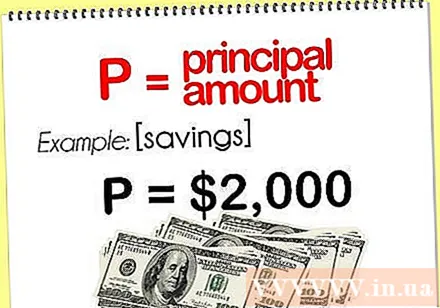

Determine the amount of capital (P). First you have to know what the initial capital is, we call it P.

- For example, if you lend to a person 2,000,000 VND, the initial capital amount is 2,000,000 VND.

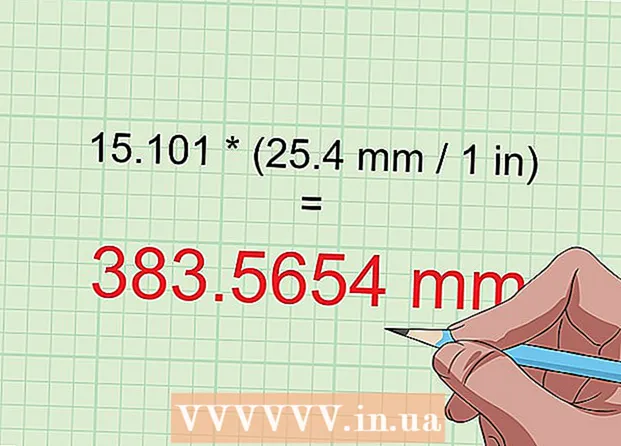

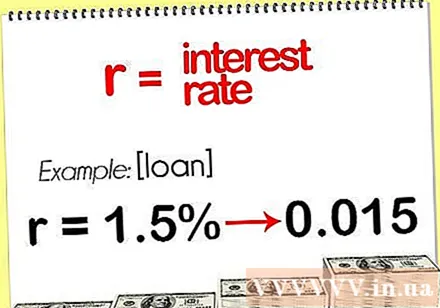

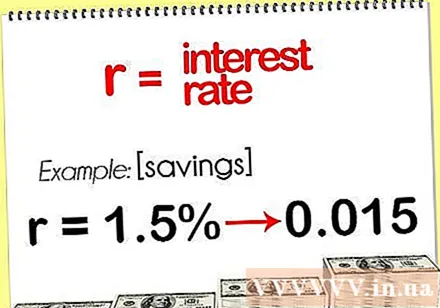

Determine the interest rate (r). Before calculating how much capital will increase in the future, you must know how fast that money will grow. This is the interest rate, denoted by r.- Let's say you lend to a borrower pledging that they will repay you VND 2 million with 1.5% of that amount by the end of the sixth month. The simple interest rate is 1.5%. But before calculating, you have to convert 1.5% to a decimal. Divide the percentage by 100 you will get the decimal value, that is, 1.5% ÷ 100 = 0.015. The r-value is now 0.015.

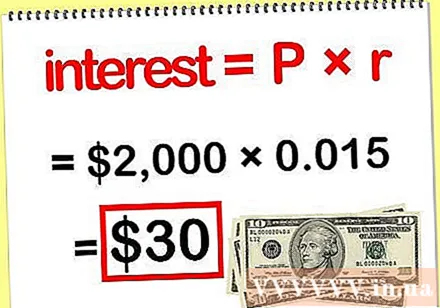

Simple interest calculation. To calculate simple interest, simply multiply your initial capital by interest, interest = P x r.- If you nest the values specified above (P = 2,000,000 and r = 0.015), the result is 2,000,000 x 0.015 = 30,000. So the amount you will receive is 2,000,000 + 30,000 dong interest.

Method 2 of 2: Compute compound interest

Determine the amount of capital (P). First you must know your initial capital amount, we call it P. To calculate the preliminary amount of interest earned, you multiply the initial capital by the interest rate as described in the section "Calculating Simple Interest". However, this calculation does not take into account the case that the initial capital also increases over time as interest accrues. To calculate compound interest for your principal, follow these steps.- For example, if you open a savings account with a deposit of 2 million VND, the initial principal is 2 million.

Determine the interest rate (r). Before calculating how much interest will be in the future, you must know how fast your principal will grow. This is rate r. Note the r value must be a decimal, not a percentage.

- Assuming a savings account you open at a 1.5% interest rate, this is the rate at which principal is growing. Before calculating the interest you must convert 1.5% to a decimal. Divide this percentage by 100 you will get the decimal value, that is, 1.5% ÷ 100 = 0.015. The r-value is now 0.015.

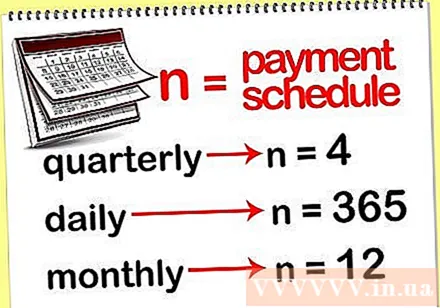

Determine the payment term (n). You must know how long the interest will be paid after the term, as it will accrue to your original principal and affect the interest for the next term. The maturity is denoted by the variable n.

- For example, if your savings account is fund-based, four times a year (every three months) interest will be added to your original principal. If interest accrues quarterly then n = 4.

- But if the interest accrues daily then n = 365, or monthly then n = 12.

Decide the number of years you want to calculate interest. The number of years to be calculated is denoted by the variable t.

- Suppose you want to know after 10 years what the interest is, then the variable t is 10.

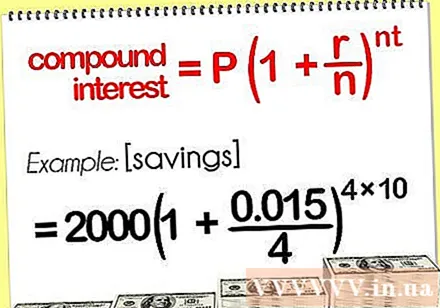

Plug values into your compound interest formula. The formula for calculating compound interest is as follows: P (1 + r / n). This formula determines the total amount of money in your account (interest plus starting principal).

- For example, if you replace the values specified above (P = 2,000,000; r = 0.015; n = 4; t = 10) into your compound interest formula, you get 2000000 (1 + 0.015 / 4).

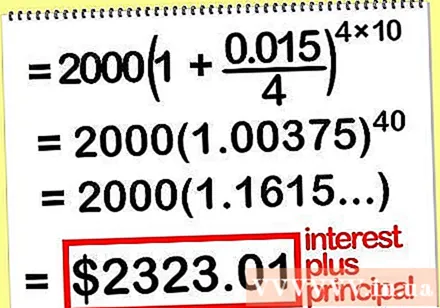

Calculate the total amount in the account. During the problem you must pay attention to the order in which calculations are performed. First calculate in parentheses first, then calculate the exponent and finally multiply by the original capital.

- With the calculation 2000000 (1 + 0.015 / 4) you get 2,323,010 VND. Now you know if you invest 2 million VND in your account with 1.5% interest rate, each fund's payment term, you will have a total (interest and capital) 2,323,010 VND in your account. ten years.

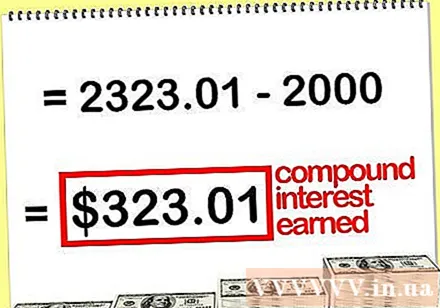

Only compute the compound interest earned. If you want to know how much interest is in VND 2,323,010 then do the following. Subtract your starting capital from the amount calculated in "Calculate the total amount in the account" step.

- For example, 2.323.010 minus the initial capital of 2,000,000 = 323.010 dong. That means if you invest 2 million dong in your account with 1.5% interest rate, each fund's payment term, you will have an interest amount of 32,010 dong after ten years.