Author:

Eugene Taylor

Date Of Creation:

16 August 2021

Update Date:

1 July 2024

Content

- To step

- Part 1 of 3: Getting started

- Part 2 of 3: Understanding the basics of investing

- Part 3 of 3: Developing your investment portfolio

Stock trading can be a great way to make money with your existing money, especially in the current economic climate where savings accounts and loans don't offer the best returns. Stock trading is not free of risk and a little loss is inevitable. However, with a lot of research and stocking in the right companies, investing can be potentially very profitable.

To step

Part 1 of 3: Getting started

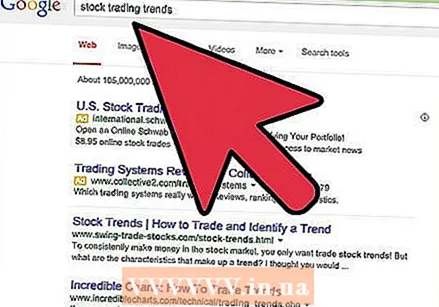

Research current trends. There are many reputable sources that report on market developments. You can subscribe to a magazine for investors such as Beleggers Belangen TKA, Beleggers Belangen, Kiplinger, Investor's Business Daily, Traders World, The Economist or Bloomberg BusinessWeek.

Research current trends. There are many reputable sources that report on market developments. You can subscribe to a magazine for investors such as Beleggers Belangen TKA, Beleggers Belangen, Kiplinger, Investor's Business Daily, Traders World, The Economist or Bloomberg BusinessWeek. - You can also follow blogs written by successful market analysts such as Abnormal Returns, Deal Book, Footnoted, Calculated Risk or Zero Hedge.

Choose an investment website. Some top websites include Scottrade, OptionsHouse, TD Ameritrade, Motif Investing, TradeKing, Binck, Lynx and Alex. Before deciding which site to use, make sure you are aware of any transaction fees and percentages of the total investment value as a fee.

Choose an investment website. Some top websites include Scottrade, OptionsHouse, TD Ameritrade, Motif Investing, TradeKing, Binck, Lynx and Alex. Before deciding which site to use, make sure you are aware of any transaction fees and percentages of the total investment value as a fee. - Make sure to use a reputable provider. You may need to read online reviews about the company.

- Choose a provider that offers services such as a mobile app, information and research tools for investors, low transaction costs, easy-to-read data and 24/7 customer service.

Create an account with one or more investment providers. You probably won't need more than one, but you may want to start with two or more so that you can later choose the provider you like best.

Create an account with one or more investment providers. You probably won't need more than one, but you may want to start with two or more so that you can later choose the provider you like best. - Make sure to pick out the minimum starting capital for each provider. Your budget may only be enough to open an account with one or two providers.

- Starting with a particularly small amount, such as $ 1000, may limit you to certain investment platforms as other platforms require a higher minimum initial capital.

Practice investing before betting real money. Some websites such as ScottradeELITE, SureTrader and OptionsHouse offer a virtual trading platform where you can experiment for a while to determine your insight without using real money. Of course you can't make money this way, but you can't lose money either!

Practice investing before betting real money. Some websites such as ScottradeELITE, SureTrader and OptionsHouse offer a virtual trading platform where you can experiment for a while to determine your insight without using real money. Of course you can't make money this way, but you can't lose money either! - Investing in this way familiarizes you with the method and the types of decisions you need to make when investing, but in general it is a poor representation of real investing. In real investing, there is a lag when you buy and sell stocks, which can lead to different prices than what you were targeting. Moreover, investing with virtual money does not prepare you for the stress of investing with real money.

Choose reliable stocks. You have a lot of choice, but in the end you have to buy shares of companies that dominate their niche, offer something that people constantly want, have a recognizable brand, a good business model and have been successful for a long time.

Choose reliable stocks. You have a lot of choice, but in the end you have to buy shares of companies that dominate their niche, offer something that people constantly want, have a recognizable brand, a good business model and have been successful for a long time. - Look at a company's public financial report to evaluate how profitable they are. A profitable business often means profitable shares. You can find the complete financial information of each exchange company in their most recent annual report on their website. If it's not on the website, you can call the company and request a hard copy.

- Look at the worst quarter in the report and decide if the risk of a repeat of this quarter outweighs the possibility of profit.

- Examine the company's leadership, operating expenses, and debts. Analyze the balance sheet and income statement, and determine whether they are profitable or have a good chance in the future.

- Compare the investment history of a particular company with the performance of similar companies. If all technology stocks were low at any given time, evaluating those stocks relatively, rather than the entire market, can give a good idea of which company is at the top of that particular industry.

- Listen to revenue conference calls. First, analyze the company's quarterly earnings, which will be published online about an hour before the call takes place.

Buy your first shares. When you're ready, take the plunge and buy a small number of reliable stocks. The exact number will depend on your budget, but aim for at least two. Well-known companies that have a good reputation and previous good investment results usually offer the most stable stocks and are good to start with. Start with a small investment and use an amount you can afford to lose.

Buy your first shares. When you're ready, take the plunge and buy a small number of reliable stocks. The exact number will depend on your budget, but aim for at least two. Well-known companies that have a good reputation and previous good investment results usually offer the most stable stocks and are good to start with. Start with a small investment and use an amount you can afford to lose. - It is fairly normal for an investor to start with a small amount such as $ 1000. Just be careful and avoid large transaction costs, as these can easily eat up your profit if you have a small starting capital.

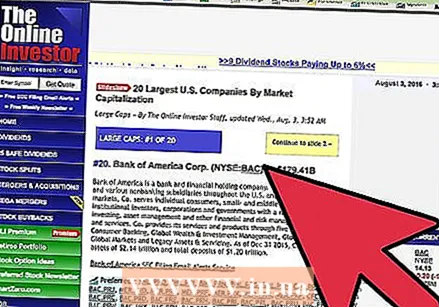

Mostly invest in mid-capital and large corporations. Medium-sized companies have a market capitalization of between two and 10 billion euros. Large companies have a market capitalization of greater than EUR 10 billion, and small companies have a market capitalization of less than EUR 2 billion.

Mostly invest in mid-capital and large corporations. Medium-sized companies have a market capitalization of between two and 10 billion euros. Large companies have a market capitalization of greater than EUR 10 billion, and small companies have a market capitalization of less than EUR 2 billion. - Market capitalization is calculated by multiplying a company's share price by the number of shares issued.

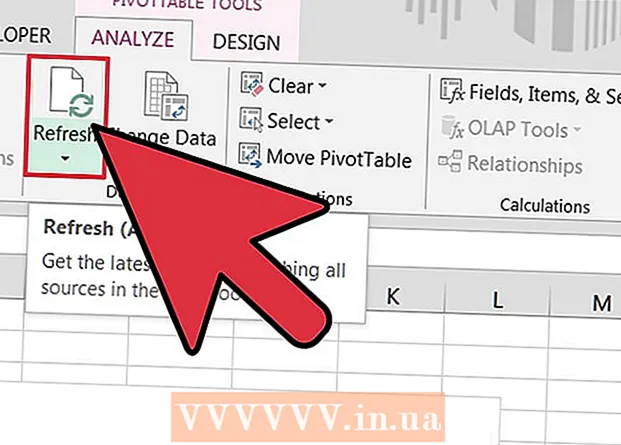

Follow the markets daily. Remember that the main rule of investing is to buy low and sell high. If your share value has increased significantly, you have to decide whether you want to sell the stock and invest the profit in (lower priced) shares.

Follow the markets daily. Remember that the main rule of investing is to buy low and sell high. If your share value has increased significantly, you have to decide whether you want to sell the stock and invest the profit in (lower priced) shares.  Consider investing in mutual funds. Mutual funds are actively managed by a professional fund manager and consist of a combination of stocks. These are diversified with investments in sectors such as technology, retail, financial, energy or foreign companies.

Consider investing in mutual funds. Mutual funds are actively managed by a professional fund manager and consist of a combination of stocks. These are diversified with investments in sectors such as technology, retail, financial, energy or foreign companies.

Part 2 of 3: Understanding the basics of investing

Buy low. This means that when stocks have a relatively low price, based on previous results, you should buy them. Of course, no one knows for sure when the price will go up or down - that's the challenge in investing.

Buy low. This means that when stocks have a relatively low price, based on previous results, you should buy them. Of course, no one knows for sure when the price will go up or down - that's the challenge in investing. - To determine whether a stock is undervalued, you need to look at both the earnings per share of a company and the purchasing activity of the company employees. Look at companies in certain industries and markets where there is a lot of activity, as you can make a lot of money there.

Sell high. You have to sell your stock at their peak, based on previous results. If you sell the stock for a higher price than you sold them with, you make money. The higher they have risen, the more money you make.

Sell high. You have to sell your stock at their peak, based on previous results. If you sell the stock for a higher price than you sold them with, you make money. The higher they have risen, the more money you make.  Don't panic sell. When a stock falls below the price you paid for it, your instinct may be to get rid of it. While there is a possibility that it could keep dropping and never come back up, consider the possibility that it can recover. Selling for a loss is not always a good idea, because then you determine your loss.

Don't panic sell. When a stock falls below the price you paid for it, your instinct may be to get rid of it. While there is a possibility that it could keep dropping and never come back up, consider the possibility that it can recover. Selling for a loss is not always a good idea, because then you determine your loss.  Study the fundamental and technical market analysis methods. These are the two basic models for understanding the stock market and anticipating price fluctuations. The model you use determines how you make decisions about which stocks to buy and when to buy and sell them.

Study the fundamental and technical market analysis methods. These are the two basic models for understanding the stock market and anticipating price fluctuations. The model you use determines how you make decisions about which stocks to buy and when to buy and sell them. - Fundamental analysis makes decisions about a company based on what they do, their character and reputation, and who runs the business. This analysis aims to add real value to the company and thereby to the shares.

- A technical analysis looks at the entire market and what motivates investors to buy and sell stocks. This includes trend watching and analyzing investor responses to events.

- Many investors use a combination of these two methods to make informed investment decisions.

Consider investing in companies that pay dividends. Some investors, known as dividend investors, prefer to invest almost entirely in stocks that pay dividends. This is one way in which your stocks can make money even when they are not increasing in value. Dividend is the realized profit of a company, which is paid directly to the shareholders on a quarterly basis. Whether or not you invest in these stocks depends on your personal goals as an investor.

Consider investing in companies that pay dividends. Some investors, known as dividend investors, prefer to invest almost entirely in stocks that pay dividends. This is one way in which your stocks can make money even when they are not increasing in value. Dividend is the realized profit of a company, which is paid directly to the shareholders on a quarterly basis. Whether or not you invest in these stocks depends on your personal goals as an investor.

Part 3 of 3: Developing your investment portfolio

Draw up a varied investment portfolio. Once you have bought a number of stocks and understand how buying and selling works, you need to expand your investment portfolio. This means investing your money in a variety of stocks.

Draw up a varied investment portfolio. Once you have bought a number of stocks and understand how buying and selling works, you need to expand your investment portfolio. This means investing your money in a variety of stocks. - Startups can be a great choice after you have built a foundation in stocks of older companies. If a startup is taken over by a larger company, you can potentially make a lot of money very quickly. However, keep in mind that 90% of startups last less than 5 years, making them a risky investment.

- Consider looking at different industries as well. If your original stocks are mostly in technology companies, try looking at the manufacturing industry or retail as well. This expands your investment portfolio and protects it against negative market developments.

Reinvest your money. When you sell your share (hopefully for more than you bought it), you have to let your money and profit roll and buy new shares. If you can make a little money every day or week, you are well on your way to a successful investment career.

Reinvest your money. When you sell your share (hopefully for more than you bought it), you have to let your money and profit roll and buy new shares. If you can make a little money every day or week, you are well on your way to a successful investment career. - Consider putting part of your profit in a savings account or retirement plan.

Invest in IPO (Initial Public Offering). An IPO is the first time a company issues shares publicly. This may be a good time to buy stock in a company you think will be successful, as IPO prices often (but not always) turn out to be the lowest price ever for the company's stock.

Invest in IPO (Initial Public Offering). An IPO is the first time a company issues shares publicly. This may be a good time to buy stock in a company you think will be successful, as IPO prices often (but not always) turn out to be the lowest price ever for the company's stock.  Take calculated risks when choosing stocks. The only way to make a lot of money investing is by taking risks and a little luck. This does not mean that you should risk everything for risky investments and hope for the best. Investing should not be played in the same way as gambling. You need to research each investment carefully and be sure to make it financially when an investment goes bad.

Take calculated risks when choosing stocks. The only way to make a lot of money investing is by taking risks and a little luck. This does not mean that you should risk everything for risky investments and hope for the best. Investing should not be played in the same way as gambling. You need to research each investment carefully and be sure to make it financially when an investment goes bad. - On the other hand, investing safely in only reliable stocks is not normally a way to "beat the market" and give you high returns. However, those stocks are often stable, which means you have a lower risk of losing your money. And with stable dividend payments and risk taking into account, these companies may be a better investment than riskier ones.

- You can also reduce the risk by hedging against losses on your investments. See how to hedge your investments for more information.

Be aware of the negative side of day trading. Brokers often charge transaction fees for each transaction, which can add up considerably. If you make more than a certain number of investments per week, you must open an institutional account with a high minimum starting capital in the United States from the Security Exchange Commission (SEC). Day trading is known for people losing a lot of money and it is very stressful so it is usually better to invest in the longer term.

Be aware of the negative side of day trading. Brokers often charge transaction fees for each transaction, which can add up considerably. If you make more than a certain number of investments per week, you must open an institutional account with a high minimum starting capital in the United States from the Security Exchange Commission (SEC). Day trading is known for people losing a lot of money and it is very stressful so it is usually better to invest in the longer term.  Talk to an accountant. When you start making serious money investing, you should talk to an accountant about how to pay taxes on your profits. That said, while it is always better to talk to a tax advisor, in many cases you can find the information yourself, avoiding an expensive advisor.

Talk to an accountant. When you start making serious money investing, you should talk to an accountant about how to pay taxes on your profits. That said, while it is always better to talk to a tax advisor, in many cases you can find the information yourself, avoiding an expensive advisor.  Know when to get out. Trading the stock market is like legal gambling and is not a fair long-term investment. This is different from investing, which is more long-term and safer. Some people can develop an unhealthy obsession with stock trading, which can make you lose a lot (even all) of your money. If you feel like you are losing control of the ability to make rational choices about investing your money, try to seek help before you lose everything. If you know an expert who is smart, rational, objective, and unemotional, ask that person for help if you feel you are out of control.

Know when to get out. Trading the stock market is like legal gambling and is not a fair long-term investment. This is different from investing, which is more long-term and safer. Some people can develop an unhealthy obsession with stock trading, which can make you lose a lot (even all) of your money. If you feel like you are losing control of the ability to make rational choices about investing your money, try to seek help before you lose everything. If you know an expert who is smart, rational, objective, and unemotional, ask that person for help if you feel you are out of control.