Author:

Morris Wright

Date Of Creation:

24 April 2021

Update Date:

1 July 2024

Content

- To step

- Part 1 of 3: Calculating the annual compound interest

- Part 2 of 3: Calculating compound interest on investments

- Part 3 of 3: Calculating compound interest with regular payments

- Tips

Compound interest differs from simple interest in that the interest income is calculated on both the original investment (the principal) and the interest accrued to date, rather than just the principal. Therefore, compound interest accounts grow faster than simple interest accounts. In addition, the value will grow even faster if the interest is compounded several times a year. Compound interest (also known as interest) is found in various investment products and also as interest on certain types of loans, such as credit card debt. With the right equations, calculating how much an amount will grow through compound interest is very easy.

To step

Part 1 of 3: Calculating the annual compound interest

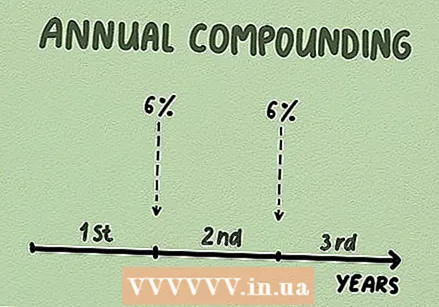

Define annual compound interest. The interest rate stated on your investment prospectus or loan agreement is on an annual basis. If you take out a car loan at, for example, 6% interest, you pay 6% interest per year. Compound interest at the end of the year is the easiest calculation for compound interest.

Define annual compound interest. The interest rate stated on your investment prospectus or loan agreement is on an annual basis. If you take out a car loan at, for example, 6% interest, you pay 6% interest per year. Compound interest at the end of the year is the easiest calculation for compound interest. - Compound interest on a debt can be calculated annually, monthly, or even daily.

- The more often your debt is compounded, the faster your interest will accrue.

- You can look at compound interest from the point of view of the investor or the debtor. Frequently calculated compound interest means that the investor's interest income will increase at a faster rate. It also means that the debtor will owe more interest on an outstanding debt.

- For example, interest on a savings account can be charged annually, while interest on a flash loan can be calculated monthly or even weekly.

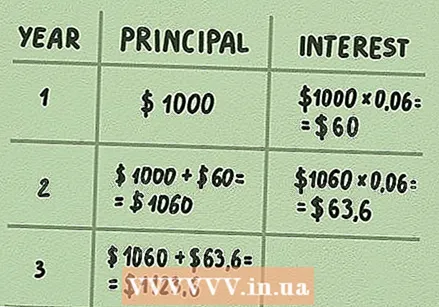

Calculate the compound annual interest for year 1. Assume you own a $ 1,000 government bond at an interest rate of 6%. Government bonds pay dividends each year based on interest and current value.

Calculate the compound annual interest for year 1. Assume you own a $ 1,000 government bond at an interest rate of 6%. Government bonds pay dividends each year based on interest and current value. - The interest over year 1 will then be € 60 (€ 1,000 x 6%).

- To calculate the interest for year 2, you must add the original principal to the total interest so far. In this case, year 2 principal is equal to $ 1,060 ($ 1,000 + $ 60). The value of the bond is therefore € 1,060 and the interest payable is calculated on the basis of this value.

Calculate compound interest for later years. To see the greater impact of compound interest, calculate the interest for later years. The principal continues to grow from year to year.

Calculate compound interest for later years. To see the greater impact of compound interest, calculate the interest for later years. The principal continues to grow from year to year. - Multiply the principal of year 2 by the interest rate of the bond ($ 1,060 X 6% = $ 63.60). The interest earned is € 3.60 higher (€ 63.60 - € 60.00). That's because the principal has increased from $ 1,000 to $ 1,060.

- For year 3, the principal is € 1,123.60 (€ 1,060 + € 63.60). The interest for year 3 is € 67.42. That amount is added to the principal for year 4 calculation.

- The longer a debt is outstanding, the greater the impact of compound interest. Outstanding means that the debt still has to be paid by the debtor.

- Without compound interest, the interest earned in year 2 would be $ 60 ($ 1,000 X 6%). In fact, the interest would be $ 60 each year if you were getting compound interest. This is known as simple interest.

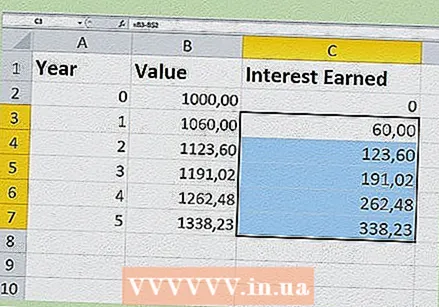

Create an Excel document for calculating compound interest. It can be useful to visualize compound interest by creating a simple model in Excel of the growth of your investment. Start by opening a document and label the top cell in columns A, B, and C as "Year", "Value", and "Interest Earned", respectively.

Create an Excel document for calculating compound interest. It can be useful to visualize compound interest by creating a simple model in Excel of the growth of your investment. Start by opening a document and label the top cell in columns A, B, and C as "Year", "Value", and "Interest Earned", respectively. - Enter the years (0-5) in cells A2 through A7.

- Enter the principal in cell B2. Suppose you started with $ 1,000. Type 1000.

- In cell B3, type "= B2 * 1.06" and press enter. This means that your interest is compounded annually at an interest rate of 6% (0.06). Click the lower right corner of cell B3 and drag the formula to cell B7. The numbers are now entered correctly.

- Place a 0 in cell C2. In cell C3, type "= B3-B2" and press Enter. This gives the difference between the values in cells B3 and B2, which represents the interest. Click the lower right corner of cell C3 and drag the formula to cell C7. The values should be entered automatically.

- Repeat this procedure for as many years as you want to track. You can also easily change principal and interest rate values by changing the formulas used and the cell contents.

Part 2 of 3: Calculating compound interest on investments

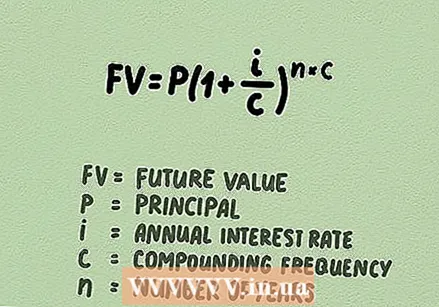

Learn the compound interest formula. The compound interest or interest formula calculates the future value of the investment after a specified number of years. The formula itself is as follows:

Learn the compound interest formula. The compound interest or interest formula calculates the future value of the investment after a specified number of years. The formula itself is as follows:  Collect the variables for the compound interest formula. If interest is calculated more often than annually, it is difficult to calculate the formula manually. You can use a compound interest formula for any calculation. To use the formula, you need the following information:

Collect the variables for the compound interest formula. If interest is calculated more often than annually, it is difficult to calculate the formula manually. You can use a compound interest formula for any calculation. To use the formula, you need the following information: - Determine the principal amount of the investment. This is the original amount of your investment. This could be how much you deposited into your account or the original price of the bond. For example, suppose your principal in an investment account is $ 5,000.

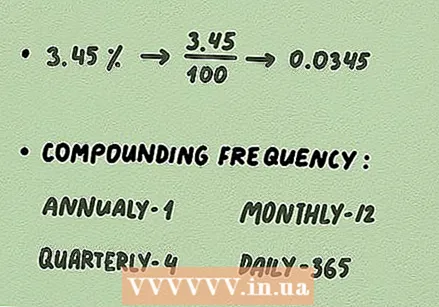

- Find the interest rate of the investment. The interest rate must be an annual amount, stated as a percentage of the principal. For example, an interest rate of 3.45% on the principal of $ 5,000.

- The interest rate must be entered as a decimal in the calculation. Convert it by dividing the interest rate by 100. In this example, it becomes 3.45 / 100 = 0.0345.

- You also need to know how often the interest is compounded. It is usually the case that interest is compounded annually, monthly or daily. Suppose, for example, that it concerns monthly calculated interest. This means that your interest rate ("c") must be entered as 12.

- Determine the period over which you want to calculate. This could be an annual growth target, such as 5 or 10 years, or the life of the bond. The maturity date of a bond is the date when the principal amount of the investment is due. As an example, we're using two years here, so enter 2.

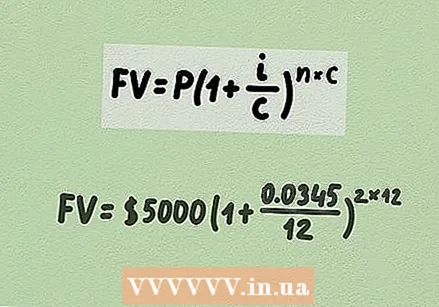

Use the formula. Substitute your variables in the right places. Check again to make sure you entered them correctly. In particular, make sure that the interest is entered in decimal form, and that you have used the correct value for "c" (interest rate).

Use the formula. Substitute your variables in the right places. Check again to make sure you entered them correctly. In particular, make sure that the interest is entered in decimal form, and that you have used the correct value for "c" (interest rate). - The investment example is then entered as follows:

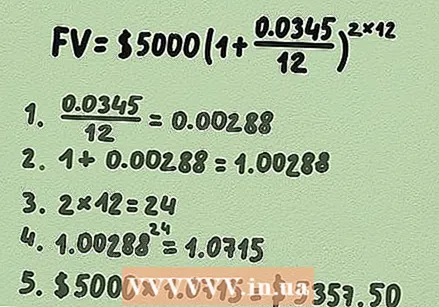

Complete the math calculations in the formula. Simplify the problem by first solving the terms in parentheses, starting with the fraction.

Complete the math calculations in the formula. Simplify the problem by first solving the terms in parentheses, starting with the fraction. - First, work out the fraction in brackets. The result:

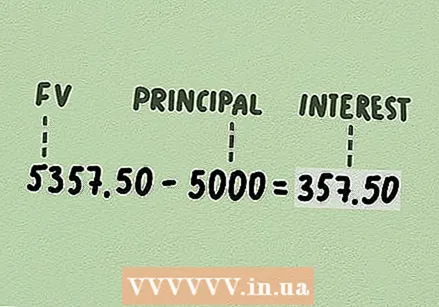

Subtract the principal from your answer. This returns the interest amount.

Subtract the principal from your answer. This returns the interest amount. - Subtract the principal of $ 5,000 from the future value of $ 5,357.50 and you get $ 5,375.50 - $ 5,000 = $ 357.50

- You have earned € 357.50 in interest after two years.

- First, work out the fraction in brackets. The result:

- The investment example is then entered as follows:

Part 3 of 3: Calculating compound interest with regular payments

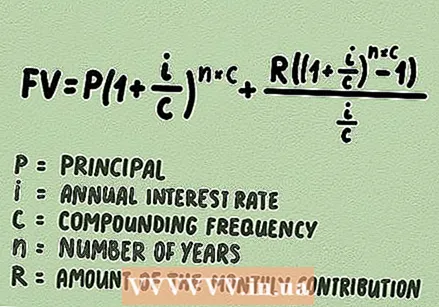

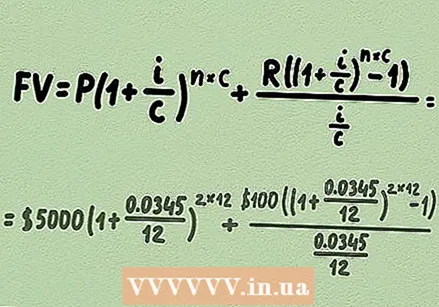

Learn the formula. Compound calculations of interest can increase even faster if you make regular deposits, such as transferring a monthly amount into a savings account. The formula is longer than that used to calculate compound interest without regular payments, but it follows the same principles. The formula is as follows:

Learn the formula. Compound calculations of interest can increase even faster if you make regular deposits, such as transferring a monthly amount into a savings account. The formula is longer than that used to calculate compound interest without regular payments, but it follows the same principles. The formula is as follows:  Fill in the variables. To calculate the future value of this type of account, you need the principal (or present value) of the account, the annual interest rate, the interest rate, the number of years to be calculated, and the amount of your monthly contribution. This information should be in your investment agreement.

Fill in the variables. To calculate the future value of this type of account, you need the principal (or present value) of the account, the annual interest rate, the interest rate, the number of years to be calculated, and the amount of your monthly contribution. This information should be in your investment agreement. - Make sure to convert the annual interest rate to a decimal number. You do this by dividing the percentage by 100. For example, based on the above interest rate of 3.45%, we divide 3.45 by 100 to get 0.0345.

- For the interest frequency, you use the number of times per year that the interest is calculated. This means the number 1 annually, 12 monthly, and 365 daily (don't worry about leap years).

Fill in the variables. We continue with the example above: suppose you decide to transfer € 100 per month to your account. On this account, with a principal amount of € 5,000, the compound interest is calculated monthly with an annual interest of 3.45%. We are going to calculate the growth of the bill over two years.

Fill in the variables. We continue with the example above: suppose you decide to transfer € 100 per month to your account. On this account, with a principal amount of € 5,000, the compound interest is calculated monthly with an annual interest of 3.45%. We are going to calculate the growth of the bill over two years. - The final formula using this information is as follows:

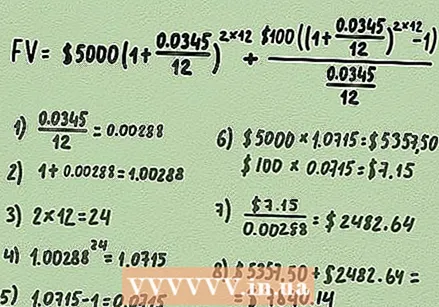

Solve the equation. Again, don't forget the correct order of operations. This means that you start by calculating the values within the brackets.

Solve the equation. Again, don't forget the correct order of operations. This means that you start by calculating the values within the brackets. - First solve the fractions within the parentheses. This means dividing "i" by "c" in three places, all for the same result of 0.00288. Now the equation looks like this:

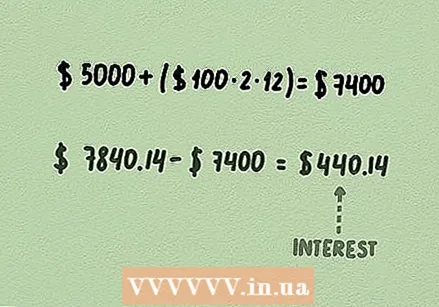

Subtract the principal and payments. To calculate the interest earned, you must deduct the amount you deposited. This means adding the principal, $ 5,000, to the total value of deposits, so: 24 contributions (2 years x 12 months / year) times the $ 100 deposited each month for a total of $ 2,400 . The total is € 5,000 + € 2,400 = € 7,400. Subtract $ 7,400 from the future value of $ 7,840.14, and you have the interest amount, $ 440.14.

Subtract the principal and payments. To calculate the interest earned, you must deduct the amount you deposited. This means adding the principal, $ 5,000, to the total value of deposits, so: 24 contributions (2 years x 12 months / year) times the $ 100 deposited each month for a total of $ 2,400 . The total is € 5,000 + € 2,400 = € 7,400. Subtract $ 7,400 from the future value of $ 7,840.14, and you have the interest amount, $ 440.14.  Expand your calculation. To really see the benefit of compound interest, imagine continuing to deposit money into the same account every month for twenty years (instead of two). In this case, the future value becomes approximately $ 45,000, although you deposited only $ 29,000, which means that your accrued interest is $ 16,000.

Expand your calculation. To really see the benefit of compound interest, imagine continuing to deposit money into the same account every month for twenty years (instead of two). In this case, the future value becomes approximately $ 45,000, although you deposited only $ 29,000, which means that your accrued interest is $ 16,000.

- First solve the fractions within the parentheses. This means dividing "i" by "c" in three places, all for the same result of 0.00288. Now the equation looks like this:

- The final formula using this information is as follows:

Tips

- You can also easily calculate compound interest using an online interest calculator. You can find an example on the US government website: https://www.investor.gov/tools/calculators/compound-interest-calculator.

- A quick way to determine compound interest is the "72 Rule". Start by dividing 72 by the amount of interest you get, say 4%. In this case, 72/4 = 18. This result, 18, is roughly the number of years it takes to double your investment at the current interest rate. Keep in mind that the 72 rule is just a quick approximation, not an exact result.

- You can also use these calculations to do "what if" calculations that can tell you how much you will earn depending on the interest rate, principal, interest rate, or number of years.