Author:

Morris Wright

Date Of Creation:

22 April 2021

Update Date:

1 July 2024

Content

- To step

- Method 1 of 3: Prepare a budget

- Method 2 of 3: Develop good habits

- Method 3 of 3: Finding inexpensive ways to have fun

- Tips

Managing money is hard enough, but when you're on a tight budget it's next to impossible. While it's not easy to stretch a dollar, there are things you could do to get more control over your wallet. First of all, you have to organize yourself by planning each month and sticking to a certain budget. Then look for ways to save a little extra here and you'll be amazed at how quickly the euros are pouring in!

To step

Method 1 of 3: Prepare a budget

Find out your total income for a month. Before you can determine how to divide your budget, you need to know exactly how much money you have available. Add up your income from a variety of sources, including your regular job, and the additional income, financial help from school, or financial help you receive from your family or others.

Find out your total income for a month. Before you can determine how to divide your budget, you need to know exactly how much money you have available. Add up your income from a variety of sources, including your regular job, and the additional income, financial help from school, or financial help you receive from your family or others. - Since most bills have to be paid once a month, it's usually easiest to plan a monthly budget no matter how often you get paid. If you want, you can of course also make your budget for other periods, such as a weekly or annual budget.

- It's okay to estimate how much you'll earn, especially if you don't get regular paychecks, such as at a performance or seasonal work. If you expect to earn about the same as last year, look at your latest tax return to see what your income was for that year. Then divide that amount by 12 to estimate your monthly income.

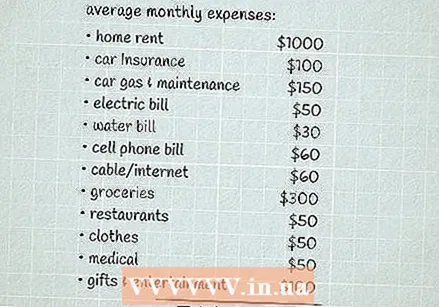

Calculate your average expenses in a month. Your expenses include everything you spend money on. This includes fixed expenses, which are the same every month, such as your rent or mortgage, car payment, insurance and amenities, as well as expenses that vary monthly, such as your groceries and entertainment expenses.

Calculate your average expenses in a month. Your expenses include everything you spend money on. This includes fixed expenses, which are the same every month, such as your rent or mortgage, car payment, insurance and amenities, as well as expenses that vary monthly, such as your groceries and entertainment expenses. - To get a good idea of what you are spending, you can go through your bank and credit card statements from the past months. If you don't have these available or you usually use cash on your purchases, try to keep track of everything you spend for about a month and then use that to set your budget.

Subtract the expenses from the income to determine your starting budget. The best way to make sure you're sticking to a budget is to build it the way you're already spending your money. If you subtract your expenses from your income and you get exactly 0, your budget is already in balance, that is, you don't spend more or less than you earn.

Subtract the expenses from the income to determine your starting budget. The best way to make sure you're sticking to a budget is to build it the way you're already spending your money. If you subtract your expenses from your income and you get exactly 0, your budget is already in balance, that is, you don't spend more or less than you earn. - Ideally, you will get a positive number, meaning you spend less than you earn. In that case, no changes to your budget are necessary unless you want to increase your savings or add a new expense.

- If you get a negative number, you are spending more than you earn each month, and you will have to find a way to cut back on your expenses.

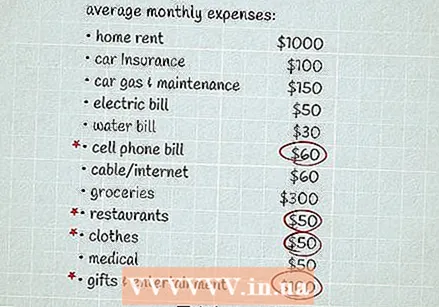

Look for things you can cut back on when there isn't enough left. Sometimes you don't realize how much money you spend on things until you see it on paper. Take a look at your expenses and see if there is anything you spend a lot of money on. Then think about whether those expenses match your priorities. If not, it could be an area where you can save some money every month.

Look for things you can cut back on when there isn't enough left. Sometimes you don't realize how much money you spend on things until you see it on paper. Take a look at your expenses and see if there is anything you spend a lot of money on. Then think about whether those expenses match your priorities. If not, it could be an area where you can save some money every month. - For example, if you add it all up, you might be surprised how much money you spend every day on snacks and sodas on the way home from work. That might be something you can easily get rid of, and you can use that money for something you really need!

- Remember, you'll probably be able to stick to your budget if it's realistic, so leave a little cash to indulge yourself every now and then. You don't have to stop going to new restaurants or buying books if you really enjoy doing that - just be considerate about the money you spend so you don't spend too much.

- You don't have to cut back on all your extra expenses, but you do need to understand where your money is going. That way, you'll know if you're spending money on the things that really matter to you, and you're less likely to overspend.

Save some of the leftover money every month. It can seem really difficult to put aside extra money when you're on a tight budget. However, it is essential to have a piggy bank, especially if you would not be able to afford an emergency financially. It's a good idea to have 3-6 months to spend in an emergency, but it's okay if you can't save all of that at once. Even if you start with just $ 5 or $ 10 a month to save, it will help to have that extra cash on hand in case you suffer an injury, unexpected expenses, or loss of income, for example.

Save some of the leftover money every month. It can seem really difficult to put aside extra money when you're on a tight budget. However, it is essential to have a piggy bank, especially if you would not be able to afford an emergency financially. It's a good idea to have 3-6 months to spend in an emergency, but it's okay if you can't save all of that at once. Even if you start with just $ 5 or $ 10 a month to save, it will help to have that extra cash on hand in case you suffer an injury, unexpected expenses, or loss of income, for example. - Set a savings goal for yourself and make sure you stick to it, for example by saving $ 10 off your paycheck every week. It can help if you automatically deduct part of your savings from each payout. That way, you won't miss out on the extra cash as quickly as you never actually get to see it.

- Keep your savings in a separate account than the money that is intended for paying your bills and your spending money, so that you do not accidentally use the savings for that.

- Once you've built up your emergency savings, you can set new savings goals, such as taking a vacation or buying a car.

Method 2 of 3: Develop good habits

Keep a calendar that will help you pay all your bills on time. If you accidentally forget that a bill has to be paid, you may have to pay a lot of extra costs and fines afterwards. To avoid that, you can use a calendar to track the expiration date of each of your accounts. Check these frequently, and mark every paid bill. To plan your budget for the next month, write the amount of each invoice in your calendar when you pay it.

Keep a calendar that will help you pay all your bills on time. If you accidentally forget that a bill has to be paid, you may have to pay a lot of extra costs and fines afterwards. To avoid that, you can use a calendar to track the expiration date of each of your accounts. Check these frequently, and mark every paid bill. To plan your budget for the next month, write the amount of each invoice in your calendar when you pay it. - Find the calendar system that works for you! For example, if you spend a lot of time on your phone, you might prefer to use a calendar or invoice tracking app. If you'd rather use a physical calendar, hang it somewhere you see it often, such as on your refrigerator or near your desk.

- Setting up automatic payments can also help you avoid missing an expiration date. It is of course possible that you still want to keep your accounts in a calendar, so that you always know what is being debited from your account. In addition, check your bank account online to check whether the payment has been successful.

- Making late payments can also negatively impact your credit score. This can cost even more money in the long run, as you may have to pay higher interest on things like a car loan or a mortgage.

Avoid using a credit card unless you can pay it off immediately. When you're on a tight budget, every dollar counts, and you don't want to waste money every month on interest charges. Only buy something if you can afford to pay for it in cash. If you do use a credit card, pay the full amount at the end of the month.

Avoid using a credit card unless you can pay it off immediately. When you're on a tight budget, every dollar counts, and you don't want to waste money every month on interest charges. Only buy something if you can afford to pay for it in cash. If you do use a credit card, pay the full amount at the end of the month. - If you have credit cards, it is very easy to use them for impulsive purchases that don't fit your budget. Unfortunately, this can ultimately put you deeply into debt. If you're struggling to control your spending, it's probably best not to own any credit cards at all. Instead, use a debit card for things like online shopping.

Save on electricity and water at home to save money on utilities. Utility bills probably make up a big chunk of your monthly budget, so finding ways to cut back on that can make a big difference. It can take time to save up for brand new energy efficient appliances, but there are also plenty of little things that can help you save all year round, such as

Save on electricity and water at home to save money on utilities. Utility bills probably make up a big chunk of your monthly budget, so finding ways to cut back on that can make a big difference. It can take time to save up for brand new energy efficient appliances, but there are also plenty of little things that can help you save all year round, such as - Turn the heating down a few degrees in the winter, or use the air conditioner less in the summer.

- Keep the curtains and blinds closed to block sunlight in summer and save on air conditioning costs.

- Checking the insulation and weather stripping and repairing or replacing them as needed.

- Install low-power shower heads to save on your water bill.

- Lowering the temperature of the boiler to 49 ° C.

- Shower on a timer to limit your water consumption.

Comparison shop for everything. Thanks to the internet, it has never been easier to compare the prices of different products and services before you buy them. Make the most of your budget by looking for the best deal on everything from clothes and shoes to cell phones and car insurance.

Comparison shop for everything. Thanks to the internet, it has never been easier to compare the prices of different products and services before you buy them. Make the most of your budget by looking for the best deal on everything from clothes and shoes to cell phones and car insurance. - In addition, it is possible to keep an eye on the internet for sales and receipts for things you were already planning to buy. However, try to avoid the temptation to buy things just because they are on sale - if you do, you don't actually save anything!

Plan your meals per week. It is almost always cheaper to cook at home, especially if you plan your menu in advance. Look at the grocery store ads in your local newspaper or online every week to see what's for sale. Then plan the meals you will eat with your family throughout the week. Sticking to your list should help you avoid overspending when you go shopping.

Plan your meals per week. It is almost always cheaper to cook at home, especially if you plan your menu in advance. Look at the grocery store ads in your local newspaper or online every week to see what's for sale. Then plan the meals you will eat with your family throughout the week. Sticking to your list should help you avoid overspending when you go shopping. - Try to use the same ingredients in more than one meal. For example, if you buy a piece of roast and a large bag of potatoes, you can use the roast with mashed potatoes and gravy for an evening meal. Then the next day you can serve the rest of the roast on sandwiches for lunch and the next evening use the rest of the potatoes for the fries for dinner.

- Proteins and vegetables can be expensive. Make them last longer by serving cheap, filling foods like oatmeal, whole grain pasta, potatoes, brown rice, and beans with every meal.

- It is often cheaper to buy groceries in bulk, but not always calculate the price per item (or price per volume) to see if the larger option is actually cheaper. Also, only buy something in bulk if you're sure you'll be using it all before the expiration date has passed.

Shop secondhand when you can. You can save a lot of money by buying second hand clothes, furniture, household items and even vehicles. Before paying the stores for something you'd like to have, check out local thrift stores, social media marketplaces, and online resale sites to see if anyone else has one they can no longer use.

Shop secondhand when you can. You can save a lot of money by buying second hand clothes, furniture, household items and even vehicles. Before paying the stores for something you'd like to have, check out local thrift stores, social media marketplaces, and online resale sites to see if anyone else has one they can no longer use. - Make sure to check a used product carefully before you buy it - you won't save money when you get home and find it torn or broken, because you will just have to replace it. This is especially true for larger items that you cannot necessarily repair yourself, such as a vehicle or appliance.

- If there's one thing you'd rather buy new, try checking the clearance section for finding discounts on off-season products. For example, you can sometimes find very cheap swimsuits, shorts and tank tops when the weather starts to cool, and the best time to buy a Christmas decoration is usually the day after the celebration.

Method 3 of 3: Finding inexpensive ways to have fun

Explore public areas such as parks and walking trails. Just because you're living on a budget doesn't mean you have to sit at home all day. When the weather is nice, go to your favorite local park, hike a nearby hiking trail, or go to a nice spot with beautiful scenery. Being out in the fresh air will help lift your mood, plus it costs nothing to get outside!

Explore public areas such as parks and walking trails. Just because you're living on a budget doesn't mean you have to sit at home all day. When the weather is nice, go to your favorite local park, hike a nearby hiking trail, or go to a nice spot with beautiful scenery. Being out in the fresh air will help lift your mood, plus it costs nothing to get outside! - Bring refillable water bottles and inexpensive snacks like popcorn so you won't be tempted to spend money on the go!

Go to free concerts and events near you. Use social media to keep up with the city service, news outlets and event organizers. That way you can keep better informed of the various events taking place in your area. When you hear about a free or cheap concert, open air festival or other public event, bring some friends and enjoy a fun, free day!

Go to free concerts and events near you. Use social media to keep up with the city service, news outlets and event organizers. That way you can keep better informed of the various events taking place in your area. When you hear about a free or cheap concert, open air festival or other public event, bring some friends and enjoy a fun, free day! - Remember, many of these events include vendors who may be selling food, crafts, and souvenirs. Usually these are quite pricey, so consider leaving your money at home in case you're tempted to buy something.

- If there is a big music festival you would like to go to but can't afford the tickets, check their website to see if they need volunteers. Many festivals give volunteers free entry in exchange for help with information tents or sales stalls.

Visit the library to read free books. Most people today spend a lot of time reading, but most of that time is on their phones. Rather than mindlessly scrolling through social media, you can stroll the shelves of your local library and enrich your mind, whether you like self-help books, autobiographies, adventure stories or novels.

Visit the library to read free books. Most people today spend a lot of time reading, but most of that time is on their phones. Rather than mindlessly scrolling through social media, you can stroll the shelves of your local library and enrich your mind, whether you like self-help books, autobiographies, adventure stories or novels. - You can also search online for free or cheap ebooks if you don't live near a library.

Teach children to enjoy themselves with the things you have around the house. If you have kids at home, encourage them to dress up, make up new games, and craft items from whatever is nearby. Children have great fantasies and they don't need the best toys or the latest equipment to have fun. However, they can sometimes use a little inspiration

Teach children to enjoy themselves with the things you have around the house. If you have kids at home, encourage them to dress up, make up new games, and craft items from whatever is nearby. Children have great fantasies and they don't need the best toys or the latest equipment to have fun. However, they can sometimes use a little inspiration - For example, you can fold hats out of a newspaper and then decorate them to make them look like pirate hats. Then you can make swords out of cardboard and run around like pirates for an afternoon! To keep the kids from getting bored during the game, you can even plan a scavenger hunt complete with homemade maps.

- To give the kids a good understanding of money later on, talk to them early on about things like the value of a dollar and how saving and investing works. Let it be an open, ongoing conversation, rather than a one-sided conversation.

Tips

- Keep your leftovers in a bag. If you have leftovers from a previous meal, take them to work or school for lunch.

- Consider visiting a local food bank if you need help obtaining food.

- To avoid making big impulsive purchases, try setting a spending limit, such as $ 100. If it costs more than that limit, agree to wait 24 hours before buying it.

- If you want to give up the cost of cable or satellite TV, try switching to a streaming service like Netflix, Prime Video, or Hulu.

- Don't get mad at yourself if you run out of budget. Any new habit takes practice to make it feel natural, so just keep trying.