Content

- Steps

- Part 1 of 3: Calculating the Inventory Turnover Ratio

- Part 2 of 3: Calculating the Inventory Turnover Period

- Part 3 of 3: Analyzing the inventory turnover period

- Additional articles

It is very important for a company selling products to be able to manage inventory in order to profit from its activities. Calculating the inventory turnover period allows you to understand how well the company is doing in terms of inventory. With this information, you can compare your company's inventory turnover period with competitors' inventory turnover. A shorter period of inventory turnover will mean higher inventory turnover and better return on assets. Calculating the inventory turnover period requires knowing the cost of goods sold for the period and the average inventory value for that period. To calculate the inventory turnover period in days, you will first need to calculate the inventory turnover ratio, for which you will need the aforementioned cost price and the average cost of the company's inventory.

Steps

Part 1 of 3: Calculating the Inventory Turnover Ratio

1 Get to know the concept of the inventory turnover ratio. Inventory turnover refers to how many times a company uses and replenishes its inventory over a given period of time. The low turnover ratio allows us to judge that the company's assets are used ineffectively and give low profits. In such a situation, the company holds too many reserves, as it does not have time to use them quickly enough. A high turnover rate can be an indicator that a company is missing out on an upsell opportunity when a customer wants to purchase a product but the company does not have enough inventory to manufacture and sell it.

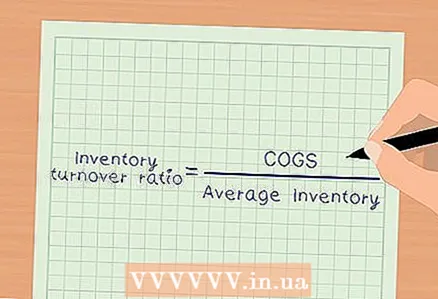

1 Get to know the concept of the inventory turnover ratio. Inventory turnover refers to how many times a company uses and replenishes its inventory over a given period of time. The low turnover ratio allows us to judge that the company's assets are used ineffectively and give low profits. In such a situation, the company holds too many reserves, as it does not have time to use them quickly enough. A high turnover rate can be an indicator that a company is missing out on an upsell opportunity when a customer wants to purchase a product but the company does not have enough inventory to manufacture and sell it. - So, the constituent elements of the calculation are the cost of goods sold and the average cost of inventory for the period.

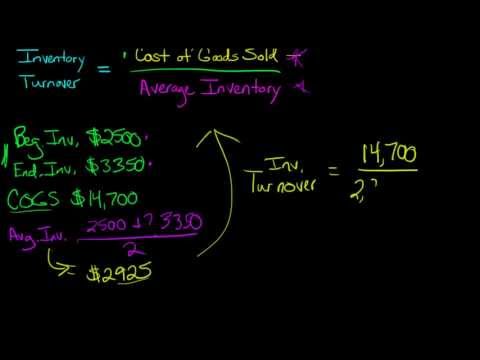

- The formula for calculating the inventory turnover ratio is as follows: Cost / Average Inventory Cost.

- Another less common option for calculating the turnover ratio is to divide the sales proceeds by the amount of inventory.

2 Determine the cost of goods sold. Cost of goods sold represents direct costs incurred in the production of goods or the provision of services. In the service sector, the cost price includes personnel costs, including salaries, bonuses, taxes. In retail or wholesale trade, the cost price includes the cost of purchasing goods from the manufacturer, as well as expenses incurred in connection with the purchase of goods, their storage and display on store shelves.

2 Determine the cost of goods sold. Cost of goods sold represents direct costs incurred in the production of goods or the provision of services. In the service sector, the cost price includes personnel costs, including salaries, bonuses, taxes. In retail or wholesale trade, the cost price includes the cost of purchasing goods from the manufacturer, as well as expenses incurred in connection with the purchase of goods, their storage and display on store shelves. - The cost of sales is reflected in the income statement.It is the value that is deducted from the revenue and gives the gross profit.

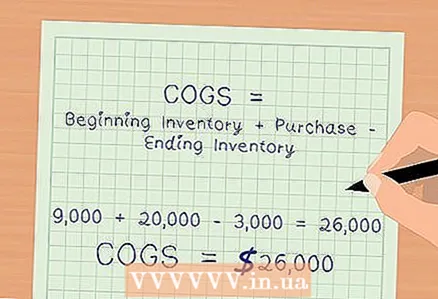

- In a trading company, the cost of sales can be simplified as follows: Cost of sales = Inventory value at the beginning of the period + Inventory purchase during the period - Inventory value at the end of the period

- For example, consider a period of 12 months, at the beginning of which the company had stocks of RUB 9,000,000, during the period it purchased goods for RUB 20,000,000, and at the end of the period, stocks were RUB 3,000,000.

- A simplified cost estimate would look like this: 9,000,000 + 20,000,000 - 3,000,000 = 26,000,000 (rubles) .

- The resulting value of 26,000,000 rubles will be indicated in the income statement on the line of the cost of sales.

3 Determine the average value of the company's inventory over the period. The average value of the cost of inventory for the reporting period is determined by the formula for calculating a simple average. The value of a company's inventory may vary significantly during the reporting period. That is why it makes sense to use its average value to calculate the financial indicators of turnover. The average value avoids inaccuracies due to sudden fluctuations in inventory levels.

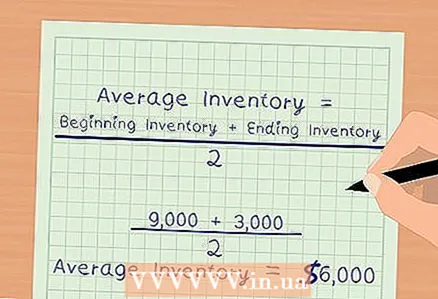

3 Determine the average value of the company's inventory over the period. The average value of the cost of inventory for the reporting period is determined by the formula for calculating a simple average. The value of a company's inventory may vary significantly during the reporting period. That is why it makes sense to use its average value to calculate the financial indicators of turnover. The average value avoids inaccuracies due to sudden fluctuations in inventory levels. - Average cost of inventory for the period: (Stocks at the beginning of the period + Stocks at the end of the period) / 2.

- For example, in the reporting year the company had stocks at the beginning of the year in the amount of 9,000,000 rubles, and at the end of the year - 3,000,000 rubles.

- The average cost of inventory for the year will be as follows: (9,000,000 + 3,000,000 / 2 = 6,000,000 (rubles) .

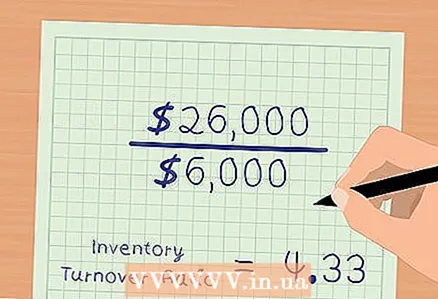

4 Use the formula for calculating the inventory turnover ratio. Knowing the cost of sales and the average cost of inventory for the period, you can calculate the inventory turnover ratio. From the above examples, it is clear that over the 12-month period under review, the cost of sales was RUB 26,000,000 and the average inventory value was RUB 6,000,000. To calculate the inventory turnover ratio, you will need to divide the cost price by the average inventory value.

4 Use the formula for calculating the inventory turnover ratio. Knowing the cost of sales and the average cost of inventory for the period, you can calculate the inventory turnover ratio. From the above examples, it is clear that over the 12-month period under review, the cost of sales was RUB 26,000,000 and the average inventory value was RUB 6,000,000. To calculate the inventory turnover ratio, you will need to divide the cost price by the average inventory value. - 26 000 000 / 6 000 000 = 4,33

- That is, this company uses and replenishes its reserves 4.33 times per year.

Part 2 of 3: Calculating the Inventory Turnover Period

1 Get to know the meaning of the concept of the period of inventory turnover. Once you know the value of the inventory turnover ratio, you can use it to calculate the inventory turnover period in days. The inventory turnover period tells how many days it takes a company to fully realize its inventory. Also, this indicator tells about how many days the available stocks will be enough. Companies use this metric to assess their efficiency in terms of inventory utilization.

1 Get to know the meaning of the concept of the period of inventory turnover. Once you know the value of the inventory turnover ratio, you can use it to calculate the inventory turnover period in days. The inventory turnover period tells how many days it takes a company to fully realize its inventory. Also, this indicator tells about how many days the available stocks will be enough. Companies use this metric to assess their efficiency in terms of inventory utilization.  2 Use the formula for calculating the inventory turnover period. The inventory turnover period is determined by dividing the number of days in the analyzed period by the inventory turnover ratio for this period. In the above example, the turnover rate was 4.33. Since in this example a period of 12 months was used, the total number of days in the period will be 365.

2 Use the formula for calculating the inventory turnover period. The inventory turnover period is determined by dividing the number of days in the analyzed period by the inventory turnover ratio for this period. In the above example, the turnover rate was 4.33. Since in this example a period of 12 months was used, the total number of days in the period will be 365. - The inventory turnover period will be calculated as follows: 365 / 4.33 = 84.2 (days).

- This suggests that it takes 84.2 days for the company to fully realize its average inventory.

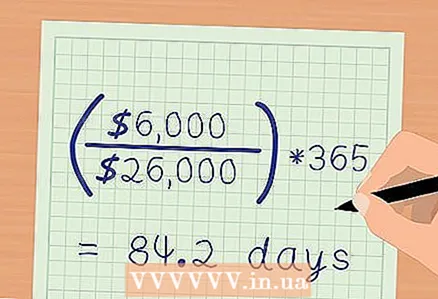

3 Apply an alternative calculation formula. If you have not previously calculated the inventory turnover ratio, you can directly use the cost of sales and average inventory values to calculate the inventory turnover period. You will need to divide the average inventory value by the cost of sales for the period. Then the resulting number needs to be multiplied by the number of days in the analyzed period.

3 Apply an alternative calculation formula. If you have not previously calculated the inventory turnover ratio, you can directly use the cost of sales and average inventory values to calculate the inventory turnover period. You will need to divide the average inventory value by the cost of sales for the period. Then the resulting number needs to be multiplied by the number of days in the analyzed period. - In the above examples, the average inventory value is RUB 6,000,000, the cost of sales is RUB 26,000,000, and the analyzed period is 365 days.

- The calculation of the inventory turnover period will look like this: (6 000 000 / 26 000 000) * 365 = 84,2

- The same value is received. It takes a company 84.2 days to fully realize its average inventory.

Part 3 of 3: Analyzing the inventory turnover period

1 Examine the money cycle. The cash cycle reflects the number of days it takes a company to convert its resources into cash flows. The inventory turnover period is one of the three components of this indicator. The second component is the period of turnover of receivables, or the number of days required by the company to collect receivables. The third component is the period of turnover of accounts payable, or the number of days required by the company to pay off its accounts payable.

1 Examine the money cycle. The cash cycle reflects the number of days it takes a company to convert its resources into cash flows. The inventory turnover period is one of the three components of this indicator. The second component is the period of turnover of receivables, or the number of days required by the company to collect receivables. The third component is the period of turnover of accounts payable, or the number of days required by the company to pay off its accounts payable. - The cash cycle reflects how the money turns into inventory and accounts payable to the company, then moves to the stage of selling products and turning into accounts receivable, and finally becomes money again.

- The cycle of circulation of funds allows you to assess the effectiveness of company management. The presence of a fast money cycle suggests that the company's management has thoughtful ways to reduce wasted time by keeping stock for a short time and getting paid for their goods quickly. Both involve strictly controlled and carefully planned production systems.

2 Evaluate inventory efficiency. The inventory turnover period reflects the duration of their storage. This indicator allows you to understand how long the cash invested in inventory remains tied. The longer the company's reserves are kept, the higher the likelihood that it will lose funds on this type of investment. Stocks may be out of date, or they may be out of date.

2 Evaluate inventory efficiency. The inventory turnover period reflects the duration of their storage. This indicator allows you to understand how long the cash invested in inventory remains tied. The longer the company's reserves are kept, the higher the likelihood that it will lose funds on this type of investment. Stocks may be out of date, or they may be out of date. - A long period of inventory turnover also reduces the return on other investments, as the company's surplus capital remains tied up in inventories.

3 Compare your company's inventory turnover period with other companies in the same industry. The indicator of the period of the company's inventory turnover becomes more meaningful in assessing efficiency when compared with the value of this indicator in other companies in the same industry. Different types of business have different inventory turnover. Perishable retailers have a shorter inventory turnover period than machinery or furniture retailers. Therefore, to understand how efficiently your company is operating with its inventory, you need to compare its inventory turnover period with the value of this indicator in other enterprises in the same industry.

3 Compare your company's inventory turnover period with other companies in the same industry. The indicator of the period of the company's inventory turnover becomes more meaningful in assessing efficiency when compared with the value of this indicator in other companies in the same industry. Different types of business have different inventory turnover. Perishable retailers have a shorter inventory turnover period than machinery or furniture retailers. Therefore, to understand how efficiently your company is operating with its inventory, you need to compare its inventory turnover period with the value of this indicator in other enterprises in the same industry. - You can also analyze the dynamics of changes in the period of inventory turnover in your company. This will help you identify positive and negative trends affecting the length of your cash cycle.

Additional articles

How to keep track of inventory for a business

How to keep track of inventory for a business  How to Obtain a QuickBooks Certification

How to Obtain a QuickBooks Certification  How to prepare an accounting report

How to prepare an accounting report  How to calculate the rate of staff reduction

How to calculate the rate of staff reduction  How to calculate the gross margin ratio

How to calculate the gross margin ratio  How to write a business report

How to write a business report  How to start a business for a teenager

How to start a business for a teenager  How to recognize counterfeit US dollars

How to recognize counterfeit US dollars  How to work at home

How to work at home  How to write a letter following a business meeting

How to write a letter following a business meeting  How to create your own cosmetics line

How to create your own cosmetics line  How to design a logo

How to design a logo  How to calculate market share

How to calculate market share  How to deal with aggressive clients

How to deal with aggressive clients