Author:

Lewis Jackson

Date Of Creation:

14 May 2021

Update Date:

25 June 2024

Content

Not being in debt when going to college is everyone's dream. Why go into debt when you can follow the simple steps below?

Steps

Method 1 of 3: Prepare for smart financial decisions

Open a bank account. If you live in the US, save $ 100-200 dollars per month from the age of 14. So by the age of 18, you will have $ 4,800-9,600. If you are in college, choose a bank that can withdraw money from ATMs on campus or near schools to avoid the high fees when withdrawing money from other banks' ATMs.

Keep track of your account balance. Use mobile banking or apps to prevent high overdraft fees.

Work on vacation or after school to save for college.

Set clear savings goals and stick to them. Reserved from now on (when you have 10 to 15 years to make money on investments) means that you'll have more to spend when you go to college.

Get high rankings in high school. Take both the ACT / SAT exams and apply to college with high scores. Students with a high grade point average in high school and higher ACT / SAT scores are more likely to have a scholarship than underperforming students.

Plan carefully about the area of the industry you want to study and learn about colleges early on. One of the best ways to save money for college is to find a low-cost community college to start your studies with. You can switch schools (or schools) after the first two years, upon completion of your foundation studies. This can save you thousands of dollars in tuition each year. According to the American Association of Community Colleges, the average tuition for a community college is $ 2,272 per year, while that for four-year college colleges is $ 5,836 per year.

Consider lower-cost schools. Remember that tuition for in-state residents is generally lower than for out-of-state residents; public school fees are lower than private schools. Compare the total cost (tuition and housing fees) with the financial aid packages before choosing.

- Consider studying at a community college. Take foundation courses and transfer credit to college with a four-year program to save money and reduce student debt.

- Consider taking summer classes at a community college. However, you should only take those classes if the cost is lower than the summer classes at your university. You may need a certificate of good rating from your current school to take these classes. In addition, you need to be sure that the results of your summer course are transferred back to the four-year university you are attending.

Plan to work in college. The fact that working while studying can help improve grades, as long as the working hours are no more than 20 hours per week. Think about the part-time jobs you like and learn skills for that job now. Typing, word processing, office skills, desk running, babysitting (in the form of babysitting or childcare), all of which can help pay your college expenses. learn. advertisement

Method 2 of 3: Find financial aid

Apply for all types of scholarships if you qualify. Don't ever think you can't. Apply if the instructions say you qualify.

Submit your application for admission by the deadline for "binding early admission applications". Depending on the school, the deadline to submit this application is November 1 or December 1. If you apply before the “regular deadline”, you will have more opportunities to receive scholarships from the school.

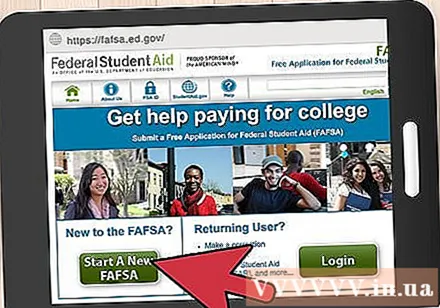

Complete the FAFSA application. This is the acronym for Free Application for Federal Student Aid (Application for Federal Student Aid). Depending on your family's economic circumstances, you may be eligible for grants, low-interest loans and employment while you study. Don't hesitate for too long, or the school will run out of funds, and you won't get benefits no matter how qualified you qualify.

Don't be afraid to ask your parents. You are almost always dependent on your parents. Just ask your parents for money or help when you find yourself in trouble.In response, remember to call home from time to time to ask about your parents. advertisement

Method 3 of 3: Living without debt in college

Simple life. When in college, try to eat affordable and not eat out too much. Don't forget that fast food restaurants are not cheaper than grocery stores, moreover, remember to stay healthy by eating healthy.

Use a good meal package, if you have purchased. Most universities require students living on campus to buy a meal package. Use a take-out food container for later, especially if the food is easy to store.

Don't party or party. Attend casual parties only. A party with friends with the food people bring together can be as fun or fun as a party at a noisy, crowded restaurant.

Do not go to school by car. This means you don't have to pay for gas, maintenance or parking fees. Plus, not bringing a car keeps you closer to school. Instead, go for less money than walking, cycling or public transportation. You can use these vehicles more easily in bustling cities.

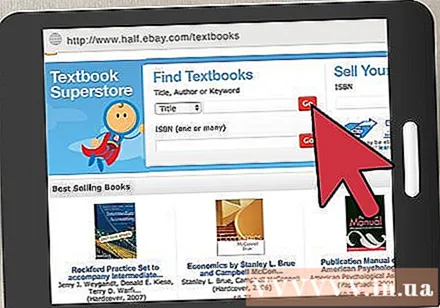

Consider buying used books or renting books. Used or rented books are cheaper than new ones. Compare bookshelves at Chegg, Amazon and school bookstores. Or you can buy books with a friend. Resell used textbooks.

If you live outside of school, find a roommate to divide your rent. Try to find apartments with home appliances available. Unlike hostels, outside rentals are usually cheaper (depending on the city) and don't require a meal package. However, make sure you don't live too far from the school and remember to calculate the price of food.

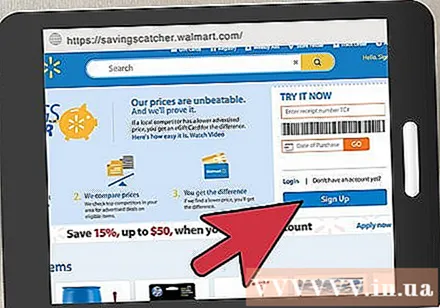

If you have to buy food, think about low-cost stores like Walmart or Kroger (using a savings card). Stock up on non-kitchen “dorm foods” such as instant cereals, oatmeal, yogurt, granola, Ramen noodles, cookies, peanut butter or hazelnut cream jam. You can save even more by bringing back food, drinks or spices from the school canteen.

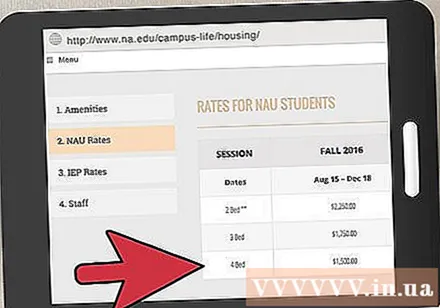

If you live on campus, choose an affordable accommodation. Find out room types and prices. A double room is usually cheaper than a single or fully furnished room, but that also means it is tighter and less private. Consider the pros and cons before choosing. advertisement

Advice

- Community colleges also often offer training courses (six months to a year) in hot areas, which can help you find a higher-paying career while finishing college. It is advisable to study for certification in areas such as healthcare, informatics or chemical lab technician while studying for a degree two years before continuing university.

- Apply for a scholarship. Don't assume you are unqualified. Most universities offer a variety of scholarships based on a variety of standards, which may include academic standards, financial need or curriculum.

- If you reach college age but still do not have enough money to pay for your studies, consider working and saving before starting instead of following the usual route from high school to straight. learn. Or you can learn something high-paying but do not take much training time, business careers such as truck driver can make it easier for you to enter university later if you live frugally and save money. learning.

- Ask about other sources of financial assistance. Many schools offer programs or grants to help first-in-family students enter college, low-income families, students with disabilities, or workers losing their jobs.

- Consider teaching in public schools for a while. There used to be a program to write off student loans if you taught in public schools for five years. Proof of education may save you from debt, but you must be capable of working in the school system. You should try volunteering to teach before considering this option, if it is not right for the job, you may be disappointed by the large debt. There may also be a grant to become a teacher. That means you must commit to accepting a lower-than-expected income in comparable careers and work hard working hours, so you need to understand everything related to this profession before moving forward.

Warning

- If you withdraw your student loans to pay for college costs, you should avoid withdrawing the maximum amount. After graduating you could end up paying $ 100 per month for every $ 10,000 you withdraw from your loan.