Author:

Laura McKinney

Date Of Creation:

1 August 2021

Update Date:

1 July 2024

Content

Creating a monthly budget can help you get out of debt and build financial capacity. But it is easier to start a budget than to keep track of it. If you want to get the absolute benefit of your budget, there are some restrictions and personal rules you need to put in place to be able to stay ahead.

Steps

Part 1 of 4: Determine What You Have

Calculate monthly income. As a rule of thumb, creating a monthly budget is a very effective way. Therefore, you need to determine the monthly income. Consider net income, which is the amount you receive after tax deductions.

- If you work hourly, multiply your hourly wage by the number of hours you work per week. If your schedule changes, use the minimum hours you work per week instead of the maximum. Multiply by 4 approximate weekly wages to get approximate monthly wages.

- If working for a certain salary, divide your annual wages by 12 to determine how much money you receive each month.

- If paid biweekly, the monthly salary will be based on 2 paychecks, because that's the full amount received each month. This is especially useful if your budget is low, then twice a year you will receive a bonus to bolster your savings account.

- If you work odd jobs and have irregular income, average your recurring income over the last 6 to 12 months. Use the average to create a monthly budget, or choose the lowest monthly total to spend for yourself in the worst case scenario.

- In the US, for example, if your monthly salary is $ 3,800 then that is your main income.

- Again, you must adjust this amount when calculating taxes. List income only as net amount.

List a few other sources of income. Other income is any money you receive on a regular basis that you do not make, such as alimony.- Another example in the US, if you make $ 200 per month from part-time work, your total income is $ 3,800 + $ 200 or $ 4,000.

Forget bonuses, overtime income, and occasional income. If you are not dependent on certain amounts received during the month, do not include them in your monthly budget.

- Fortunately, you get the additional income, which will be "profit". That is, how much money you can spend on unexpected things (or, to save better).

Part 2 of 4: Determine your spending

Calculate your total monthly debt. One of the keys to successful budgeting is accurate spending tracking. It includes debt payments as well as other expenses. Find out how much you pay each month for car loans, mortgages, rentals, credit cards, student loans and any other form of debt. Mark each number separately, but also need to sum the numbers to determine how much you owe.- In the US, for example, monthly payments might include the following: $ 300 car payments, $ 700 mortgage payments, and $ 200 credit card payments. Then total monthly spending is $ 1,200.

Track monthly insurance payments. These usually include anything you pay each month for renters insurance, homeowners insurance, auto insurance, other motor vehicle insurance, health insurance and life insurance.- As another example in the US, the costs for monthly insurance might include the following: $ 100 car insurance and $ 200 health insurance. Total monthly premium will be $ 300.

Averaging a number of gadgets monthly. Utilities include the monthly service you pay your provider, and usually include bills for water, electricity, gas, telephone, network service, cables and satellite. Keep new and old invoices from last year to calculate a monthly average for each add-on, and add the average numbers together.

- In the US, for example, monthly utility costs might include the following: $ 100 water bills and $ 200 electricity bills. A total of $ 300 for monthly utility costs.

Determine your average monthly grocery purchase invoice. Look at grocery receipts from a few months ago to determine how much money you usually spend each month.

- For example, the average monthly cost of grocery shopping for a person in the US could be $ 1,000.

Pay attention to the amount of cash you have withdrawn earlier. Consider receipts from automatic teller machines (Automated Teller Machine) and bank account notices to determine how much money you normally withdraw each month. In this issue, determine how much money has been spent on essential and wanted items.

- If you keep all your receipts from the previous month, take a closer look and work out how much you've spent on certain essentials — gasoline, food and a few others. Subtract this total from the total cash you withdraw each month to see how much you've spent on the things you want — new video games, brand name bags, and more.

- If you don't keep the receipt, try to make an estimate based on memory.

- In the US, for example, if you withdraw $ 500 per month at an automatic teller machine, and spend $ 100 on groceries, then you subtract $ 100 from the $ 500 total and explain this is the cost of buying groceries. This leaves $ 400 per month for withdrawals at automatic teller machines.

Charge some special fees. Special costs don't recur every month, but they happen often enough for you to predict. Some examples include holiday gifts, birthday gifts, vacations, and repairs or replacements that you anticipate to pay in the near future. Determine how much the planned special cost is for each month, January through December.

- For example, you might guess you have to spend $ 100 per month on maintenance.

Part 3 of 4: Organizing your budget

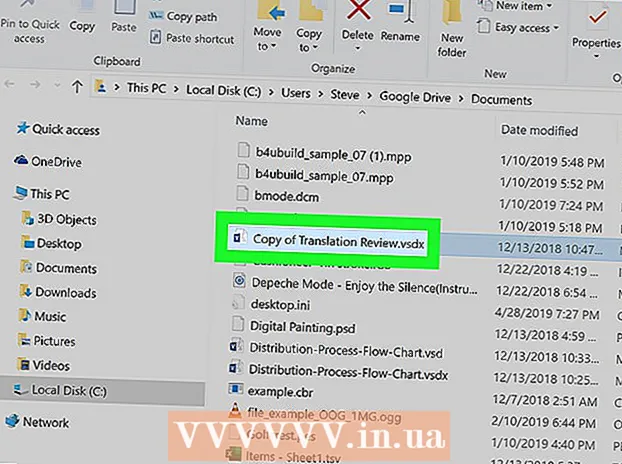

Decide how you want to track your budget. You can use pencil and paper, standard spreadsheet software, or specialized budgeting software. The software can make it easy to calculate and make changes as needed, but it's also convenient to write down a budget and keep it in your checkbook or credit card as a constant reminder.

- One of the greatest benefits of using software to organize your budget, like a spreadsheet, is that you can control the "what if" case. In other words, you can see what will happen to your budget if your monthly mortgage increases to $ 50 per month by simply inserting the new increment in the "Mortgage" value. The software will check everything right away and help you visualize how much of the increasing variable will impact your free spend.

- Bank of America offers a spreadsheet template that you can download for free.

Organize your budget. Divide your budget into two basic parts: income and expenses. Fill in each section of information as you calculated above, marking a separate category for each individual income stream as well as each expenditure goal.

- Calculate twice the total for the "income" section. For the first time, add together all the new income you have for each month. For the second time, add everything together, including the money you have saved in your account.

- Calculate three totals for the "spend" section. For the first time, add together some stabilization costs, including debt payments. Stable costs are also considered essential or essential, although some, like food, change from month to month. In general, the charges do not pose much difficulty for a person.

- For the second time, add unnecessary or changed expenses that you have control over how much is spent, like eating out or entertainment.

- For the third time, calculate the total cost by adding up the other two items.

Subtract your total expenses from your new income. To be able to save money, you should have a positive margin. To be able to break even, the two totals need to be even.- For example, if your total cost per month is $ 3,300 and your monthly income is $ 4,000 per month, then the difference is $ 4,000 - $ 3,300 or $ 700 per month.

Make some changes. If you subtract your total expenses from your new income and make a negative difference, investigate your change costs and make adjustments. Cut back on unnecessary things, like games and clothes. Keep changing until you have some money to break even or save.- Ideally, your income should exceed your expenses and not just break even. There will always be expenses that you did not know in advance. That is a constant law of the universe.

Try not to let your total expenses exceed your gross income. Sometimes in excess of new income means the savings will run out. Sometimes this can happen if necessary, but don't make a monthly routine like that. However, your gross income also includes savings, so if you exceed your savings, you will be in debt.

Keep a paper copy for the budget. Place it near your checkbook or in a dedicated targeted newsletter for the budget. It's best to have an electronic copy, but the hard copy will last long even if the computer is compromised and the files are deleted. advertisement

Part 4 of 4: Making adjustments

- Review your budget regularly. While keeping track of your monthly budget, you should review and adjust it from time to time. Actively track your income and spending for at least 30-60 days (more if income or expenses have a big difference from month to month) so you can see any changes and make adjustments. exactly. Compare your actual expenses with what you plan to spend. Find any expenses that tend to rise from month to month and try to limit those expenses if possible.

- Save money wherever you can. Analyze your spending and look for ways to cut back. You may not realize how much money you've spent on dining or entertainment in the past. Look for high-value bills that account for a larger share of your total expenses than you might think (for example, if you are spending more money on cable TV and phone than on your meals). Think about how to cut these costs down and save them over time.

- Adjust your budget for a savings account or change your life. There will come a time when you need to save up to buy something of great value or make a change to handle a life event. When that happens, start over and find ways to add new expenses or necessary savings to your budget.

- Be realistic. Change is an important part of budgeting, and you can expect to change many things. Even if you plan on spending your money on the bare essentials, the prices for many essentials — like gas and food — fluctuate in a way that you cannot predict when budgeting. Always be prepared to face these fluctuations and should not set savings goals but cut your budget too hard. advertisement

Advice

- Think of spending will always be higher than income, because people tend to act against optimism.

Warning

- Don't allow yourself to spend your savings too often. Target that money a few times in a period of time is acceptable and must happen, especially in emergencies and unforeseen costs appear. However, if you plan on spending your savings too often, the money will quickly run out.

What you need

- Pencil

- Financial records

- Spreadsheet software

- Budgeting software

- Invoices and previous financial statements