Author:

Robert Simon

Date Of Creation:

21 June 2021

Update Date:

1 July 2024

Content

Working capital is a measure of cash and working assets available, serving the daily operating needs of the company. Mastering this information will support your business management and help you make the right investment decisions. By calculating working capital, you can determine whether a business is able to meet its short-term obligations and, at the same time, how long it will take to do so. With little or no working capital, the future of the business may not be very good.Working capital is also useful in evaluating a firm's resource use efficiency. The formula for working capital is:

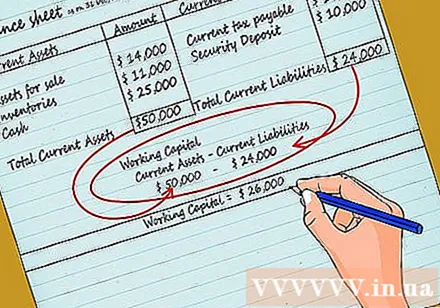

Working capital = current assets - short-term liabilities

Steps

Part 1 of 2: Performing Simple Calculations

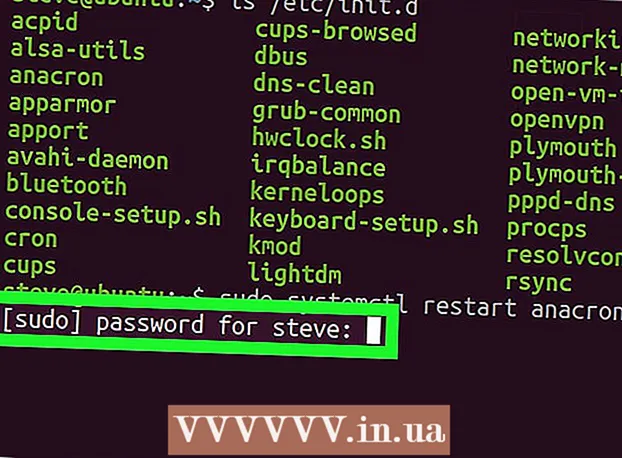

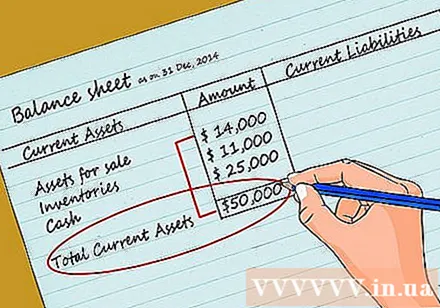

Short-term assets. Short-term assets are assets that a business can convert into cash for a period of one year. These include cash and other short-term accounts. Examples: accounts receivable, upfront expenses and inventory.- Typically, you can find the above information on a company's balance sheet - this document should include a section on short-term assets.

- If your balance sheet does not include your total short-term assets, check each line of your balance sheet. Add up all the accounts that meet the short-term asset definition to get the total. For example, you would add the parameters "accounts receivable", "inventory", "cash and equivalents".

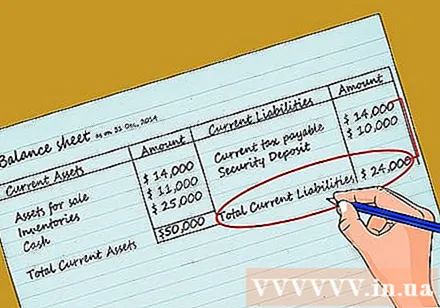

Short-term debt calculation. Short-term debts are those that need to be paid off in a one-year period. These include payables, accruals and short-term loans payable.- Your balance sheet should show your total short-term debt. If not, use the balance sheet information to find this sum by accruing the listed short-term debt accounts. For example, they might include "accounts payable and provisions", "taxes payable" and "short-term liabilities".

Working capital calculation. This is just a basic subtraction. Subtract total current assets from total short-term liabilities.- For example, suppose a company has short term assets of VND 1 billion and short term debt of VND 480 million. Working capital of the company will be 620 million dong. With existing short-term assets, the company can pay off all its short-term liabilities and, at the same time, cash in to serve other goals. The company can use cash for business operations or to pay off long-term debts. It can also be used to pay dividends to shareholders.

- If the short-term debt is greater than the short-term assets, the result shows that working capital is in short supply. The shortage of working capital is a warning sign that the company is in danger of default. In this situation, the company may need other long-term sources of finance. That could be a sign that the company is in trouble and perhaps, not a good investment option.

- For example, let's say the company has 2 billion dong of short-term assets and 2.4 billion dong of short-term debt. Working capital of the equipment company is short of 400 (or - 400) million dong. In other words, the company will not be able to meet its short-term obligation and must sell long-term assets equivalent to VND400 million or find other sources of finance.

Part 2 of 2: Understanding and managing working capital

Calculate the short-term ratio. For more in-depth analysis, many analysts use the "short term ratio" - an indicator of the financial strength of a company. Also using the figures used in the first two steps in Part 1, instead of monetary values, the short-term ratio formula gives us a comparison ratio.

- Ratios are a way of comparing two values and their correlation. Calculating a ratio is often just a simple division problem.

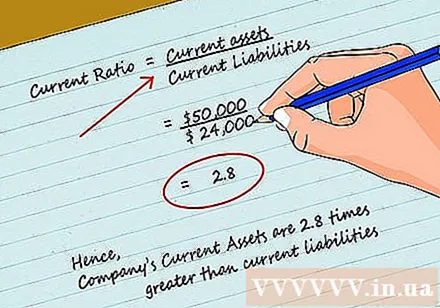

- To calculate the short-term ratio, divide your short-term assets by short-term liabilities. Current ratio = short-term assets ÷ short-term liabilities.

- Continuing with the example in part 1, the company's short-term ratio is 1,000,000,000 ÷ 480,000,000 = 2.08. That means the company has 2.08 times more current assets than current liabilities.

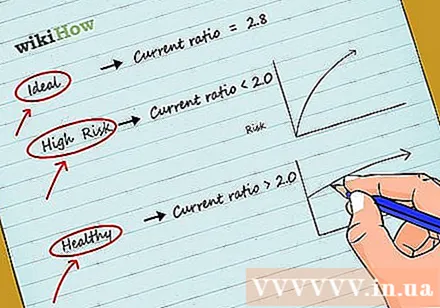

Understand what coefficients mean. Short-term ratio is a way of assessing a company's ability to meet short-term obligations. Simply put, it indicates the company's ability to pay its bills. A short term ratio should be used when comparing two different companies or industries.

- The ideal short-term ratio is around 2.0. A ratio low or below 2.0 may indicate a greater risk of default. On the other hand, a factor exceeding 2.0 could be a sign that management is too safe and not ready to take advantage of existing opportunities.

- In the above example, the short term ratio 2.08 is probably a healthy indicator. You can understand how this index shows that short-term assets can finance short-term liabilities of more than two years. Of course, we are tacitly assuming here that short-term debt is maintained at the present level.

- Different industries have different accepted short-term ratios. Some industries occupy capital and may need debt to meet operational needs. For example, the manufacturing company often has a high short-term ratio.

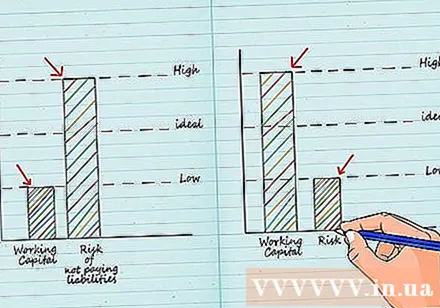

Manage your working capital. Business managers must keep track of all sectors to maintain working capital at an appropriate level. These include inventories, accounts receivable and accounts payable. Management must assess profitability and risks that can arise with too little or too much working capital.

- For example, a company with too little working capital is at risk of not being able to pay off its short-term debts. Even so, keeping too much working capital may also be bad. Companies with a lot of working capital can invest in long-term productivity improvements. Working capital surpluses, for example, can be invested in a manufacturing facility or a retail store. These types of investments could increase future revenue.

- When working capital is too high or too low, remind the tips below for some ideas for improving short-term ratio.

Advice

- Managing credit recipients to avoid late payment from customers. In case of urgent collection, consider a discount policy when paying early.

- Paying off short-term debt upon maturity.

- Don't buy fixed assets (like a new factory or building) with short-term debt. Converting fixed assets into cash fast enough to repay debt is difficult. It will affect your working capital.

- Manage inventory levels. Try to avoid shortages or redundancies. Many manufacturers use the immediate production system (J.I.T) in inventory management because it is cost effective. It also uses less space and reduces damage or damage in inventory.