Author:

Peter Berry

Date Of Creation:

12 February 2021

Update Date:

1 July 2024

Content

In the business world, Net present value (also known as NPV) is one of the most useful tools for making financial decisions. Typically, NPV is used to estimate whether an asset purchase or investment is worthwhile over the long term, rather than simply investing the equivalent amount in a savings account at a bank. Although commonly used in the world of corporate finance, it is also used for everyday use. In general, you can calculate NPV using the formula NPV = ⨊ (P / (1 + i) t) - C, where P = Cash Flow in a Specific Time, i = Discount Rate (or rate of return), t = Time of the cash flow and C = Initial Investment Cost.

Steps

Part 1 of 2: Calculating NPV

Determine the initial investment cost. This is the "C" of the above formula. In the business world, the value of property bought and invested is often aimed at making money in the long run. This type of investment usually contains the initial cost of the investment - usually the value of the property purchased.- For example, imagine that you run a small lemonade stand. You are considering buying a juicer to save time and effort instead of squeezing lemon juice with your hands. If the press costs $ 100, then this $ 100 is your initial investment.

Determine a time period for analysis. This is the "t" in the above formula. As mentioned above, businesses and individuals make investments with the aim of making money in the long run. In order to calculate the NPV for your investment, you need to define a specific period of time as you work to determine if you will get your capital back from the investment. This time period can be measured in multiple time units, but most financial calculations will use the year unit.- In our lemonade stand example above, let's say we have researched the juicer we plan to buy online. According to the majority of user reviews, the machine runs well, but usually breaks down after about three years. In this case, we will use three years as the NPV calculation period to determine if the press will help you recoup your initial capital amount before it broke down.

Estimate your cash inflow from time to time. This is the “P” in the above formula. You need to estimate how much money your investment will give you during the time it makes you money. These amounts (also known as "cash inflows") can be specific, known, or estimated numbers. In the latter case, from time to time, businesses and finance companies will devote a great deal of time and effort to making accurate estimates, hiring business experts, analysts, etc.- Let's continue with the lemonade stand example. Based on your past productivity and your best estimate of the future, you assume using a $ 100 press will give you an additional $ 50 in the first year, $ 40 in the second year, and $ 30. in the third year by minimizing the time employees spend squeezing lemons (and thereby saving the cost of paying your wages). In this case, you expect your earnings to be: $ 50 in year 1, $ 40 in year 2, and $ 30 in year 3.

Determine the appropriate discount rate. This is the value "i" in the above formula. In general, in presentYour available money will be worth more in the future. This is because you can save money you have in the meantime and make a profit over time. In other words, it's better to own $ 10 today than $ 10 after a year because you can invest $ 10 now and make more than $ 10 in a year. In order to calculate NPV, you need to know the interest rate on an investment account or opportunity that has a similar level of risk to the investment you are analyzing. It is called the "discount rate" and is expressed as a decimal, rather than a percentage.

- In corporate finance, a firm's average cost of capital is often used to determine the discount rate. In the simpler situation, you can use the rate of return on savings, equity investments, etc. that you can invest in rather than chasing the investment you are analyzing.

- Going back to our lemonade stand example, if you didn't buy the juicer, you would invest that money in the stock market, where you can feel confident that your money will be. profit 4% per year. In this case, 0.04 '(decimal of 4%) is the discount rate we use in our calculation.

Discount your cash flow. Next, we will calculate the value of the cash inflow for each period we analyze against how much we make on the replacement investment for the same period. This is called a cash flow "discount" and is calculated using a simple formula P / (1 + i)where P is the value of cash flow, i is the discount rate, and t is time. We don't need to worry about the initial investment yet - we'll use it in the next step.

- Continuing with the lemonade counter example, we are analyzing with a time span of three years, so we need to use the formula three times. You can calculate the discounted annual cash flow as follows:

- Year One: 50 / (1 + 0.04) = 50 / (1.04) = $48.08

- Year Two: 40 / (1 +0.04) = 40 / 1.082 = $36.98

- Year Three: 30 / (1 +0.04) = 30 / 1.125 = $26.67

- Continuing with the lemonade counter example, we are analyzing with a time span of three years, so we need to use the formula three times. You can calculate the discounted annual cash flow as follows:

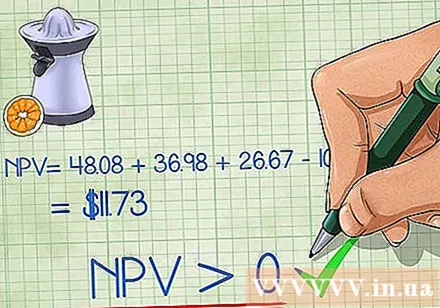

Sum your discounted cash flows and subtract your initial investment. Finally, to calculate the NPV of the project, acquisition assets, or investment you're analyzing, you need to add up all of the discounted cash flows and subtract the initial investment. The value you get will be the NPV value - The amount of your investment vs. other alternative investment gives you a discount rate. In other words, if the number is positive, you will make more money than you would when you used it for another alternative investment, as the 4% assumption you could make from the equity market in the example. on. If this is negative, you will make less money.

- For our lemonade stand example, the final NPV value of the juicer would be:

- 48.08 + 36.98 + 26.67 - 100 = $11.73

- For our lemonade stand example, the final NPV value of the juicer would be:

Determine whether you should invest or not. In general, if your investment has a positive NPV, it is more profitable than spending money on another alternative investment and you should accept it. If the NPV is a negative number, it's best to invest your money elsewhere, and should discard the investment you are planning to make. Keep in mind that these are just general principles - in fact, you'll often have to focus more on the process of determining whether an investment is a wise idea.

- In the lemonade stand example, the NPV is $ 11.73. Since this is a positive number, we can decide to buy the press.

- Keep in mind that this doesn't mean the lemonade juicer will only earn you $ 11.73. In fact, it means that the press will give you 4% annual return, plus $ 11.73. In other words, it would be $ 11.73 more profitable than your alternative investment.

Part 2 of 2: Using the NPV equation

Compare investment opportunities through NPV value. Calculating the NPV value for a variety of investment opportunities allows you to easily compare your investment methods to determine which one is more valuable. In general, the investment with the highest NPV will be the most valuable because it is most profitable. For this reason, you should first pursue the investment with the highest NPV (assuming that you do not have the resources to make every investment measure with a positive NPV).

- For example we have three investment opportunities. One opportunity has an NPV of $ 150, one is $ 45, and one - $ 10. In this situation, we would pursue the $ 150 investment first because it possesses the highest NPV value. If we have the resources, we can make a second $ 45 investment because it's less valuable. We should not make an investment - $ 10 because with a negative NPV, it will not be more profitable for you than investing in something else with a similar level of risk.

Use the formula PV = FV / (1 + i) to find present and future values. This is a slightly modified equation from the standard NPV formula, you can quickly determine how much a present sum will be worth in the future (or a future sum will be as valuable as possible). how in the present). Just use the formula PV = FV / (1 + i), where i is the discount rate, t is the time period analyzed, FV is the future money value, and PV is the present value. If you already know i, t, and FV or PV, it is quite simple to find the final variable.

- For example we want to know how much $ 1,000 will be worth in 5 years. If we knew that we would at least have a 2% return on this money, we would use 0.02 for i, 5 for t, and 1,000 for PV, and then find FV like this:

- 1,000 = FV / (1 + 0.02)

- 1,000 = FV / (1.02)

- 1,000 = FV / 1.104

- 1,000 x 1.104 = FV = $1,104.

- For example we want to know how much $ 1,000 will be worth in 5 years. If we knew that we would at least have a 2% return on this money, we would use 0.02 for i, 5 for t, and 1,000 for PV, and then find FV like this:

Study valuation methods to find more accurate NPV values. The accuracy of the NPV calculation is based on the accuracy of the discount rate value and future cash flows. If the discount rate is close to the actual rate of return you could get from putting your money in an alternative investment that carries the same risk, and the future cash inflow is almost the same as the money You actually get the return on your investment, your NPV will be quite accurate. advertisement

Advice

- Keep in mind that there may still be other non-financial factors (such as environmental or social issues) that you should consider when making any investment decisions.

- You can also calculate NPV using a financial calculator or an NPV spreadsheet, which is quite useful if you don't have a calculator for calculating discounted cash flows.

Warning

- Avoid making financial decisions without considering monetary value over time.

What you need

- Pencil

- Paper

- Computer