Author:

Louise Ward

Date Of Creation:

3 February 2021

Update Date:

1 July 2024

Content

Do you feel uncomfortable when in need of money and empty your pocket? No matter how much or how little money you have, smart spending is essential as it allows you to effectively use your money. Follow the tips below to cut back on your spending and spend more on shopping.

Steps

Method 1 of 4: Fundamentals of Expenditure

Develop a budget plan. Review your expenses and sources of income for an overview. Keep an invoice or keep an expense in a book every time you shop. Review your bills each month and add them up to build a budget.

- Arrange purchases by category (food, clothing, entertainment, etc.). The type with the highest spending for the month (or items you think is unusually high) might be the right audience to cut back.

- Once you have checked the status of your purchases, set a monthly (weekly) limit to shop for each category. Make sure the total budget is less than your income for the same period and that the remainder is used for savings if possible.

Develop a shopping plan. Shopping on inspiration can make all of your expenses go big. Write down what to buy when you are calm at home.- Do a preliminary price survey trip before going to the real shopping. Record prices for items purchased at one or more stores. Go back home without buying anything and decide what to buy on the second trip, the "real" purchase. The less you focus and spend in the store, the less you will spend.

- If you take each purchase as an important decision, you will make a better decision.

- Don't get trial samples or try something for fun. Even if you don't have the intention to buy, the sentiment after the trial may convince you to buy right away instead of taking the time to scrutinize it.

Avoid impulsive shopping. If shopping planning is a good thing, impulsive shopping is a bad thing. Follow the steps below to avoid ineffective shopping:- Don't shop just for fun. If you buy because you feel the joy of shopping, you will definitely buy too many things you don't need.

- Don't shop when you're not awake. Alcohol, medication, or lack of sleep can impair your ability to make decisions. Even shopping when hungry or listening to music loudly is a bad idea as you probably won't follow your buying list.

Let's go shopping alone. Children, friends who love to shop or even friends with shopping interests you like can make you shop more.- Didn't hear from the salesman. If you need to find out, please politely listen to their advice but ignore all buying advice. If they don't leave you alone, leave the store and come back to buy later.

Please pay in full in cash. Credit cards and debit cards stimulate you to spend more for 2 reasons: You can spend more than you have, and because there is no real money to hand, your mind will not consider “real purchases”. ". Likewise, paying by installments or installments will make it difficult to see how much you are spending.

- Don't bring more money than you need, because if you don't have extra money, you won't spend more. Likewise, withdraw your money weekly according to a pre-calculated budget for each week from your ATM card rather than when you run out of money.

Don't be fooled by marketing programs. External factors often influence what we buy. Be careful and try to understand all the reasons you get caught up in a product.

- Don't buy something just for advertising. Do not trust the advertisements too much, whether on TV or on product packaging. They are designed to stimulate you to shop without providing an overall selection of options.

- You also shouldn't buy just because of a discount. Coupons and coupons are great on the products you're about to buy, but buying such unnecessary stuff just because a 50% discount won't save you money!

- Be aware of pricing tips. Understand that the "$ 1.99" price tag is "2" dollars. Product evaluation should be based on real value, not that it is a bargain compared to other products of the same company. (By comparing "worse" products, you might be tempted to pay extra for gadgets you don't really need.)

- Don't automatically buy an average priced product in a category. Professional marketers know that if they want you to buy a high-priced product instead of a low-priced product, they can influence your decision by adding super-priced products to The other one seems to be at an average and reasonable price point.

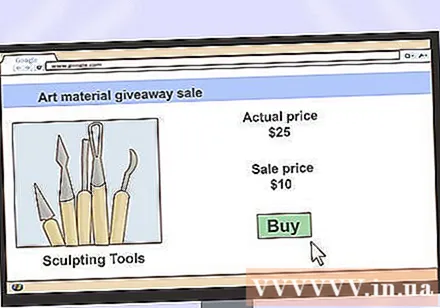

Wait for promotions and discounts. If you know that you need a product but not in a hurry, wait until it shows up in the discount box or try to find a discount coupon.

- Just Use coupons or take advantage of discounts on your products really need or decided to buy before the sale. The attractiveness of the discounts easily makes customers buy things they don't really need.

- Buy some products at off-season. A jacket is much cheaper if you buy it in the summer.

Self-study. Before buying expensive products, search the internet or read consumer reports to find the best products for the cheapest prices. Find products that are affordable to you and that fit your needs and are durable.

Calculate all your costs. You may pay more than the price on the label for high priced products. Read both the fine print and the total amount before making a decision.

- Don't be fooled by installments. Calculate the total amount you will pay (monthly payment x total number of months) to find the cheapest option.

- If you are in debt, calculate the total interest you will pay.

You should occasionally buy yourself a few cheap gifts. This may seem paradoxical (Is this buying something you don't need?), But giving yourself a reward will make it easier to keep the plan going. Because when you try not to spend the unnecessary things, you can end up "breaking" that and spending more than usual.

- Put a small amount of money in your budget for these things. The goal is to cheer yourself up and prevent possible cross-banging.

- If you buy yourself expensive items, cut them down. Take a bath at home instead of going to the spa, or borrow movies from the library instead of the theater.

Method 2 of 4: Spending on Clothes

Buy only what you really need. Browse the closet to see what you've got. Sell or give away things you don't wear or no longer fit to get a better picture of your condition.

- Cleaning the closet is not an excuse to buy a new one. The goal here is to find out what clothes you already have and which ones you need to buy more.

Know when to buy for quality. It is unwise to buy the most expensive brand socks because they will tear quickly. However, spending money on better, more durable shoes will save you money in the long term.

- Remember that price is not associated with quality. Find the most durable brand rather than pick the most expensive one.

- Likewise, wait until the item you need sells for a discount if possible. And remember not to use the discount to justify buying something you don't need.

Shop at a second hand store. A few second-hand stores have very good items. At the very least, you can get some basic stuff for a fraction of a new item.

- Second-hand stores where rich people are rich often receive high-quality donations.

If you can't find it in the second hand store, buy a cheap item of the same type. Sometimes the brand doesn't come with quality. advertisement

Method 3 of 4: Eat and drink

Prepare a menu for the week and a buying list. Once you have a food budget, write down what you will eat and what you need to buy at the store in advance.

- This will not only prevent you from spontaneous buying at the store, but also from wasting food scraps - a big expense for many families. If you find that you are also throwing away leftovers, reduce cooking amounts.

Learn tips to save money with food. There are many ways to save money when shopping for food, from buying in bulk to knowing when products are on sale for the day.

Minimize eating and drinking at the restaurant. Eating out is a lot more expensive than cooking on your own and eating out should not be the result of the excitement of someone trying to save money.

- Instead, make your own at home and bring it with you to eat at work or class.

- Bring water from home instead of paying for it.

- Likewise, if you drink coffee regularly, buy a coffee maker and save money by drinking coffee.

Method 4 of 4: Save Smart Money

Save money. Smart spending is always associated with savings. Spend as much of your savings as possible in savings accounts or reliable investment tools.The more you save, the better your financial situation will be. What is the purpose of smart spending, if not saving? Here are a few ideas for you to consider:

- Establish an emergency fund.

- Open a Roth IRA or 401 (k) account.

- Avoid unnecessary fees.

- Make a meal plan for each week.

Get rid of costly habits. Bad habits like smoking, drinking or gambling can cost you all your savings. Getting rid of these habits is essential for both your budget and your health.

Don't buy things you don't need. If in doubt, ask yourself the following questions. If you can't answer "yes" to all, then obviously you shouldn't spend money buying.

- Will I use it regularly? Make sure you finish the milk before it breaks down or you wear a dress often, not a couple of times.

- Am I missing something that has the same purpose? Look out for products whose functionality can be replaced with the ones you already have. You don't need the super specialized kitchen utensils or an exercise set, while the sweatpants and t-shirts are interchangeable.

- Will this product make my life better? This is a complex question, but buying products that encourage "bad habits" or make you overlook important parts of your life should be avoided.

- Will I remember this product if I don't buy it?

- Would buying it make me happy?

Eliminate some unnecessary pleasures. If you have a gym card with little exercise, don't buy a new one. Does an impulsive spender use up items after buying? If not, sell it. Spend your money and effort in areas where you are truly passionate. advertisement

Advice

- It's easier to stick to a budget plan if all family members are committed to it.

- Look for utility services and insurance regularly. Many services (telephone, internet, cable or satellite TV, etc.) offer great deals to new customers. If you know how to switch companies, you can always pay less. (Some phone companies will pay you a cancellation fee for you if you switch to their service.)

- When comparing two cars, figure out how much gas would cost you if you bought a less efficient model (mileage per gallon of lower gas) (.

- Don't buy dry-wash-only clothes. Please check the information carefully before buying clothes. You won't want to pay often on dry cleaning.

- Many websites have ways to calculate the total cost for a car per year for the first 5 years (still new). Type in "cost of owning a car". They will charge the cost of gasoline, insurance, maintenance, repairs, etc. At the same time, check maintenance and read the manufacturer's recommendations. This will save you thousands of dollars in the long run.