Author:

Laura McKinney

Date Of Creation:

6 August 2021

Update Date:

1 July 2024

Content

Shopping addictions can have enormous consequences on everyday life, career, and finance. Since shopping is an integral part of global capitalist culture, it is sometimes difficult to determine whether you are overusing them. In this article, we will talk about the signs of shopping addiction, how to change buying habits, and seek professional help if necessary.

Steps

Part 1 of 3: Learning about shopping addiction

Recognize the problem. As with all addictions, recognizing behaviors and their impact on everyday life and relationships is the key to success in the fight against addiction. You can use the list of signs below to determine your level of shopping addiction. This is an important step in determining exactly how restrictive it should be, from minimizing shopping to stopping shopping altogether.

- Shop or spend money when you feel sad, angry, lonely, or stressed

- Arguing with others about your shopping to explain your behavior

- Feeling confused or lonely without your credit card

- Consistently make purchases with credit card instead of cash

- Feel the excitement or the extreme joy of shopping

- Feeling guilty, annoyed, or ashamed of spending too much

- Lie about spending habits or the price of specific goods

- Obsess about money

- Spend a lot of time calculating money and bills to get more shopping

Evaluate your shopping habits. Keep a note of all merchandise purchased between two weeks and a month, and note how purchases are paid for. Ask yourself the following questions to manage when and how to buy. In addition, you also need to track the amount spent during this period to determine the level of your shopping addiction.

Determine the type of shopping addiction. Arbitrary shopping comes in many forms. Identifying these types of addiction helps you to understand your addiction to find solutions. You can either define it yourself based on this list, or use a shopping habit log.- Buyers are stimulated to shop when their mood is unhappy

- Addicts are constantly buying the perfect stuff

- Buyers love flashy things and a strong sense of spending

- People buy things just because they are on sale

- People "crazy" buy goods just to return them and then buy new ones, creating a vicious cycle with no end.

- Collectors enjoy a sense of completeness by purchasing one set or each item in a different color or style.

Know the long-term consequences of shopping addiction. Shopping addicts can have short-term positive effects, such as feeling good after a trip, but the long-term effects of this condition can be quite negative. You need to identify these influences clearly to overcome insatiable buying habits.- Overspending and financial trouble

- Buying spontaneously and unnecessarily (e.g. planning to go buy a coat and leave the store with ten)

- Cover up the problem to avoid criticism

- Feeling of helplessness due to the vicious cycle of shopping causes guilt, which in turn causes yourself to over-shop more than before.

- Affected relationship with secrecy, dishonesty about debt, and physical isolation that drives up demand for shopping.

Realize that overspending is often caused by psychological factors. For many people, this is a way to deal with negative emotions. Like all addictions, shopping can solve temporary problems, help people feel better, and create delusions of fun and safety. Determine if buying is to fill a void in your life that can replace a healthier, more productive lifestyle. advertisement

Part 2 of 3: Changing behavior to restrict shopping

Understand that you are provoked. Triggers are things that make you want to shop. Keep a journal for at least a week, and every time you want to shop, write down the things that bring the idea down. The cause may be environmental, friend, advertising, or emotional (such as anger, shame, or boredom). Being aware of your triggers helps you avoid the risk of shopping while limiting this habit.

- For example, you might shop before an important event. You tend to buy a wide variety of expensive clothes, cosmetics, or other accessories that will prepare you for the event.

- When you realize this, you can plan action management for big events. You can quit shopping and spend an hour searching for clothes in your wardrobe.

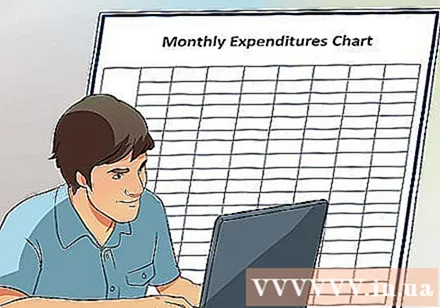

Cut down on shopping costs. The best way to limit purchases without having to give up altogether is to monitor your budget for out-of-demand items. Keep your finances tight, and only do your shopping when your budget for the month (or even the week) allows it. Then you can shop from time to time, but not overdo it, leading to serious financial problems.

- When shopping, you should bring enough cash for shopping. Leave your credit card at home to avoid temptation to spend too much.

- You can also make a list of what is already available and what to buy. Check the list to visualize and see when you are about to buy things you already have a lot or no need to buy.

- Wait at least 20 minutes before shopping. Don't force yourself to buy something; Instead, spend some time thinking about why you should or shouldn't buy.

- If you shop too much at certain stores, you should limit going there or go with friends to control the shopping. If you shop online, don't save the website.

Give up shopping completely. If your shopping addiction is too severe, only buy the essentials. Be extra careful when shopping, and make a shopping list for yourself. Avoid discounted and inexpensive items that you do not need to use, as well as set the amount to spend when shopping. The more specific you have, the more helpful you are.For example, when buying food and personal belongings, make a list of what to buy (such as toothpaste, deodorant, etc.) and don't buy anything off this list.

- Stop paying with your credit card and cancel all existing credit accounts. If you need it in an emergency, you should ask a loved one to keep it. This is quite important because we often spend twice as much when buying with credit card instead of cash.

- Do your research before going to the store. Often times we buy unnecessary items, so you need to determine what to buy. This makes shopping less enjoyable when you don't have to spend time researching at the store.

- Cancel a loyalty card with something not on the list of essential items.

Avoid shopping alone. Most haphazard shoppers tend to go alone, and if you're with someone else, you're less likely to overspend. This is the advantage of peer pressure; You need to create a habit of buying in moderation according to the opinion of people you trust.

- You can ask a loved one to manage your finances for you.

Join other activities. Make time for something useful. When practicing arbitrary behavioral changes, it's important to make time for the things that really matter (but believe they won't harm you).- People often get excited by activities that immerse them in and forget about time. You can learn new skills, complete a long-delayed project, or improve yourself in other ways. You can read, walk, cook, or play an instrument, as long as your mind is fully focused on the activity.

- Sports and walking can make you happier, and they are suitable alternatives to when shopping hits.

Keep track of your progress. Don't forget to praise and encourage yourself during the time you get out of your shopping routine. You should take note of your progress, as quitting addiction is not easy. Objectively evaluate progress so you can get through moments of self-blame that are hard to avoid.- Keep track of your spending with a spreadsheet. Review shopping (or website sales visits) by marking the calendar.

Make a list of places not to go. Identify places that can stimulate you to shop. Most likely this is a mall, store, or large mall. Your personal rules must be clear and easy to understand to avoid breaking the law. Make a list of where to go and stop temptation to arise until your shopping spree has subsided. Check the list to make sure you don't go to "dangerous" places and situations.- You don't have to avoid these places all the time, as this is a daunting task filled with advertising and rich merchandise.

- If you just need to cut costs and don't necessarily give up shopping altogether, just limit your visit to these places. Make a schedule to go to your favorite store and stick to it.

- You don't have to avoid these places all the time, as this is a daunting task filled with advertising and rich merchandise.

Avoid walking. When you start cutting back, take a break from traveling. This helps you avoid the temptation to shop in a strange place. People often shop more when outside of their familiar environment.

- Note that online shopping also feels novel, so you must also struggle with these temptations.

Mail management. These include paper letters and electronic mail. Unsubscribe from the mail and the catalog of goods sent by the shopping store.

- Avoid getting credit card ads by signing up for Opt-Out Prescreen. By providing the information here, you will not receive such types of advertisements.

Computer Management. The Internet is a popular way of shopping, so you need to monitor your online shopping as well as your store. Avoid accessing commercial sites by blocking favorite online purchases.

- Download an ad-blocking application with the function of hiding ads in the browser.

- One-click shopping is dangerous. You should limit online shopping by deleting your credit card number from websites associated with your account, even if you have blocked these websites.

- This step makes you safer; If you find out the reason for visiting the site, you should take some time to think before making a purchase.

Part 3 of 3: Seeking help

Take advantage of support from friends and family. Secrecy is one of the traits of shopping addiction (and most addiction). Therefore, you should not hesitate to ask for help with shopping. Tell friends and family about the current situation, and have them shop or buy essentials for the first time away from extreme temptation.

- You should only disclose it to someone close to you that can assist in limiting your purchases.

See a therapist. A therapist will help you figure out what is causing your shopping addiction, such as depression. There is no effective treatment for this addiction, but you may be prescribed an antidepressant, such as an SSRI.

- The most common method used to treat addiction is cognitive behavioral therapy (CBT). This therapy helps you identify and correct thinking patterns related to shopping.

- This form of treatment also gives you less attention to external motivations, such as the appearance of success and wealth, and enhances the inner values instead, such as feeling comfortable and maintain good relationships with loved ones.

Join the community. The program for treating shopping addiction in groups is quite rich and effective. This ability to share your emotions and give advice to people with addictions helps you to get rid of this useless spending habit.

- Search for addiction remediation programs in your area.

- Visit the special website to find a specialist or a therapist group.

Meet with a financial advisor. If your shopping addiction leaves you in a financial crisis, consider talking to a financial advisor. This person will help you deal with the big debt that arises from shopping addiction.

- Overcoming the financial consequences of shopping addiction can lead to stress and anxiety with psychological problems. Stress can aggravate the problem, so the financial advisor is very helpful at the moment.