Author:

Louise Ward

Date Of Creation:

8 February 2021

Update Date:

1 July 2024

Content

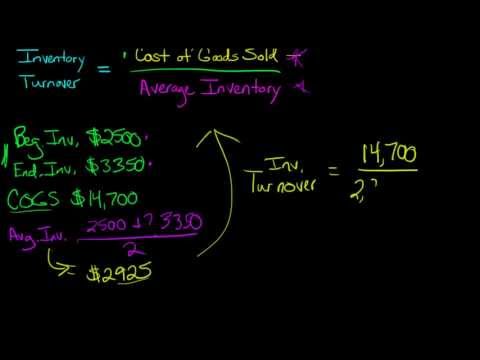

Inventory Turnover is a way to measure the number of times a business sells its inventory over a given period of time. Enterprises use inventory turnover to evaluate the competitiveness, profitability of projects, and overall evaluation for businesses in the industry. Unlike employee resignation, a high inventory turnover ratio will be considered a positive factor, because it indicates that goods are sold relatively quickly before they are likely to be damaged. . In general, inventory turnover is calculated by the formula Turnover = Cost of goods (COGS) / Average inventory value.

Steps

Method 1 of 2: Find Inventory Turnover

Select a specific time period for the calculation. Inventory turnover is always calculated for a specific period - so you can choose any time period from a financial day to a fiscal year - even the entire life of the business. However, inventory turnover ratio can not Instant description of business performance. While the value of the enterprise's inventories can be defined at any given time, the cost of the goods is not an immediate value, so a specific time period must be chosen for calculate.

- In this article, we will use the following example for illustration and calculation. Let's say we own a company that sells coffee wholesalers. In this case, the selected time period is a year activities of the company. In the next step, we will find the inventory turnover ratio for this one year period.

Find the cost of goods for the selected time period. After determining the time period, the first step to take is to find the cost of the goods (also known as "COGS") for this period. The COGS is the direct cost of creating the goods. Usually, this includes the cost of the production of the good plus any labor costs directly related to the production of the good.- The COGS does not include costs such as transportation and distribution costs that are not directly related to the production of the goods.

- In the example above, we had a fairly high yield year, and spent $ 3 million on seeds, pesticides and other costs related to coffee growing and $ 2 million on tuberculosis costs. for planting seeds. In this case, we can say our COGS is USD 3 million + USD 2 million = 5 million USD.

Divide the COGS by the average value of your inventory. Next, divide the COGS by the average of the inventory value over the period you are analyzing. Average Inventory Value is the average financial value of all the goods you keep in stock and on the shelves that have not been sold for a given period of time. The simplest way to find this value is to add your chosen opening inventory plus your closing inventory and divide it in half. However, the use of additional data points in the middle of the period may help to produce a more accurate average. If you use more than two data points, add all the values together, then divide by the number of data points to find the average.- In our example, let's say at the beginning of the year we have $ 0.5 million worth of coffee beans stored as inventory. At the end of the year, we have $ 0.3 million in grain. So the average value of inventories is (0.5 million + 0.3 million) / 2 = $ 0.4 million.

- Next, divide the COGS by the average value of inventory to find the inventory turnover ratio. In our example, the COGS is $ 5 million and the average inventory value is $ 0.4 million, so our inventory revenue for one year is $ 5 million / $ 0.4 million = 12,5. The factor found is a ratio excluding units.

You can quickly estimate your inventory turnover ratio using the formula Inventory Turnover = Sales / Inventory. If you don't have time to follow the standard equation described above, this formula can help you calculate the approximate value of your inventory turnover ratio. However, most businesses avoid using this method because the results can be inaccurate. Because revenue is calculated at consumer prices but your inventory is at lower wholesale prices, calculating a formula can make your inventory turnover higher than it really is. health. As a general rule, this equation should only be used for quick estimates - for more important calculations you should use the equation above.- For the same example, let's say we had sales of $ 6 million in the past year. To find the inventory turnover coefficient with the replacement equation above, we will divide this sales value by the final inventory value listed above of 0.3 USD. The result is 6 million USD / $ 0.3 million USD = 20. The result found is significantly higher than the 12.5 we calculated using the standard equation.

Method 2 of 2: Increase accuracy in calculation

Use different inventory data points for more accurate results. As noted above, finding the average inventory value from the start and end inventory values can give you an approximate average of inventory values, but this does not take into account volatility. inventory in the stage you have chosen. Using additional data points will help make your values more accurate.

- When choosing a data point, make sure the data point is evenly divided over the selected time period. For example, if you are looking for the average value of inventory for a year, you cannot use twelve points from the same January but instead use one point from the first day of each month.

- Assume that our opening inventory for one year of business is $ 20,000 and our closing value is $ 30,000. Using the basic method above, we'll get an average value of $ 25,000. However, just adding a new data point, we will have a different picture. For example, let's say we also use a data point from the middle of the year with a value of $ 40,000. In this case, our average inventory value is ($ 20,000 + $ 30,000 + $ 40,000) / 3 = $ 30,000 - slightly higher (and a more representative representation of average inventory value. troops) compared to the previous value.

Use the formula Time = 365 days / inventory turnaround to find the average time of your inventory sales. This step will tell you how long it takes on average to sell all of your inventory. First, find the normal annual inventory turnover ratio. Then divide 365 days by the inventory turnover rate. This will be the number of days you have to sell all of your inventory.

- For example, let's say we have an inventory turnover rate of 8.5 for a given year. By dividing 365 days by 8.5, we get the result 42.9 days. In other words, on average, we sell all of our inventory about every 43 days.

- If your inventory turnaround for a period other than a year, simply replace 365 days with the number of days in the period selected in the formula. For example, if you have an inventory turnover ratio of 2.5 for September, then the average time to sell all inventory is calculated by 30 days / 2.5 = 12 days.

Use inventory turnover ratio as an approximate measure of performance. Often (though not always) businesses want to sell inventory quickly, instead of being slow. Therefore, a firm's inventory turnover ratio can be used to find clues about its performance, especially compared to its competitors. However, it's important to remember that it's important to compare contexts. Low inventory sales aren't always bad, and high inventory sales aren't always good.

- For example, high-end sports cars often fail to sell quickly because their market is quite small. As a result, you can estimate a sports car dealership's inventory turnover rate to be quite low - they may not even sell out all of their inventory in a year.On the other hand, if the inventory turnover rate of the same agent suddenly rises sharply, this could be a very good thing, but it could also be a bad thing, depending on the context - for example, this could indicates a product shortage, and may lead to loss of sales.

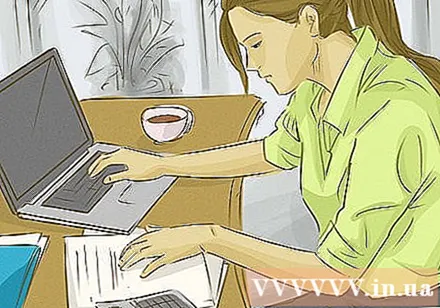

Compare your inventory turnover ratio to the industry average. A useful way to evaluate a firm's performance is to compare the inventory turnover ratio with the average value of firms in the same industry. Several financial publications (both print and online) have been issued with industry average inventory turnover ratings, which you can use as a benchmark for measuring your performance. company. You can find such rankings here. However, again, it is important to note that these values represent the industry average and in some cases the inventory turnover ratio is significantly lower or higher than the value. Statistics can be a good thing.

- Another useful tool to compare your firm's inventory turnover ratio with the industry average is the inventory turnaround tool that approximates BDC. This tool allows you to select an industry, then find the hypothetical inventory turnover rate by entering the firm's COGS and average inventory value and then comparing it to the mean. average of the industry you have selected.

Advice

- See industry-specific stats to see how your inventory turnover compares to competitors and similar businesses. The company's accountant advises that you should choose as similar cases as possible in order to really evaluate whether the inventory turnover ratio shows how successful your company is in that area. how.

- Guaranteed cost of sales and average inventory value based on the same valuation. For example, if your business is a multinational, make sure you use the same currency for these two values. Since both of these numbers will be in the form of sum values, they will be correlated and produce accurate results.