Author:

Louise Ward

Date Of Creation:

12 February 2021

Update Date:

1 July 2024

Content

The phrase "pay yourself first" has become hugely popular among investors and personal finance. Instead of paying every bill and cost and then saving the rest, do the opposite. Save for investing, retiring, college, future prepayments or anything that needs long-term accumulation efforts. already Please consider other things.

Steps

Part 1 of 3: Determine your current costs

Determine your monthly income. Before you pay yourself in advance, you need to be clear about how much you need to pay. Start by looking at your current monthly income. To do that, you just have to accumulate all the revenue for a month.

- Note that this is “net” income or money received after taxes and deductions.

- If earnings fluctuate from month to month, use the average of your last six months or slightly lower. Using a lower number is always a better choice, because then, you are more likely to end up with more instead of less than expected.

Determine the monthly cost. The easiest way to determine your monthly expenses is to look at your bank statements for the past few months. Just add up all your bill payments, cash withdrawals or transfers. Also, don't forget the portion of your income received in the form of cash that you spent.- There are two basic types of costs to keep in mind: fixed and variable. Fixed costs do not change from month to month and usually include things like rentals, utilities, phone / internet, liabilities and insurance. Variable costs fluctuate from month to month and may include food, entertainment, gasoline or other miscellaneous purchases.

- If you find it difficult to track your own spending, you might consider using a software like Mint (or so many others). With Mint, you just sync it with your bank account and the software will track your spending, by category. It helps you have a clear, orderly and up-to-date view of your spending situation.

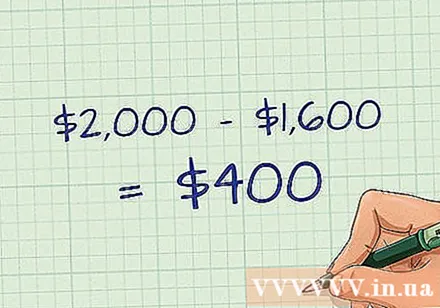

Subtract your monthly expenses from your income. So you know how much will be left in your hands at the end of each month. This is important because it can help you figure out how much money you need to upfront for yourself. You will not want to save for the future only to realize that what is left cannot meet even the important fixed costs in everyday life.- If your monthly income is 40 million / month and the total cost is 32 million, then you will basically have 8 million to pay yourself first. It's a good idea of how much money can accumulate each month.

- Note that this number could be much higher. Once you know how much money is left each month, you can take steps to cut costs to save even more.

- Cutting costs will be even more important if you are negative at the end of the month.

Part 2 of 3: Budgeting on a lower cost basis

Find ways to cut down on fixed costs. Although they may be fixed, that doesn't mean you can't replace them with lower costs of the same type. Let's look at each of the fixed costs and see if there is a way to cut it.- For example, while it is possible that the cost of mobile phones is fixed per month, is it feasible to plan on using less data capacity to save costs? Similarly, it is possible that the rent is fixed, but if it accounts for more than half of your income, you should consider switching from a two-bedroom unit to a one-bedroom unit or moving to a high-level area. more affordable price.

- If buying car insurance, don't forget to contact your broker each year to see if there is a better option. Or you can also keep looking for a better price.

- If your credit card debt is usually high, consider picking up your debt together to reduce the fixed monthly interest expense. This way, you can pay off your credit card debt with a loan with a lower interest rate.

Find ways to cut down on variable costs. Most of these savings come from here. Look carefully at your monthly expenses and determine where the non-fixed expenses are. Look at the small expenses that can accrue over time such as drinking coffee, eating out, grocery bills, gasoline or relaxing, entertaining.

- When looking for ways to cut these costs, think about what you want and what you need. Cut as many "wanted" items as possible. For example, maybe at work, having lunch every day is what you need, but buying lunch at the cafeteria is what you want. It is entirely possible to choose a less expensive option than to prepare your own meals.

- The key here is to look at the volatile costs that make up the bulk of your budget. Is most of your overspending on gasoline, food, entertainment or impulsive shopping? You can achieve cuts in these categories, such as by taking public transport, preparing regular lunch boxes and moving towards more affordable entertainment or credit. Use at home to reduce impulsive spending.

- Search the internet for novel ways to reduce your spending in categories that are difficult for you.

Calculate the amount of money remaining after the cut. If you can identify a few items for cutting back on, subtract them from your expenses. Next, you can subtract your new monthly income from these new expenses to see how much you have left at the end of the month.

- Let's say your monthly income is 40 million and 32 million is your total expenses. After finding ways to cut back, you could save an additional 4 million per month and reduce your monthly costs to just 28 million. Now, each month you will get 12 million VND.

Part 3 of 3: Pay yourself first

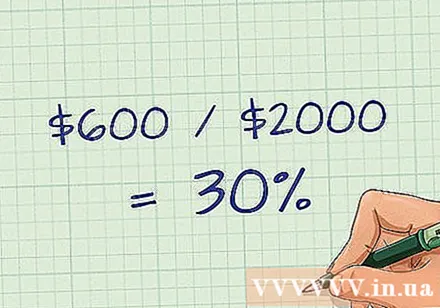

Decide how much to pay for yourself. Now that you have determined how much is left over each month, you can decide how much to pay yourself first. Experts have heterogeneous recommendations on this number. In the famous personal finance book The Wealthy Barber, author David Chilton advises that we should prepay for ourselves 10% of our net or after-tax income and deductions. The figure given by other experts ranges from 1% to 5% ..

- The best solution is to pay yourself as much upfront as possible, based on the amount left over each month. For example, if at the end of the month you have 12 million and 40 million is your income, you will be able to save up to 30% of your income. unexpected spending or rewards).

Set savings goals. Once you know how much you can afford to pay for yourself, try to set a savings goal. For example, your goals might include retirement, education savings, or down payment for a home. Determine your goal's cost and divide it by your personal affordability each month to determine the number of months to work.

- For example, maybe you want to save 1 billion on your prepayments. If you have a balance of 12 million per month and choose to save 6 million, you will need 13 years to save 1 billion.

- In this case, you can increase your monthly savings to 12 million to halve the time (because your balance is 12 million per month).

- Remember that if you invest your money in a high-interest savings account or another form of investment, the interest earned will further shorten the time needed to save. To find out how quickly a savings account will grow at a given interest rate (say 2% / year) go online and search for the phrase "Compound Interest Calculator".

Create separate accounts from all other accounts. This account should be used only for a specific purpose, usually investing or saving. If possible, choose an account with a higher interest rate. Usually the type of account has a limit on the number of withdrawals and that's a good thing because you don't intend to do that anyway.

- Consider opening a high interest savings account. Many organizations offer this type of savings, and they often have a much higher interest rate than a checking account.

- If you are in the US, you might also consider opening the Roth IRA for savings. The Roth IRA allows your assets to grow over time without incurring taxes. In a Roth IRA, you can buy a stock, invest in a mutual fund, a bond or a portfolio swap and all of these products offer a higher chance of return than a high-interest savings account. .

- Other options include Traditional Personal Pension and 401 (k) Pension.

Add money to your account as soon as you receive it. If you get a direct transfer, have a portion of your pay automatically go into a segregated account. You can also set up an automatic weekly or monthly remittance order from the main active account to the other if necessary balance is maintained to avoid excessive withdrawal fees. It's important to do it before spending money on anything else, including bills and rent.

Leave the money there. Don't touch them. Don't pull out. You should have your own emergency fund to use for these situations. Usually the fund should be enough to pay you for three to six months. Don't confuse an emergency fund with an investment or savings fund. If you find you can't afford your bills, find other ways to make money or cut costs. Don't pay with your credit card (see Warnings below). advertisement

Advice

- Even small savings will help the future.

- Start small, if necessary. Saving 100 or even 20,000 per week is better than nothing. As your expenses decrease or your income increases, you can increase the amount you pay for yourself.

- Set a goal, like "I'll have 400 million in five years." It will help you stick to your prepayment.

- The idea behind this is that if we don't pay ourselves up somehow, we will find a way to spend all the money until we have very little left. In other words, it seems that costs always "sprout" to keep pace with our income. If you cut your income by paying yourself up front, your expenses will be kept under control. If that doesn't work, become resourceful instead of draining your savings.

Warning

- If you become extremely dependent on your credit card to pay yourself first, you lose the point of doing so. Why save 400 million on prepayments in the future when you have to borrow 400 million (with interest included)?

- It can be difficult to pay yourself up in advance as directed above when you have urgent financial obligations, such as a mortgage due or a creditor has pulled to the door. Some believe that no matter what, you should pay yourself first. Others believe there are times when it is advisable to pay others first. Where the boundary lies is up to you.