Author:

Judy Howell

Date Of Creation:

5 July 2021

Update Date:

23 June 2024

Content

- To step

- Method 1 of 3: Determine your hourly wage as a self-employed person

- Method 2 of 3: Determine your hourly wage in paid employment

- Method 3 of 3: Using advanced calculations to determine your hourly wages

- Tips

For many people, finding their hourly wages is simply a matter of looking at their latest pay slip. But if you are employed or self-employed, it can be a bit more difficult to calculate your hourly wages. You can calculate your hourly wage based on a project, a period, or a payment. If you calculate per payout, you can include certain variables to get a more accurate result.

To step

Method 1 of 3: Determine your hourly wage as a self-employed person

Keep track of how many hours you work. In order for this method to work, you need to determine the time period that you are going to calculate. You can calculate your hourly wages based on an annual income for a more accurate result, or you can calculate it based on a specific project or period.

Keep track of how many hours you work. In order for this method to work, you need to determine the time period that you are going to calculate. You can calculate your hourly wages based on an annual income for a more accurate result, or you can calculate it based on a specific project or period. - For example, if you are paid per assignment or project, you may want to keep track of the hours of that project to determine your hourly wages for that project. You can also calculate your hourly wages for a shorter period, such as a month or a few weeks.

Calculate your income. Keep your paychecks. Make sure to use the same time period you chose for your hours. This can be for a project, or for multiple payments.

Calculate your income. Keep your paychecks. Make sure to use the same time period you chose for your hours. This can be for a project, or for multiple payments. - You can choose whether or not to include taxes. Keep in mind that if you don't include taxes, your hourly wages will be higher.

Divide your income by the number of hours worked. This way you will find your hourly wage, based on the project or the period you have chosen.

Divide your income by the number of hours worked. This way you will find your hourly wage, based on the project or the period you have chosen. - Income / Number of hours = Hourly wages

- For example: € 15,000 / 2,114 = € 7.10 per hour

- You can check your results with this online tool, which also allows you to add additional variables to your calculation.

Method 2 of 3: Determine your hourly wage in paid employment

Calculate your income per year. Many people already know their annual salary, but if you don't know this yet, check your latest pay slip. Use your gross salary - this is the amount without taxes - and multiply this by the number of payments per year.

Calculate your income per year. Many people already know their annual salary, but if you don't know this yet, check your latest pay slip. Use your gross salary - this is the amount without taxes - and multiply this by the number of payments per year. - If you get paid biweekly, multiply the amount by 26.

- If your company pays out twice a month - for example, on the 15th and 30th / 31st of the month - multiply the amount by 24.

Calculate how many hours you work in a year. For a quick and easy calculation you can use a standard formula such as:

Calculate how many hours you work in a year. For a quick and easy calculation you can use a standard formula such as: - 7.5 hours per day x 5 days per week x 52 weeks per year = 1,950 hours worked per year.

- 8.0 hours per day x 5 days per week x 52 weeks per year = 2,080 hours worked per year.

Calculate your hourly wage. Once you have your income and hours worked, divide your annual income by the annual number of hours worked. You then arrive at an estimate of your hourly wage.

Calculate your hourly wage. Once you have your income and hours worked, divide your annual income by the annual number of hours worked. You then arrive at an estimate of your hourly wage. - For example: if your total income was € 15,000 and the number of hours worked was 2,080, you would end up with 15,000 / 2,080 = approximately € 7.21 per hour.

Method 3 of 3: Using advanced calculations to determine your hourly wages

Adjust your annual income. If applicable, add any additional cash flows from your work to your salary. This can include tips, bonuses, work incentives, etc.

Adjust your annual income. If applicable, add any additional cash flows from your work to your salary. This can include tips, bonuses, work incentives, etc. - All expected bonuses and extra incentives must also be added to your annual total amount.

- If you are employed and receive a tip, the calculation becomes a bit more complicated. Then keep track of your tips for a few weeks or even months, dividing the total by the number of weeks you tracked. This will give you an average of tip earnings per week. Multiply this amount by the number of weeks in which you will receive a tip, and omit the weeks in which you will not receive a tip (if you are on vacation, for example).

- The longer you keep track of your tips, the more accurate your estimate will be.

Add working hours if you are working overtime. To calculate your overtime hours: multiply the number of overtime hours worked by the wages you receive for those overtime hours, and add the total to your annual salary.

Add working hours if you are working overtime. To calculate your overtime hours: multiply the number of overtime hours worked by the wages you receive for those overtime hours, and add the total to your annual salary. - Depending on your position, overtime can be paid or unpaid. In any case, add the hours worked to your hours total.

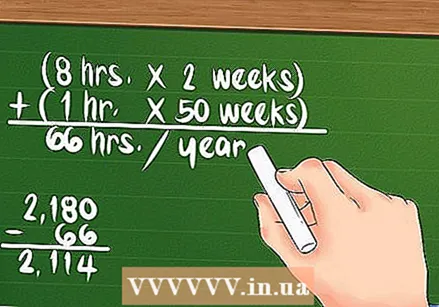

- For example: you work an average of two hours a week overtime, except for the two weeks per year that you are on leave. Your extra hours are then 2 hours x 50 weeks = 100 hours per year.

- In this example, your adjusted hours total is 2080 + 100 = 2180.

Subtract hours from your calculation if you have been given paid leave. Add up the number of hours you were given and subtract it from the total number of hours worked. Also take vacation days, sick leave, special leave and days on which you were too early or late.

Subtract hours from your calculation if you have been given paid leave. Add up the number of hours you were given and subtract it from the total number of hours worked. Also take vacation days, sick leave, special leave and days on which you were too early or late. - Only take paid leave that you will actually use. You may have saved up to two weeks of sick leave, but chances are you won't be using all of this.

- For example: you take two weeks of paid vacation a year, you are never sick, and you always leave an hour earlier on Friday afternoon. Your hours will be deducted (8 hours x 10 days) + (1 hour x 50 weeks) = 130 hours per year.

- Your adjusted working hours per year are then 2180 - 130 = 2050.

Tips

- Check that your work will always be available. If you are only paid when there is work, your actual income will be much lower.

- When divided, the hourly wage will be slightly less accurate than the annual salary, due to rounding. But with small changes in your annual salary (up to about € 200), your hourly wages will not change much.

- Check whether your leave hours are paid, and for how many hours you are being paid.