Author:

Morris Wright

Date Of Creation:

22 April 2021

Update Date:

1 July 2024

Content

- To step

- Part 1 of 4: Drawing up a budget

- Part 2 of 4: Spend your money successfully

- Part 3 of 4: Smart investing

- Part 4 of 4: Saving

- Tips

- Warnings

You are not taught personal financial management in school. Yet almost everyone needs it. A few figures: 21% of the Dutch do not know who is taking care of their pension. 15% of the Dutch have no savings and 40% have too little savings to absorb unexpected setbacks. Almost 200,000 households in the Netherlands are in debt counseling; that is 2.5% of all Dutch households. If you find this data worrying and want to turn the tide, read the concrete advice for a better future below.

To step

Part 1 of 4: Drawing up a budget

Keep track of all your expenses for a month. You don't have to adjust your expenses; just do as always but keep track of what you spend. Keep all your receipts, keep track of how much cash you spend and what is taken from your bank account.

Keep track of all your expenses for a month. You don't have to adjust your expenses; just do as always but keep track of what you spend. Keep all your receipts, keep track of how much cash you spend and what is taken from your bank account.  After a month you make an overview of your expenses. Do not write down what you would have liked to spend; write down what you actually spent. Create categories that make sense to you. A simple overview of monthly expenses might look like this:

After a month you make an overview of your expenses. Do not write down what you would have liked to spend; write down what you actually spent. Create categories that make sense to you. A simple overview of monthly expenses might look like this: - Monthly income: € 3000

- Expenses:

- Rent / mortgage: € 800

- Fixed charges (energy bill / water / internet): € 125

- Groceries: € 300

- Eating out: € 125

- Petrol: € 100

- Health insurance and healthcare costs: € 200

- Other: € 400

- Saving: € 900

Draw up your budget now. Based on the tracked expenses and your knowledge of previous expenses, you now determine what amount you need per category. How much of your income do you want to spend on each category? You can also use an online budget help for this. Check the website of your bank to see if it offers a budget aid, or use the budget aid from Nibud. Keep in mind that some bills do not come every month, but once a year, such as some insurance and municipal taxes. Make sure to include those expenses in your budget.

Draw up your budget now. Based on the tracked expenses and your knowledge of previous expenses, you now determine what amount you need per category. How much of your income do you want to spend on each category? You can also use an online budget help for this. Check the website of your bank to see if it offers a budget aid, or use the budget aid from Nibud. Keep in mind that some bills do not come every month, but once a year, such as some insurance and municipal taxes. Make sure to include those expenses in your budget. - Make separate columns in your budget for expected expenses and realized expenses. In the column "expected expenses" you indicate what you plan to spend on a particular category. Those amounts should be the same every month. In the column 'realized expenses' you enter what you have actually spent. These amounts can vary per month, depending on how many groceries you have done, for example, or how often you have been out for dinner.

- Many people include savings in their budget. They then set aside a fixed amount every month. Especially if you have little or no savings, this is a wise thing to do. Nibud advises to save 10% of your net income every month. How much savings is good to have depends on your situation.

Be honest with yourself about your budget. It's your money. So there's no point in lying to yourself about how much you spend. The only person that affects you with that is yourself. If you have absolutely no idea what you're spending, it can take a few months to get your budget in order. Then draw up an approximate budget that is as good as possible, and adjust it over time.

Be honest with yourself about your budget. It's your money. So there's no point in lying to yourself about how much you spend. The only person that affects you with that is yourself. If you have absolutely no idea what you're spending, it can take a few months to get your budget in order. Then draw up an approximate budget that is as good as possible, and adjust it over time. - For example, if you include in your budget that you save $ 500 per month, but you already know in advance that it will be a battle every month to achieve that, then include a more realistic amount in your budget. After a few months, take a critical look at your budget again. Perhaps you can reduce certain expenses, so that you can still achieve the desired savings amount.

Keep track of your budget. Many expenses differ per month. That makes it difficult to draw up a good budget. Therefore, keep a close eye on your expenses, so that you can make adjustments where necessary.

Keep track of your budget. Many expenses differ per month. That makes it difficult to draw up a good budget. Therefore, keep a close eye on your expenses, so that you can make adjustments where necessary. - With a budget, your eyes are opened, if they weren't already open. Many people only realize how much they actually spend after drawing up a budget, often on unimportant things. With that knowledge you can cut unnecessary expenses and spend more money on meaningful things.

- Be prepared for the unexpected. With a budget you realize that you never know when certain costs will come, but that you can still take those costs into account. You do not plan when your washing machine will break, but it is certain that it will break. With a budget, you are better prepared for unplanned but necessary expenses.

Part 2 of 4: Spend your money successfully

If you can rent, don't buy. How often have you bought a DVD, which was then dusted in a cupboard for years? You can rent books, magazines, DVDs, tools, party supplies. Renting instead of buying saves you high purchase costs, a lot of hassle and storage space.

If you can rent, don't buy. How often have you bought a DVD, which was then dusted in a cupboard for years? You can rent books, magazines, DVDs, tools, party supplies. Renting instead of buying saves you high purchase costs, a lot of hassle and storage space. - Don't rent at random. If you use something often enough, it may be wiser to buy it. Run a cost analysis to assess whether you can rent or buy something better.

If you can afford it, pay off part of your mortgage. For many people, a house is the most expensive thing they ever buy. It is therefore good to understand how your mortgage works and when it is best to make extra repayments. With an extra repayment you pay less interest and you can ultimately save money.

If you can afford it, pay off part of your mortgage. For many people, a house is the most expensive thing they ever buy. It is therefore good to understand how your mortgage works and when it is best to make extra repayments. With an extra repayment you pay less interest and you can ultimately save money. - If you can make extra repayments, do it sooner rather than later. The sooner you pay extra, the less interest you pay.

- Pay attention to the conditions of your mortgage. With some mortgages there is a maximum that you can repay extra. Above that, you pay a fine, which can be considerable.

- If the interest on your mortgage is higher than the current mortgage interest rate in the market, ask your mortgage provider if you can convert the mortgage. You often pay a fine, but if the interest benefit is large enough, this can still be interesting. If you cannot convert your mortgage to a lower interest rate at your own mortgage provider, see if you can transfer your mortgage to another mortgage provider (this is called "transferring").

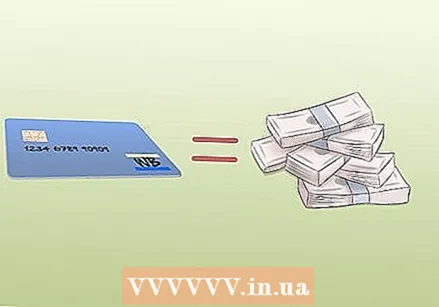

Realize that a credit card is useful, but not always wise. With a credit card you can make payments that would otherwise not be possible, for example on vacation or if you want to order something on a foreign website. However, keep in mind that you will pay a hefty interest on your expenses if you do not pay the credit card bill immediately.

Realize that a credit card is useful, but not always wise. With a credit card you can make payments that would otherwise not be possible, for example on vacation or if you want to order something on a foreign website. However, keep in mind that you will pay a hefty interest on your expenses if you do not pay the credit card bill immediately. - Think of your credit card as cash. Some people pretend that their credit card is an unlimited cash machine that allows them to spend without worrying about being able to afford it. Any expense with your credit card means that you are accumulating debt with the credit card company. If you pay your bill in full every month, nothing is wrong, but if you pay too late, the costs will quickly add up.

- Keep an eye on which rates you pay for which expenses. Your credit card company charges (sometimes hefty) rates for debit cards and payments abroad. Even if you pay with your credit card via a website, this can cost you extra money. It may then be cheaper to pay with another payment method. If you pay in a currency other than your own, pay close attention to the exchange rate used by your credit card company. You can find all rates on the website of your credit card company.

Spend what you have, not what you hope to earn. You may have the idea that you earn a lot, but if you are regularly in the red, it does not help you. The single most important rule of spending money is, unless there is an emergency, you only spend the money you have, not the money you ever hope to have. If you stick to this, you will avoid getting into debt and you will be well prepared for the future.

Spend what you have, not what you hope to earn. You may have the idea that you earn a lot, but if you are regularly in the red, it does not help you. The single most important rule of spending money is, unless there is an emergency, you only spend the money you have, not the money you ever hope to have. If you stick to this, you will avoid getting into debt and you will be well prepared for the future.

Part 3 of 4: Smart investing

Immerse yourself in various investment opportunities. As an adult you realize that the financial world is a lot more complex than what you could imagine as a child. Investing is a world in itself; in addition to “ordinary” buying shares, there are options, futures and warrants. The more you know about financial instruments and options, the better you can make choices with regard to investing your money, and the better you know when to take a step back.

Immerse yourself in various investment opportunities. As an adult you realize that the financial world is a lot more complex than what you could imagine as a child. Investing is a world in itself; in addition to “ordinary” buying shares, there are options, futures and warrants. The more you know about financial instruments and options, the better you can make choices with regard to investing your money, and the better you know when to take a step back.  Make use of pension plans that your employer offers. In addition to the regular retirement pension, for which you pay compulsory premium, you can often opt for supplementary pensions. Tax benefits apply to many of these: you pay the premium from your gross salary, so that you do not pay any income tax on that part of the salary.

Make use of pension plans that your employer offers. In addition to the regular retirement pension, for which you pay compulsory premium, you can often opt for supplementary pensions. Tax benefits apply to many of these: you pay the premium from your gross salary, so that you do not pay any income tax on that part of the salary. - Ask your pension fund or the personnel department at your work what the options are. For example with regard to partner's pension or disability pension. In addition to the tax benefit, you may be able to get an extra discount through your employer on, for example, disability insurance.

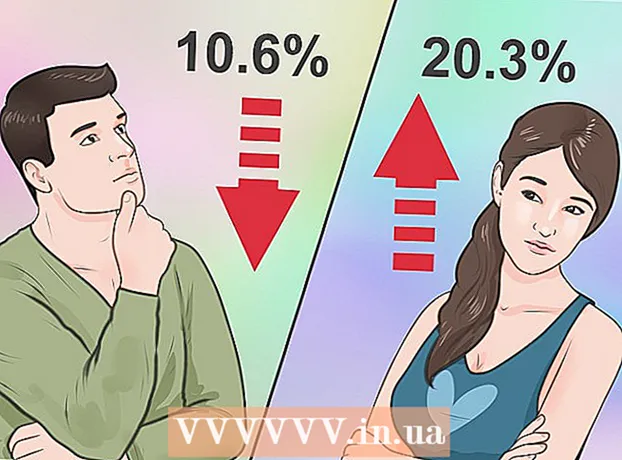

If you are going to invest in stocks, do not gamble with your money. Many people who start investing buy and sell stocks on a daily basis to make small profits that way. This may be a good tactic for experienced investors, but it carries significant risks and is more like gambling than investing. As a beginner you better go for the long term. That means you keep your money in the same stock for years, or even decades.

If you are going to invest in stocks, do not gamble with your money. Many people who start investing buy and sell stocks on a daily basis to make small profits that way. This may be a good tactic for experienced investors, but it carries significant risks and is more like gambling than investing. As a beginner you better go for the long term. That means you keep your money in the same stock for years, or even decades. - Look at the basics of a business. What is their liquidity, how successful have their new products been in recent years, how do they deal with their employees, what strategic partnerships do they have? Based on this, determine whether you want to invest in a company. Buying shares is more or less assuming that the current share price is too low and that the stock will rise in the future.

- If you want to run less risk, choose funds instead of shares. Via a fund you invest in several companies at the same time, so that your risk is more spread. If you put all your money into one stock, and that stock plummets to an all-time low, you're screwed. If you put all your money into 100 different shares, several shares can fall without you noticing too much. That is, in outline, how a fund limits risk.

Make sure you have good insurance. Expect the unexpected and be prepared. You never know when you will unexpectedly be faced with high costs. Good insurance can help weather a crisis. Check which insurance policies you and your family need, for example:

Make sure you have good insurance. Expect the unexpected and be prepared. You never know when you will unexpectedly be faced with high costs. Good insurance can help weather a crisis. Check which insurance policies you and your family need, for example: - Term life insurance (for when you or your partner should die)

- Health insurance (basic insurance is compulsory in the Netherlands; check which additional insurance policies you may need)

- Home insurance (for damage to your home)

- Contents insurance (for theft of and damage to your contents due to fire, water, etc.)

Check which additional pension provisions are available. You may be able to save in your employer's pension scheme. If you are a self-employed person, there is the fiscal retirement reserve. If you do not expect to have sufficient income in this way after retirement, you can take out life insurance.

Check which additional pension provisions are available. You may be able to save in your employer's pension scheme. If you are a self-employed person, there is the fiscal retirement reserve. If you do not expect to have sufficient income in this way after retirement, you can take out life insurance.- Supplementary pension products are often investments in shares. That means that you are dependent on the return that is made. It is easier to get a good return if you invest over a longer period of time. This also means that it is better to take out such a supplementary pension product early on. Don't wait until you're 60 to think about how much money you will need after retirement.

- Talk to a financial advisor about products that guarantee a certain income. You then know for sure what income you will receive later, during a pre-agreed number of years, or as long as you live. Do not only look at yourself, but also at your partner, if any. With some income products, the benefits will transfer to your partner in the event of your death.

Part 4 of 4: Saving

Set aside as much money as possible. Make saving a priority. Try to save at least 10% of your income every month, even if you only have a limited budget.

Set aside as much money as possible. Make saving a priority. Try to save at least 10% of your income every month, even if you only have a limited budget. - Think of it this way: if you can save $ 10,000 a year (that's less than $ 1,000 a month) for 15 years, then you'll have $ 150,000 plus interest after that. That's enough to pay for your kids' college or a bigger house.

- Start saving young. Even if you are still in school, saving is important. People who are good at saving see it more as a valuable principle than a necessity. If you start saving young, and invest your savings wisely, a modest start will naturally become great. It pays to think ahead.

Make a jar for emergencies. Saving is no more and no less than putting money aside that you do not need immediately. Having more income than you need means you are not in debt. Being in no debt means being prepared for emergencies. A contingency savings box helps you when you need it most.

Make a jar for emergencies. Saving is no more and no less than putting money aside that you do not need immediately. Having more income than you need means you are not in debt. Being in no debt means being prepared for emergencies. A contingency savings box helps you when you need it most. - Think of it like this: suppose your car gives up and the repair costs € 2000. If you were not prepared for that, you will have to take out a loan. You then quickly pay an interest of 6 or 7 percent, or even more.

- If you had had an emergency jar, you would not have had to take out a loan and you would not have had to pay interest. It really pays to be prepared.

- Think of it like this: suppose your car gives up and the repair costs € 2000. If you were not prepared for that, you will have to take out a loan. You then quickly pay an interest of 6 or 7 percent, or even more.

In addition to saving for retirement and having an emergency fund, it is important to set aside an amount of three to six months in ordinary expenses. Once again, saving is about being prepared for the unexpected. If you unexpectedly lose your job, you don't want to have to take out a loan to pay your rent. Setting aside three, six, or even nine months of expenses will keep your life going, even if you face setbacks.

In addition to saving for retirement and having an emergency fund, it is important to set aside an amount of three to six months in ordinary expenses. Once again, saving is about being prepared for the unexpected. If you unexpectedly lose your job, you don't want to have to take out a loan to pay your rent. Setting aside three, six, or even nine months of expenses will keep your life going, even if you face setbacks.  Pay off debts as soon as possible. Whether you are overdrawn in your bank account, have a student debt or a mortgage, a debt can seriously hinder your ability to save. Be the first to pay off the debt for which you pay the highest interest. Once that debt is paid off, you move on to the debt with the next highest interest. Continue in this way until you have paid off all of your debts.

Pay off debts as soon as possible. Whether you are overdrawn in your bank account, have a student debt or a mortgage, a debt can seriously hinder your ability to save. Be the first to pay off the debt for which you pay the highest interest. Once that debt is paid off, you move on to the debt with the next highest interest. Continue in this way until you have paid off all of your debts.  Grow your pension. If you are approaching 50 and you have not yet saved for your pension, do so as soon as possible. If you are building up pension through your employer, ask your pension fund how much extra pension you can save.

Grow your pension. If you are approaching 50 and you have not yet saved for your pension, do so as soon as possible. If you are building up pension through your employer, ask your pension fund how much extra pension you can save. - Put saving for retirement at the top of your list of savings goals, even above your children's study pot. Your children can work in addition to their studies or take out a student loan, but there is no loan for pension accrual.

- If you have no idea how much money you should be saving to get by later, you can use an online calculator to help you out. For example, those of the Dutch government.

- Ask a financial advisor for advice. If you want to maximize your retirement but have no idea where to start, talk to a financial advisor. A financial advisor can help you organize your financial future. You do pay consultancy costs, but with a good advisor it pays for itself.

Tips

- Make different money boxes for different purposes. For example, fixed costs, going out, clothing, saving and training. Divide your income over the different pots. For example, 60% for regular letting, 5% for going out, 10% for saving, and so on. These piggy banks can be real or digital. More and more banks allow you to open multiple savings accounts within one account, so that you can easily create different piggy banks.

- If you are in the red at the bank more often than you actually want, ask your bank if you can block the overdraft. This prevents you from spending more money than you have.

- Do you want to know how much you actually know about pension? Then take this quiz from AFM.

Warnings

- Don't be tempted to buy stacks of credit cards. You pay an annual fee for each credit card, and with many credit cards it is very easy to spend (much) more money than you have. Instead, choose one or two good credit cards.