Author:

Joan Hall

Date Of Creation:

3 July 2021

Update Date:

1 July 2024

Content

Share capital is the capital that a company owes to its shareholders, since the shareholders have invested their capital in this company. On the other hand, shareholders (as investors) may suffer losses in the event of a poor financial condition of the company (in this case, there may be no share capital at all, since its size is not regulated).

Steps

Method 1 of 2: Calculating Equity Capital

1 Calculate total assets. These include tangible assets such as office furniture, cars, inventory and real estate, as well as intangible assets such as copyrights, trade marks, long-term contracts, personnel.

1 Calculate total assets. These include tangible assets such as office furniture, cars, inventory and real estate, as well as intangible assets such as copyrights, trade marks, long-term contracts, personnel. - The value of tangible assets is considered solely with regard to their depreciation (decrease in value over time).

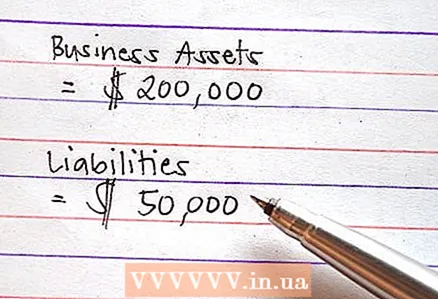

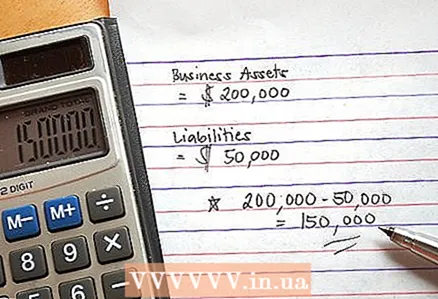

2 Calculate the total liabilities.

2 Calculate the total liabilities. 3 Subtract the total liabilities from the total assets. The result will be equity capital. It can be negative if the company's liabilities exceed its assets.

3 Subtract the total liabilities from the total assets. The result will be equity capital. It can be negative if the company's liabilities exceed its assets.

Method 2 of 2: Share Capital Per Shareholder

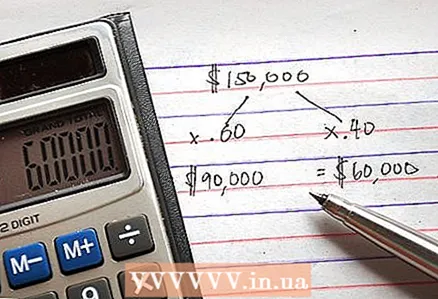

1 Divide the value of the share capital by the number of shareholders in the company (if they all hold equal shares in the company), or by the percentage each shareholder owns. As a result, you will calculate the share capital per shareholder. For example, if two shareholders own equal shares in a company, divide the share capital by 2 to calculate the share capital per share. If one shareholder owns 60% of the company and the other owns 40%, multiply the share capital first by 0.6 and then by 0.4 to calculate the share capital per shareholder.

1 Divide the value of the share capital by the number of shareholders in the company (if they all hold equal shares in the company), or by the percentage each shareholder owns. As a result, you will calculate the share capital per shareholder. For example, if two shareholders own equal shares in a company, divide the share capital by 2 to calculate the share capital per share. If one shareholder owns 60% of the company and the other owns 40%, multiply the share capital first by 0.6 and then by 0.4 to calculate the share capital per shareholder.

Tips

- Share capital is important when analyzing the value of a company. If there are several shareholders (more than one), then the share capital is divided between them in proportions corresponding to their shares in the company.

- The specific mechanisms for distributing share capital to shareholders vary from company to company.

- Share capital is not the selling price of the company (although the selling price can be equated to the share capital). Selling prices take into account other variables, such as goodwill or brand popularity.