Content

One of the ways for a business to survive is to ensure a sustainable rate of growth. In basic terms, business growth is often limited by the amount of capital in a company. The more capital a company has, the greater its potential for growth. However, if the business grows too quickly, then there may not be enough capital to support growth. If a business grows too slowly, then it can go into a stage of stagnation. It is very important for the company to determine the optimal growth rate that could be maintained regardless of economic, political, consumer and competitive factors. Sustainable growth rates help the company to plan future capital based on the profit that can be achieved with the existing capital and the percentage of this profit reinvested in it. Since this information helps to assess the current position and plan the future of the company, it is very important to know how to calculate a sustainable growth rate.

Steps

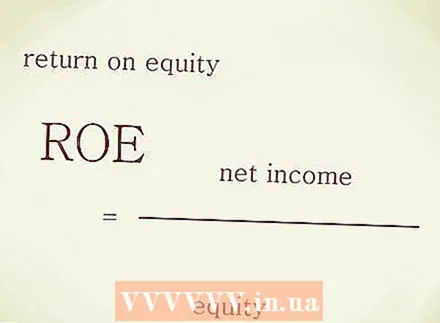

1 Calculate your return on equity (ROE).

1 Calculate your return on equity (ROE).- Determine the amount of the company's capital. It will be equal to the share capital of the company.

- Determine the net profit for the period under review. Net income is the difference between gross income and the cost of doing business, including taxes.

- Return on equity is calculated by dividing net income by equity. For example, if the amount of equity is $ 100 and the net profit is $ 20, then the return on equity is 20%. This indicator in itself is valuable for investors, since it can be used to assess the effectiveness of investments.

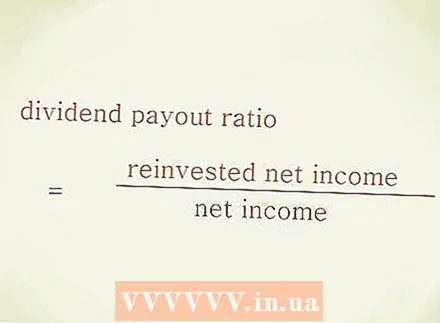

2 Calculate your dividend payout rate (DPR).

2 Calculate your dividend payout rate (DPR).- Determine the amount of net income that is re-incorporated into equity. If, in the above example, $ 10 of net income was reinvested in equity, then the dividend payout rate is 50% or 0.5.

3 Calculate the rate of sustainable growth. The formula for the calculation is as follows: ROE x (1 - DPR). So, for the above example, the calculation looks like this: 20% x 0.5 = 10%. The sustainable growth rate is 10%. $ 10 was reinvested, which means the company's equity capital increased to $ 110.

3 Calculate the rate of sustainable growth. The formula for the calculation is as follows: ROE x (1 - DPR). So, for the above example, the calculation looks like this: 20% x 0.5 = 10%. The sustainable growth rate is 10%. $ 10 was reinvested, which means the company's equity capital increased to $ 110.

Tips

- Another definition of sustainable growth is the maximum level of growth a company can maintain without raising additional funding.

- Keep in mind that growing a company requires additional costs. It can be an increase in payroll for hiring new employees, and large expenses for selling more goods, and new equipment for operational needs, etc. If the company nevertheless resorts to raising funds by issuing additional shares or using a loan, then this affects the capital and its future growth.

Warnings

- Sustained growth suggests room for expansion. If such an opportunity is not available, or is not used, then this will have an impact on the return on equity and the amount of reinvested profit. A company's profitability and its growth are closely related. Sustainable growth is a useful tool when planning a company's expansion, but ultimately it is influenced by other factors.