Author:

Carl Weaver

Date Of Creation:

28 February 2021

Update Date:

1 July 2024

Content

This article is a great starting point for anyone looking to buy property in Canada. Although the article is aimed more at UK buyers, it still provides useful information for all non-residents interested in buying property in Canada.

Steps

1 Think about why you chose Canada. An increasing number of Britons are choosing Canada as their second home. In this country, they are attracted by incredible landscapes, a laid-back lifestyle, as well as political and social stability. Plus the ease of travel and the increasing coverage of low-cost airlines, as well as the fact that the Canadian international real estate market is still young, forcing developers looking to attract UK clients to provide affordable prices.

1 Think about why you chose Canada. An increasing number of Britons are choosing Canada as their second home. In this country, they are attracted by incredible landscapes, a laid-back lifestyle, as well as political and social stability. Plus the ease of travel and the increasing coverage of low-cost airlines, as well as the fact that the Canadian international real estate market is still young, forcing developers looking to attract UK clients to provide affordable prices. - The Canadian residential real estate market has performed well in recent years. It only suffered from the global recession in world markets. Residential property is cheaper here than in the UK, which, together with historically healthy capital gains, makes it an attractive investment target for Britons looking to buy a second home or move here permanently.

- Canada is said to have weathered the global recession better than any other emerging economy in the world. The government saved money when there was a budget surplus in the country for 12 years. The problems that can now be observed in Canadian companies are almost exclusively the result of their impact on world markets. This gives Canadian real estate a real chance to get over the recession well, even though real estate prices are currently in decline.

2 Look for popular places. Years ago, the fearless British immigrated to every corner of Canada. However, for those considering buying a vacation home, the choice of location will depend on the time and cost of travel. These elements will vary greatly depending on where you live in Britain. Due to the relative ease of travel, those British looking to purchase a second home traditionally prefer eastern Canada. However, the recent introduction of low-cost transatlantic airlines has led to increasing interest in the western regions of the country. Resorts specially built in these areas are also becoming popular. We hope this article helps you get started somewhere. There are many sources where you can get additional information, including television, radio programs, magazines, the Internet and real estate exhibitions, as well as real estate agents in the UK and Canada.

2 Look for popular places. Years ago, the fearless British immigrated to every corner of Canada. However, for those considering buying a vacation home, the choice of location will depend on the time and cost of travel. These elements will vary greatly depending on where you live in Britain. Due to the relative ease of travel, those British looking to purchase a second home traditionally prefer eastern Canada. However, the recent introduction of low-cost transatlantic airlines has led to increasing interest in the western regions of the country. Resorts specially built in these areas are also becoming popular. We hope this article helps you get started somewhere. There are many sources where you can get additional information, including television, radio programs, magazines, the Internet and real estate exhibitions, as well as real estate agents in the UK and Canada. - Eastern Canada - Homes in eastern Canada are usually cheaper than similar homes in the western part of the country. Traditionally, among all large cities in Canada, the lowest prices for residential real estate are in Montreal.However, they are growing rapidly now, so this could be a good time to invest. This city has a lot to offer. Picturesque countryside and excellent sports facilities for skiing are within easy reach. The US border is a 40-minute drive south. Boston and New York are six hours away by car or one hour by train. There are also several daily flights to London with a flight time of approximately seven hours. Toronto is also gaining popularity thanks to its strong rental market. Rental income from real estate in Toronto and Montreal remains high despite the global crisis.

- Vancouver - British Columbia, Canada's westernmost province. With its mountains, lakes, rivers and beaches, it is also the most beautiful province. It also has the mildest climate and the friendliest society. The largest city in the province is Vancouver. Here are the highest residential property prices in Canada. The city, which is adjacent to the Whistler ski resort, hosted the 2010 Olympics, driving prices even higher. Transport links with Britain are improving. There is a direct daily flight from London to Vancouver (flight time is approximately 9.5 hours).

- Rocky Mountains - Many people visit the Rocky Mountains for the holidays and fall in love with this amazing place. However, real estate here is quite expensive, most of which is located inside national parks and therefore is inaccessible to most buyers. One of the places worth thinking about is Canmore, Alberta. Given that it is close to Banff and Kananaskis National Parks, just a couple of hours from Calgary International Airport (flight time to London is approximately 9 hours) and has a temperate climate, it is not surprising that Canmore has doubled its population since then. as in 1988 it hosted the Winter Olympics. Prices are relatively low, but they are constantly increasing. Prices are also rising in Calgary, a young city with a good primary real estate market.

- Resorts - Canada is the tenth most popular tourist destination, but still has great potential for growth. The government has invested huge sums of money in tourism, especially in the eastern part of the country, which until recently was heavily neglected. Therefore, resort complexes have now become big business. More and more Britons are seeing the benefits of buying resort property. Most of them are skiers who have become disenchanted with the cost and crowds inherent in European resorts. However, most resorts, even those that offer winter sports, are now open year round, providing fun for the whole family. These factors help to extend the rental season and attract a wide range of buyers. As a bonus, it is worth noting that the quality of the buildings is very high, the maintenance is handled by the management company, and the capital gains are generally excellent, especially in eastern Canada.

3 Buy a property. Find out all the rules and regulations. The rules for buying real estate in different parts of Canada differ, so it is advisable to inquire about them when researching the area. For example, in British Columbia, New Brunswick, Newfoodland, Nova Scotia, Ontario and Quebec, there are no restrictions on foreign ownership, provided you spend no more than six months a year in Canada. However, in Banff, which is located in a national park, only the businesses and employees of the park can own the property, and even they are issued a 42-year renewable lease.

3 Buy a property. Find out all the rules and regulations. The rules for buying real estate in different parts of Canada differ, so it is advisable to inquire about them when researching the area. For example, in British Columbia, New Brunswick, Newfoodland, Nova Scotia, Ontario and Quebec, there are no restrictions on foreign ownership, provided you spend no more than six months a year in Canada. However, in Banff, which is located in a national park, only the businesses and employees of the park can own the property, and even they are issued a 42-year renewable lease. - Each province has a limit on the amount and type of land that can be owned. Unless you are purchasing new property from a developer, potential buyers must register with a real estate agent (realtor).

4 Check out the buying process. The process of purchasing real estate in Canada is different from that in Britain and other countries, and the practice of gas pumping is completely unknown. Since most Canadian realtors have extensive partnerships, it is quite common to find that one realtor can access all the available properties in the area. Once you have selected your property, you will need to appoint an independent realtor (or buyer's agent) to represent your interests. In most real estate transactions, the seller pays both of the realtors involved. Your agent will prepare a purchase offer, which will then be presented along with the deposit. If the deal fails, the deposit may be refunded. When the seller and the buyer have signed the contract and the terms have been reached (for example, with regard to the mortgage), the sale process can be continued.

4 Check out the buying process. The process of purchasing real estate in Canada is different from that in Britain and other countries, and the practice of gas pumping is completely unknown. Since most Canadian realtors have extensive partnerships, it is quite common to find that one realtor can access all the available properties in the area. Once you have selected your property, you will need to appoint an independent realtor (or buyer's agent) to represent your interests. In most real estate transactions, the seller pays both of the realtors involved. Your agent will prepare a purchase offer, which will then be presented along with the deposit. If the deal fails, the deposit may be refunded. When the seller and the buyer have signed the contract and the terms have been reached (for example, with regard to the mortgage), the sale process can be continued.  5 Prepare to cover the costs. Transaction costs in Canada, although they vary from province to province, typically range between 4.7 and 11% of property value, making Canada one of the cheapest countries to buy in terms of fees. The asking price for new homes is usually matched with 7% goods and services tax (GST) and up to 10% provincial sales tax (PST). Alberta is the only province where no provincial sales tax is collected.

5 Prepare to cover the costs. Transaction costs in Canada, although they vary from province to province, typically range between 4.7 and 11% of property value, making Canada one of the cheapest countries to buy in terms of fees. The asking price for new homes is usually matched with 7% goods and services tax (GST) and up to 10% provincial sales tax (PST). Alberta is the only province where no provincial sales tax is collected. - In New Brunswick, Newfoodland, Labrador and Nova Scotia, the goods and services tax is combined with an 8% provincial retail tax. Together they represent 15% of the combined sales tax.

- Under certain conditions, goods and services tax and provincial sales tax can be reduced or avoided altogether (see Taxation section). Buying costs vary from province to province, but buyers should prepare up to £ 2,000 in legal fees, inspection and insurance. Also, do not forget about the purchase tax, which ranges from 0.5 to 2% of the price of the property.

6 Fund your purchase. When it comes time to fund your purchase, consider all of your options. It is advisable to pay in cash, of course, if you can afford it, but you may not want to invest a relatively large amount of money in this way. Another way is to obtain a loan against an already mortgaged house in Britain, or to obtain a mortgage on Canadian property from Canadian or British lenders. Re-mortgages are an easier option. Freeing up capital in a UK home means that a second home can be purchased with cash without the need for a second bond. However, this method is available only to those who have direct rights to their first home.

6 Fund your purchase. When it comes time to fund your purchase, consider all of your options. It is advisable to pay in cash, of course, if you can afford it, but you may not want to invest a relatively large amount of money in this way. Another way is to obtain a loan against an already mortgaged house in Britain, or to obtain a mortgage on Canadian property from Canadian or British lenders. Re-mortgages are an easier option. Freeing up capital in a UK home means that a second home can be purchased with cash without the need for a second bond. However, this method is available only to those who have direct rights to their first home. - Several UK mortgage providers will lend 80% of the purchase price for a second home for 15 years.

7 Taxation system. Canada's Tax System - The federal and provincial governments levy income taxes, which together account for more than 40% of total tax revenue. Taxes are progressive, and the rich pay a higher percentage of their profits than those who earn less. There is no inheritance tax in Canada as such. Inheritance is considered a liquidation of assets and is therefore subject to capital gains tax, which is currently 25%.

7 Taxation system. Canada's Tax System - The federal and provincial governments levy income taxes, which together account for more than 40% of total tax revenue. Taxes are progressive, and the rich pay a higher percentage of their profits than those who earn less. There is no inheritance tax in Canada as such. Inheritance is considered a liquidation of assets and is therefore subject to capital gains tax, which is currently 25%. - Several other federal, provincial, and local taxes are paid by individuals, including sales tax (see the Cost section in the Buying Property section) and real estate tax. Residential real estate is subject to annual local taxation ranging from 0.5 to 2% of its value.

- Taxation of Non-Residents - Non-residents pay federal and provincial income taxes from Canadian sources of income. Since the UK has a comprehensive double taxation treaty with Canada, taxes paid in Canada can reduce UK debt. NTU and PNP are levied on new homes purchased for personal use.However, in some cases, for example, if the owner of a resort property makes a pool out of it for rent and uses it for 10 percent or less per year, the house is classified as commercial property and is not subject to taxation. Rental income is taxed at 25%, but expenses can be tax deductible.

- A non-resident selling property in Canada must pay 25% Capital Gains Tax, which is charged as a percentage of profits.

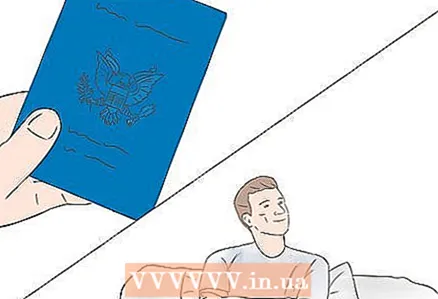

8 Deal with passports, visas and residence.

8 Deal with passports, visas and residence.- Passports and Visas - To enter Canada as a guest, a UK citizen must have a standard passport issued for 10 years. Visas are usually not necessary, although sometimes there are exceptions. Non-residents can stay in Canada for a maximum of 6 months a year.

- Residence - Permanent Resident Status gives a non-Canadian citizen the right to reside in that country. To obtain this status, you must fulfill some obligations. Those who wish to obtain permanent residence must apply for immigrant status. Since this is a rather complicated process, it is recommended that you consult with a lawyer specialized in immigration.

9 Available means of communication.

9 Available means of communication.- The telephone is an excellent service throughout Canada using state of the art technology through a number of national and provincial telephone companies. As in the UK, coin-operated telephones are found in many public places and the number of payphones accepting major credit cards is growing. Almost all telephone companies produce prepaid calling cards for domestic and international use. They can be purchased at many stores, including gas stations, pharmacies, and post offices. Some companies also produce related cards, with the result that the cost of the call is charged to the caller's credit or debit account.

- Internet - Internet cafes are available in many large and even some small towns. Many large hotels, public libraries and other establishments also have Internet access.

Tips

- In the aftermath of World War II, the growth of Canada's manufacturing, mining and service sectors transformed Canada from an agricultural country to an industrial and urban country driven by technology and innovation. Three out of four Canadians are employed in the service sector. Natural gas deposits on the east coast as well as in the west make Canada self-sufficient in energy. Moreover, this country is rich in natural resources. She has good prospects. Real growth rates have been almost 3% since 1993, and the unemployment rate is falling, although these figures have deteriorated slightly due to the global crisis. Aside from the global crisis, the only remaining problems are divisions in the country, resulting in continued constitutional divisions between the Anglo- and French-speaking areas, as well as an outflow of personnel to the United States.

- The currency in Canada is the Canadian dollar. The current exchange rate is CAD 1.90 to GBP 1. Banks are open from 10:00 am to 4:00 pm, Monday through Friday. UK debit cards can be used at ATM machines found in many public places, including cinemas and supermarkets, not to mention banks.

- Credit cards and travelers checks are also widely used here. There are no foreign exchange restrictions on the import or export of local and foreign currency. However, if you are looking to move money abroad, whether in a lump sum or to meet regular financial obligations, you should consult a financial advisor or a foreign exchange risk expert who can advise on how to reduce the risk of currency fluctuations like spot or forward transactions.

- Many new immigrants do not have the Canadian credit history required for bank home financing.For these people, a lease with a purchase option can be an important step towards obtaining a loan, allowing them to buy a home much earlier. EasyHomeBuy Canada has an extensive database of homes, as well as information on the process and vendors offering this option. You should carefully review these lease-to-foreclosures transactions as many will not qualify for a future loan and will have an unpleasant experience.

Warnings

- This article is for informational purposes only. When conducting any type of property transaction, you should always seek professional help.

- Until this process is successfully completed, you must have a sponsor approved by the Government of Canada, as home sellers are not allowed to provide a home to a foreigner without proof of sponsorship approved by the Government of Canada

- You need to make savings as buying property can get quite expensive.

- Buying a home or property abroad is an important decision that should not be taken lightly. Before making any decision, it is very important to make sure that you thoroughly research every aspect and are familiar with all the important facts. Individual circumstances are very different from each other, so it is important to get professional advice that is specific to your situation, especially in areas such as buying a property, potential rental returns, taxation and mortgages.