Author:

Christy White

Date Of Creation:

11 May 2021

Update Date:

21 June 2024

Content

- To step

- Method 1 of 4: Basic rules for spending money

- Method 2 of 4: Spend money on clothes

- Method 3 of 4: Spend money on food and drinks

- Method 4 of 4: Save money wisely

- Tips

Do you also hate it when your wallet is empty when you need real money? No matter how much or how little money you have, it is a good idea to spend it wisely so that you always get your money's worth. Follow the tips below to spend less on important things and handle shopping in a safer way.

To step

Method 1 of 4: Basic rules for spending money

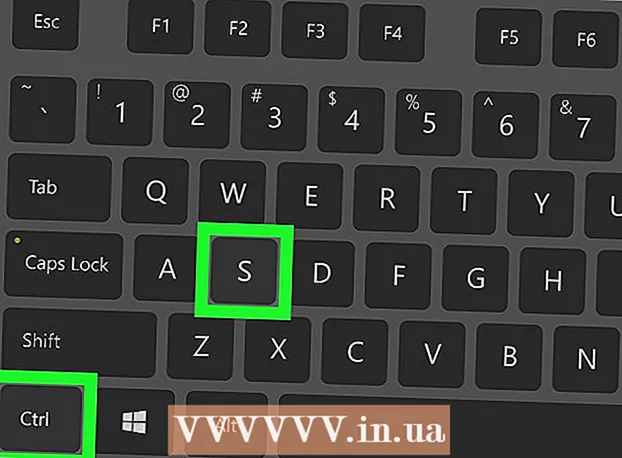

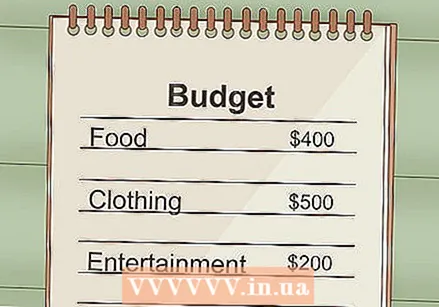

Draw up a budget. Keep track of your expenses and income so that you have an accurate picture of your financial situation. Keep receipts or write down your purchases in a notebook afterwards. Check your bills every month and add those expenses to your budget.

Draw up a budget. Keep track of your expenses and income so that you have an accurate picture of your financial situation. Keep receipts or write down your purchases in a notebook afterwards. Check your bills every month and add those expenses to your budget. - Organize your purchases by category (food, clothing, entertainment, etc.). The categories that you spend the most money on each month (or that you think you've spent a surprising amount on) can be good categories for saving money.

- When you've tracked your purchases for a while, set a monthly (or weekly) limit for each category. Make sure your total budget is less than your income during that period so that if possible you have enough money left to save.

Plan your purchases in advance. If you make decisions on a whim, your expenses can be high. Write down what to buy while you are calm and at home.

Plan your purchases in advance. If you make decisions on a whim, your expenses can be high. Write down what to buy while you are calm and at home. - Take a preliminary tour of the shops before you actually hit the road to buy something. Pay attention to the prices of multiple alternative products in one or more stores. Go home without buying anything and on your second "real" tour of the shops, decide which products to buy. The more focused you are and the shorter you are in the store, the less you will spend.

- If you are motivated to see every purchase as an important decision to make, you will make better decisions.

- Do not accept free samples or trial packs or try on clothes just for fun. Even if you don't plan to buy it, the experience can convince you that you need to make a decision now rather than think carefully about it beforehand.

Avoid impulse buying. If planning your purchases in advance is a good idea, buying something on a whim is a bad idea. To avoid making purchasing decisions for the wrong reasons, follow the tips below:

Avoid impulse buying. If planning your purchases in advance is a good idea, buying something on a whim is a bad idea. To avoid making purchasing decisions for the wrong reasons, follow the tips below: - Do not view shop windows or shop for fun. If you just buy something because you love to shop, chances are you end up spending too much money on things you don't need.

- Don't make purchasing decisions if you can't think clearly. Alcohol, other drugs, or a lack of sleep can affect your ability to make wise decisions. Even shopping when you're hungry or listening to loud music can be a bad idea if you don't stick to your shopping list.

Go shopping alone. Children, friends who love to shop, or even just a friend whose taste you respect can influence you to spend more.

Go shopping alone. Children, friends who love to shop, or even just a friend whose taste you respect can influence you to spend more. - Do not take advice from store employees. If you have a question that you would like an answer to, listen politely to the answer the employee gives you, but ignore any advice he gives about purchasing products. If the employee doesn't want to leave you alone, leave the store and come back later to make a decision.

Pay with cash and pay the full amount immediately. Debit cards and credit cards can make you spend more money for two reasons: you have a lot more money at your disposal than you normally would and because you are not paying with visible money, your brain does not register it as a "real one." purchase. In a similar way, having your expenses recorded at the pub or buying a product where you don't have to pay until later makes it more difficult for you to realize how much money you are actually spending.

Pay with cash and pay the full amount immediately. Debit cards and credit cards can make you spend more money for two reasons: you have a lot more money at your disposal than you normally would and because you are not paying with visible money, your brain does not register it as a "real one." purchase. In a similar way, having your expenses recorded at the pub or buying a product where you don't have to pay until later makes it more difficult for you to realize how much money you are actually spending. - Don't bring more cash than you really need. If you don't have a larger amount with you, you can't spend it. Likewise, you should also withdraw the amount you set for your weekly budget from the ATM once a week, instead of topping up your wallet every time you run out of cash.

Don't be fooled by commercials. Outside influences are a big factor in determining what we spend our money on. Be on the lookout and try to realize the reasons why you are drawn to a product.

Don't be fooled by commercials. Outside influences are a big factor in determining what we spend our money on. Be on the lookout and try to realize the reasons why you are drawn to a product. - Do not buy products based on an ad or advertisement. Whether it's commercials on television or product packaging, always be skeptical of advertisements and commercials. They are designed to encourage you to spend money and will not paint an accurate picture of the options you have.

- Do not buy products just because you get a discount. Coupons and offers come in handy for products you were already planning to buy. If you buy something you don't need just because you get a 50% discount on it, you don't save money.

- Be aware of tricks used to make products appear cheaper. Translate that price from $ 1.95 to $ 2. Judge the price of a product only by the price itself and not because it's a better deal than another product from the same company. (By not assigning value to the "bad deal", someone can trick you and make you pay more for additional options you don't need.)

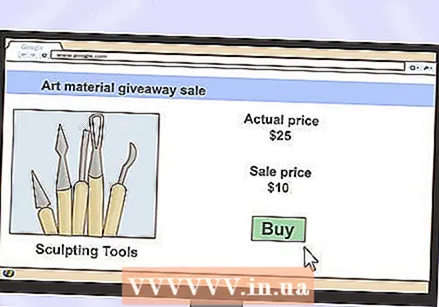

Wait for offers and discounts. If you know you need a particular product but you're not in a hurry, wait until it's on sale or try to find a coupon for it.

Wait for offers and discounts. If you know you need a particular product but you're not in a hurry, wait until it's on sale or try to find a coupon for it. - Make only use of coupons and offers for products that you really need or that you had already decided you wanted to buy before they were on sale. An attractive lower price is an easy way to get customers to buy something they don't need.

- Buy products that are only useful during a certain part of the year out of season. A winter coat should be cheap in the summer.

Do your research. Before making expensive purchases, do research on the internet or read product reviews to find out how you're getting your money's worth. Find the product within your budget that will last the longest and that best suits your needs.

Do your research. Before making expensive purchases, do research on the internet or read product reviews to find out how you're getting your money's worth. Find the product within your budget that will last the longest and that best suits your needs.  Consider all costs. You will end up paying a lot more than the sticker price for many expensive products. Read all the fine print and add up all the amounts before making a decision.

Consider all costs. You will end up paying a lot more than the sticker price for many expensive products. Read all the fine print and add up all the amounts before making a decision. - Don't be fooled by lower monthly payments. Calculate the total amount you will spend (monthly payment x the number of months until you have paid everything) to find the cheapest option.

- If you borrow money, calculate how much interest you have to pay in total.

Treat yourself to something cheap every now and then. This may sound like a paradox (aren't you buying something you don't need right now?), But it's actually easier to achieve your money-saving goals if you give yourself the occasional reward. If you try to stop unnecessarily spending money out of nowhere, you will end up losing it and spending more money in one go than you should.

Treat yourself to something cheap every now and then. This may sound like a paradox (aren't you buying something you don't need right now?), But it's actually easier to achieve your money-saving goals if you give yourself the occasional reward. If you try to stop unnecessarily spending money out of nowhere, you will end up losing it and spending more money in one go than you should. - Set aside a very small amount in your budget for these treats. The goal is to give yourself a small reward for staying positive and avoiding wasting a large amount of money later on.

- If the ways you typically use to treat yourself are rather expensive, look for cheaper alternatives. Take a bubble bath at home instead of going to a spa or borrow a movie from the library instead of going to the cinema.

Method 2 of 4: Spend money on clothes

Only buy what you really need. Search your wardrobe and see which items of clothing you already have. Sell or give away any items of clothing that you don't wear or that don't fit you. This will give you a better idea of your situation.

Only buy what you really need. Search your wardrobe and see which items of clothing you already have. Sell or give away any items of clothing that you don't wear or that don't fit you. This will give you a better idea of your situation. - Tidying up your wardrobe is no reason to buy replacement items. The goal is to find out which types of clothing you have enough of, and which types are not.

Know when you can spend more on quality. It's not very smart to buy the most expensive brand of socks, because they wear out quickly anyway. However, spending more money on a better quality pair of shoes that last longer can save you money in the long run.

Know when you can spend more on quality. It's not very smart to buy the most expensive brand of socks, because they wear out quickly anyway. However, spending more money on a better quality pair of shoes that last longer can save you money in the long run. - Keep in mind that a sale price does not guarantee the quality of a product. Research what the brands are with the most sustainable products instead of assuming that the most expensive product is also the best.

- Likewise, if possible, you should also wait until the product you need is on sale. Remember, you shouldn't use an offer as an excuse to buy products you don't need.

Buy from thrift stores. Some second-hand clothing stores sell surprisingly good quality clothing. At the very least, you should be able to get basic garments for a fraction of the price of a new garment.

Buy from thrift stores. Some second-hand clothing stores sell surprisingly good quality clothing. At the very least, you should be able to get basic garments for a fraction of the price of a new garment. - Thrift stores in wealthier neighborhoods usually receive better quality items of clothing.

If you can't find anything you like at a thrift store, buy clothes from cheap house brands. The logo of a fashion designer does not indicate that a garment is of a better quality.

If you can't find anything you like at a thrift store, buy clothes from cheap house brands. The logo of a fashion designer does not indicate that a garment is of a better quality.

Method 3 of 4: Spend money on food and drinks

Compile a weekly menu and a shopping list. When you have set a budget for food and drink, write in advance exactly which meals you will eat and what you need to buy at the supermarket to prepare these meals.

Compile a weekly menu and a shopping list. When you have set a budget for food and drink, write in advance exactly which meals you will eat and what you need to buy at the supermarket to prepare these meals. - This not only prevents you from making impulse purchases at the supermarket, but also from wasting money by throwing food away. This is a big expense for many people. If you find yourself throwing food away, prepare less food for the meals you have scheduled.

Read tips on how to save money on food. There are many ways to save money when shopping at the supermarket, such as buying food in bulk or knowing when different products are cheaper.

Read tips on how to save money on food. There are many ways to save money when shopping at the supermarket, such as buying food in bulk or knowing when different products are cheaper.  Don't eat in a restaurant too often. Eating out is a lot more expensive than preparing your own food. A person trying to save money should never go to a restaurant on a whim.

Don't eat in a restaurant too often. Eating out is a lot more expensive than preparing your own food. A person trying to save money should never go to a restaurant on a whim. - Instead, prepare a packed lunch at home and take it with you to work or school.

- Fill a water bottle at home under your own tap instead of buying expensive bottled water.

- If you drink coffee often, buy a cheap coffee maker and save money by brewing coffee at home.

Method 4 of 4: Save money wisely

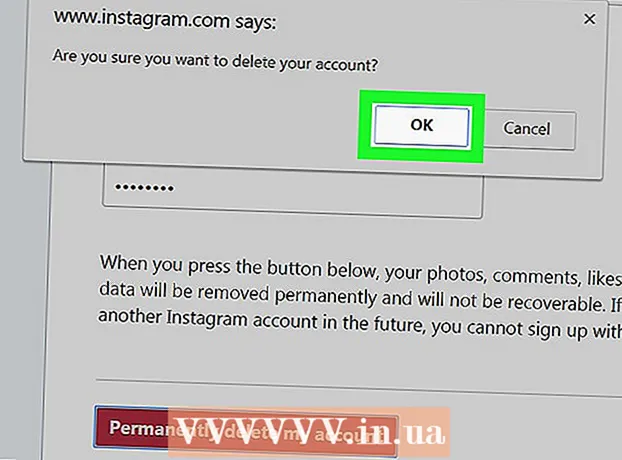

Save money. Making wise spending decisions goes hand in hand with saving money. Every month, try to include as large an amount as possible in your budget that you deposit into a savings account or put into another reliable investment that you accrue interest on. The more money you save each month, the better your overall financial health will be. And that's actually the purpose of spending your money wisely, isn't it? Here are some savings ideas to consider:

Save money. Making wise spending decisions goes hand in hand with saving money. Every month, try to include as large an amount as possible in your budget that you deposit into a savings account or put into another reliable investment that you accrue interest on. The more money you save each month, the better your overall financial health will be. And that's actually the purpose of spending your money wisely, isn't it? Here are some savings ideas to consider: - Set money aside for emergencies.

- Avoid unnecessary costs and surcharges.

- Put together a weekly menu in which you plan all meals for that week.

Break expensive habits. Compulsive habits such as smoking, drinking, or gambling can easily use up all the money you had saved. If you can banish these habits from your life, it will not only benefit your wallet, but also your health.

Break expensive habits. Compulsive habits such as smoking, drinking, or gambling can easily use up all the money you had saved. If you can banish these habits from your life, it will not only benefit your wallet, but also your health.  Don't buy products you don't need. If you are unsure about a particular purchase, ask yourself the questions below. If you don't answer all of them with "yes", it is a strong signal that you should not spend the money.

Don't buy products you don't need. If you are unsure about a particular purchase, ask yourself the questions below. If you don't answer all of them with "yes", it is a strong signal that you should not spend the money. - Will I be using this product regularly? Make sure you drink all of the milk before it turns sour, or that there are enough summer months left so you can wear that skirt more than a few times.

- Am I missing something that serves the same purpose? Pay attention to specialized products whose function can also be performed by standard products that you already have at home. You probably don't need extra special kitchen equipment or a special sports outfit when sweatpants and a T-shirt will do the trick.

- Will this product improve my life? This is a tricky question, but you should avoid purchases that lead to “bad habits” or cause you to neglect important parts of your life.

- Will I miss this product if I don't buy it?

- Will this product make me happy?

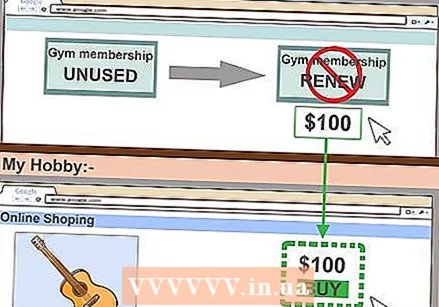

Prune your hobbies. If you have a gym subscription that you are not using, do not renew it. Do you have a collection that you don't care about anymore? Then sell your stuff. Only spend your money and your energy on things you really care about.

Prune your hobbies. If you have a gym subscription that you are not using, do not renew it. Do you have a collection that you don't care about anymore? Then sell your stuff. Only spend your money and your energy on things you really care about.

Tips

- Avoid clothes that can only be cleaned at the dry cleaner. Check the care label before buying a garment. You don't want to spend money on the dry cleaner repeatedly.

- Sticking to a budget will be a lot easier if everyone in your household gets along well.

- Regularly compare energy suppliers, internet providers, telephone providers and insurers. Many services (telephone, internet, television, insurance, etc.) offer better deals to new customers in order to acquire customers. If you keep changing providers, you will always have the cheapest subscription or contract. (Some phone providers will pay the cancellation fee for canceling your old phone plan earlier if you switch to them.)

- When comparing two cars, calculate how much more money you would spend on fuel if you bought the car that is less fuel efficient.