Author:

Louise Ward

Date Of Creation:

7 February 2021

Update Date:

24 June 2024

Content

If you know how to calculate your loan payments, you can plan your expenses. You should use an online loan calculator because when using a regular calculator, you will make mistakes if you calculate the formulas too long.

Steps

Method 1 of 3: Using an Online Calculator

Open an online loan repayment program. You can click on the computer "sample" at the top of the page, then open it with Google Drive or download - download (review the instructions) and open in Excel or another program. Alternatively, access the following links:

- Bankrate.com and MLCalc are both simple but full-fledged payment schedules including your outstanding balance.

- CalculatorSoup is very useful for loans with irregular payments or interest. For example, mortgages in Canada are compounded every 6 months. (The interest programs calculated above all assume interest and payables take place each month).

- You can create your own spreadsheet in Excel.

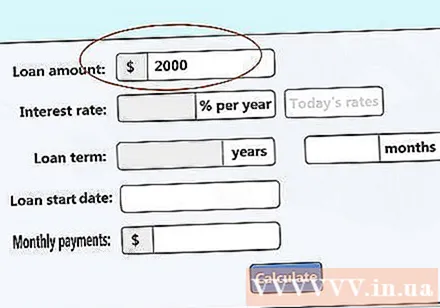

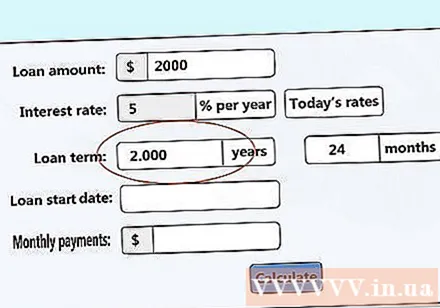

Enter the loan amount. This is the total amount you have borrowed. If you want to calculate a partially paid loan, fill in the remaining amount you must pay.- This part is listed as the “base amount”.

Enter interest rate. This is the annual interest rate on your loan, in percentage terms. For example, if you pay 6% interest, enter “6” ..

- The compounding period has no effect here. The interest rate here is the nominal interest rate, including the interest that is recalculated regularly.

Fill in interest payment period. This is the period during which you are expected to pay all interest. Use the time period in interest terms to calculate your minimum monthly payment. Then shorten the time to work out a higher monthly payment so you can pay off your debt early.- Paying off your debt in a shorter amount of time is a good sign as your total payments will be less.

- Read the section next to this section to see whether the program is calculated by month or year.

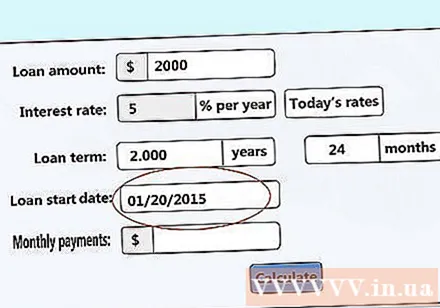

Choose a start date. This feature is used to calculate the date when you will pay off the debt.

Click calculate. Some calculators will automatically update the "pay by month" section after you complete the information. Another will appear when you click on "calculate", and will provide you with a graph showing your repayment schedule.

- “Principal” is the amount of principal remaining while “Interest” is the interest to be paid.

- Programs will display a fully “fully amortized” repayment program, meaning you will pay the same amount monthly.

- If you pay less than the amount shown on the screen, you will have to pay more when the debt is due and the total final amount you will pay will be more.

Method 2 of 3: Self-calculation of Debts Payable

Write down the formula. The formula used to calculate loan payments is M = P * (J / (1 - (1 + J))). Follow the steps below to use a formula or see a quick explanation of the variables in a formula:

- M = amount payable

- P = Principal, original loan amount

- J = Effective interest rate. Note that this is not the annual interest rate; See explanation below.

- N = Total number of payments

Be careful about rounding results. Ideally you should use a graphing calculator application or software that calculates the entire formula in one line. If you are using a calculator that can only do one step at a time, or you want to follow the steps below, round up to no more than 4 digits before proceeding to the next step. Rounding to decimals can skew the final calculation result.

- Simple calculators have an "Ans" button. This button will use the previous result for the next calculation, so that it is more accurate to press the number again.

- The examples below are rounded after each step, but the final step includes both the hand calculation and the quick calculation in one line so you can compare your results.

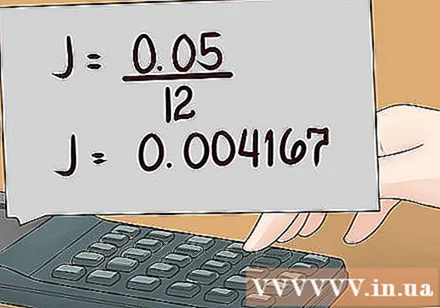

Calculate effective interest rate J. Most loan terms refer to the "annual nominal interest rate" but you do not actually pay your loan annually. Divide the nominal interest rate by 100 and leave it as a decimal, then divide it by the number of periods you pay during the year to get your effective rate.

- For example, if the annual interest rate is 5% and you pay each month (12 times a year), take 5/100 to get 0.05 then divide J = 0.05 / 12 = 0,004167.

- In exceptional cases, interest is charged at a time different from the repayment schedule. As in Canada, mortgages are charged twice a year even though borrowers pay them 12 times a year. In this case, the sale will split the interest rate in half.

Notice the total number of N payments. The debt term can specify the number of payments or you can do it yourself. For example, the payment period is 5 years and you will pay 12 times per month, the total number of payments will be N = 5 * 12 = 60.

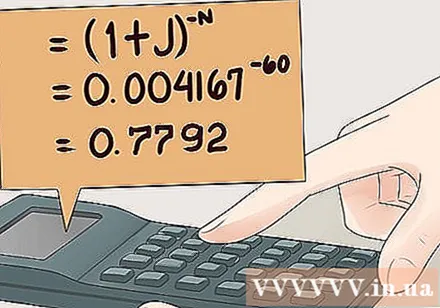

Calculate (1 + J). First add 1 + J, then the exponent "-N". Remember that there is a negative sign before N. If your computer can't calculate the negative sign, rewrite 1 / (((1 + J)).

- In our example, (1 + J) = (1,004167) = 0,7792

Calculate J / (1- (your answer). In a simple calculation, first calculate 1- the number you calculated in the previous step. Then divide J by the result, using the calculated effective rate J previously.

- In our example J / (1- (previous results)) = 0,01887

Calculate the amount to be paid monthly. Multiply the previous result by your loan P. The result will be the amount you have to pay each month to pay off your debt on time.

- For example, if you borrow 30 million dong (30,000,000). You will multiply the result in the last step by 30,000,000. Continuing our example: 0.01887 * 30,000,000 = 566.100 dong per month.

- This method applies to all currencies.

- If you calculate our example in 1 line using a calculator, you will get a more accurate result, nearly 566,137 VND. If we pay 566,000 and 100 dong per month as shown above, we will pay close to the deadline and will need a few tens of thousands more to pay off the debt (less than 100,000 in this case).

Method 3 of 3: Understanding the Principle of Loans

Find out whether loans have fixed-rate and adjustable-rate loans. Loans usually fall into one of these two categories. Make sure you understand what is applying to your loan:

- A loan "permanent" have constant interest rates. Your monthly loan payment will also be fixed as long as you pay it on time.

- Loan with interest "adjusted" This means that interest rates are periodically adjusted to match current interest rates, so you may end up with less or more debt if interest rates change. Interest is recalculated only during the “adjustment period” specified in the loan term. If you calculate the current interest rate a few months prior to the time of the adjustment, you can plan ahead.

Understand the principal repayment gradually. Gradual repayment of principal indicates a gradual decrease in the initial loan ratio (principal). There are two main types:

- Loan “installment installments”: you can pay a fixed amount each month for the life of the loan, paying both principal and interest. The examples and instructions given above all use this approach.

- "Interest only" lets you pay less during the "interest only" period, because the money you're paying is just the interest, not the "principal" you borrowed. After the interest period is over, your monthly payments will be higher because you are paying both principal and interest. In the long run, you'll have to pay more than the first.

At first pay a lot of money to save for later. Paying more money will help reduce your total debt and long-term borrowing costs, as interest rates will be lower. The earlier you pay, the more money you can save.

- On the other hand, paying less than scheduled will make you pay more. Also, some loans have a minimum monthly payment requirement, and you may be charged an additional fee for not paying the minimum amount.

Advice

- You can find the following formula to calculate your payout. These Results - These formulas are equivalent and give the same results.

Warning

- A "adjustable rate" loan or mortgage, also known as a "variable rate" or a "floating rate", can change your payments significantly if the rate rises sharply or falls sharply.

- The “adjustment period” of these loans tells you the frequency of the rate adjustment. To see if you can pay in bad situations, calculate your payout when interest rates hit "ceiling."