Author:

Roger Morrison

Date Of Creation:

19 September 2021

Update Date:

8 May 2024

Content

Most people are familiar with the concept of interest, but not everyone knows how to calculate it. Interest is the value added to a loan or an advance to pay for the use of someone else's money over a period of time. Interest can be calculated in three ways. Regular interest is the easiest to calculate and generally applies to short-term loans. Compound interest is a bit more complicated and worth more. After all, the continuous compounding of interest will grow the fastest and this is the formula that most banks use for mortgage loans. The information you need for all of these calculations is generally the same, but the math is a bit different for each.

To step

Method 1 of 3: Calculate simple interest

Determine the principal. The principal is the amount of money you will use to calculate the interest. This can be an amount that you deposit into a savings account or put into some kind of investment. In that case you can calculate the interest you earn. The alternative is that if you borrow money, such as for a mortgage, the principal is the amount you borrow, and you can calculate interest that you owe.

Determine the principal. The principal is the amount of money you will use to calculate the interest. This can be an amount that you deposit into a savings account or put into some kind of investment. In that case you can calculate the interest you earn. The alternative is that if you borrow money, such as for a mortgage, the principal is the amount you borrow, and you can calculate interest that you owe. - In either case, whether you are going to collect or pay interest, the amount of principal is generally symbolized by the variable P.

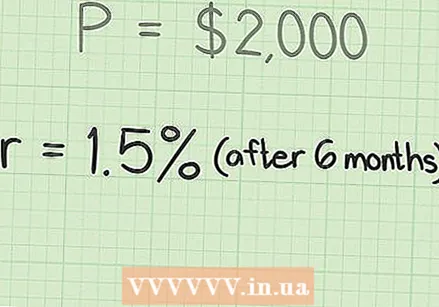

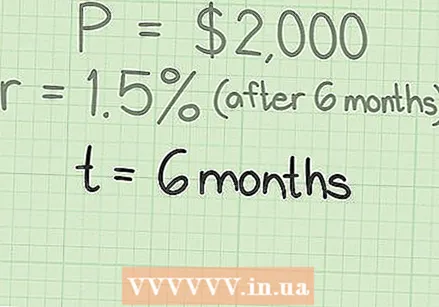

- For example, if you borrowed a friend of $ 2,000, that $ 2,000 will be the principal.

Determine the interest. Before you can calculate how much the principal will increase in value, you need to know the interest rate by which the principal will grow. That's your interest. The interest is generally advertised or agreed between the parties before the loan is made.

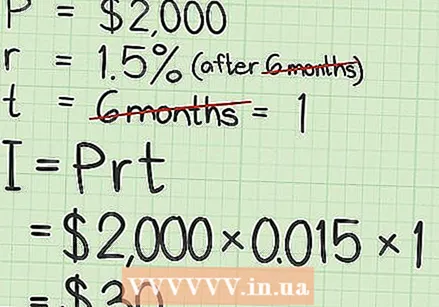

Determine the interest. Before you can calculate how much the principal will increase in value, you need to know the interest rate by which the principal will grow. That's your interest. The interest is generally advertised or agreed between the parties before the loan is made. - For example, suppose you have lent money to a friend under the agreement that he will pay back the $ 2,000 after six months at 1.5% interest. The one-off interest is 1.5%. But before you can use the 1.5% percentage, you have to convert it to a decimal. If you want to convert percent to a decimal, divide the percentage by 100:

- 1,5% ÷ 100=0,015.

- For example, suppose you have lent money to a friend under the agreement that he will pay back the $ 2,000 after six months at 1.5% interest. The one-off interest is 1.5%. But before you can use the 1.5% percentage, you have to convert it to a decimal. If you want to convert percent to a decimal, divide the percentage by 100:

Check the term of the loan. The term is another term for the term of the loan. In some cases, you agree to the term of the loan by borrowing the amount. For example: most mortgages have a fixed term. In many cases, with a private loan, the borrower and lender will agree to a previously agreed term.

Check the term of the loan. The term is another term for the term of the loan. In some cases, you agree to the term of the loan by borrowing the amount. For example: most mortgages have a fixed term. In many cases, with a private loan, the borrower and lender will agree to a previously agreed term. - It is important that the length of the term matches the interest rate, or at least be measured in the same units. For example: if it concerns an annual interest, your term must also be measured in years. If the rate is advertised as 3% per year, but the loan lasts only six months, then you calculate an annual interest rate of 3% over a 0.5 year period.

- Another example: if the agreed rate is 1% per month, and you borrow the money for six months, the term for the calculation is six months.

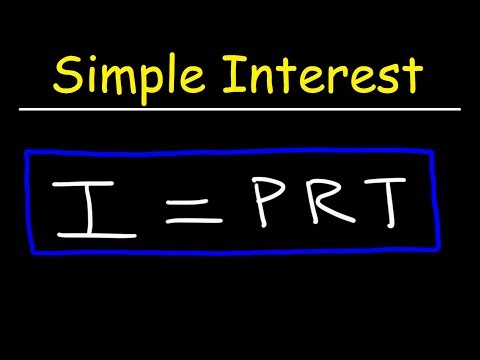

Calculate the interest. To calculate the interest, multiply the principal by the interest rate and the term of the loan. This formula can be expressed algebraically as:

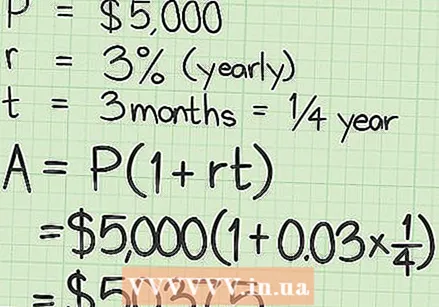

Calculate the interest. To calculate the interest, multiply the principal by the interest rate and the term of the loan. This formula can be expressed algebraically as:  Try another example. Suppose you deposit € 5000 in a savings account with an annual interest of 3%. After just three months, you withdraw the money, along with any interest.

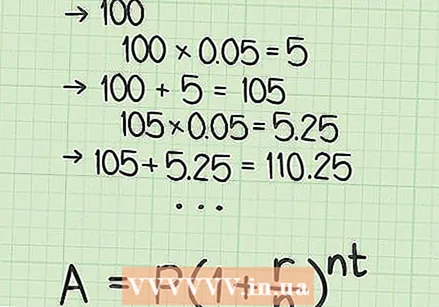

Try another example. Suppose you deposit € 5000 in a savings account with an annual interest of 3%. After just three months, you withdraw the money, along with any interest.  Understand compound interest. Compound interest means that by earning interest, the interest is added to the amount in your account and you start to earn (or pay) interest on top of the interest. A simple example: if you deposit $ 100 at 5% interest per year, you will have earned $ 5 interest at the end of a year. If you put that back into your account, you will have earned 5% of $ 105 by the end of the second year, not just the original $ 100. Over time, this can increase very significantly.

Understand compound interest. Compound interest means that by earning interest, the interest is added to the amount in your account and you start to earn (or pay) interest on top of the interest. A simple example: if you deposit $ 100 at 5% interest per year, you will have earned $ 5 interest at the end of a year. If you put that back into your account, you will have earned 5% of $ 105 by the end of the second year, not just the original $ 100. Over time, this can increase very significantly. - The formula for calculating the value (A) of the compound interest goes as follows:

Know what the principal is. As with simple interest, the calculation starts with the amount of the principal. The calculation is the same whether you are calculating interest on borrowed or lent money. The principal is generally denoted by the variable

Know what the principal is. As with simple interest, the calculation starts with the amount of the principal. The calculation is the same whether you are calculating interest on borrowed or lent money. The principal is generally denoted by the variable  Determine the percentage. The interest rate must be agreed before the loan is issued and shown as a decimal number for the calculation. Note that the percentage can be converted to a decimal by dividing it by 100 (or faster, shifting the decimal two places to the left). Make sure you know for which period the interest rate applies. The percentage has

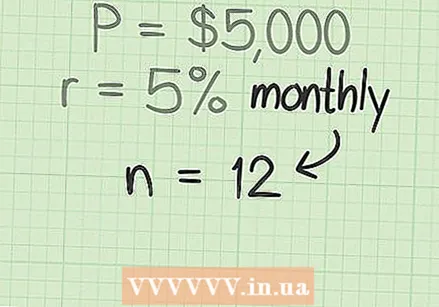

Determine the percentage. The interest rate must be agreed before the loan is issued and shown as a decimal number for the calculation. Note that the percentage can be converted to a decimal by dividing it by 100 (or faster, shifting the decimal two places to the left). Make sure you know for which period the interest rate applies. The percentage has  Know when the interest compoundes. Compounding interest means that the interest is calculated periodically and added back to the principal. For some loans this can be done once a year. For others, this is every month or quarter. You need to know how often each year interest will be compounded.

Know when the interest compoundes. Compounding interest means that the interest is calculated periodically and added back to the principal. For some loans this can be done once a year. For others, this is every month or quarter. You need to know how often each year interest will be compounded. - If interest is compounded annually, then n = 1 holds.

- If interest is compounded quarterly, then money n = 4.

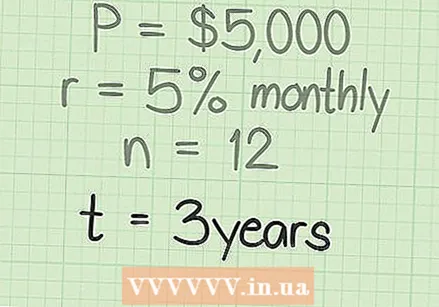

Know the term of the loan. The term is the period over which the interest will be calculated. The term is generally indicated in years. If you have to calculate the interest over another period, you have to convert it into years.

Know the term of the loan. The term is the period over which the interest will be calculated. The term is generally indicated in years. If you have to calculate the interest over another period, you have to convert it into years. - For example: with a loan for one year,

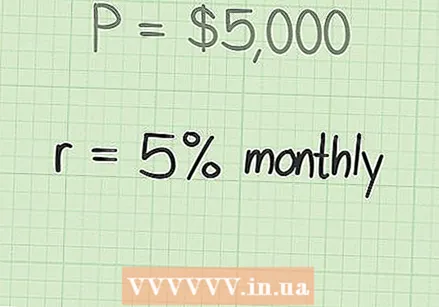

Determine the variables of the situation. In this example, suppose you deposit $ 5000 into a savings account with 5% compound monthly interest. What is the value of that account after three years?

Determine the variables of the situation. In this example, suppose you deposit $ 5000 into a savings account with 5% compound monthly interest. What is the value of that account after three years? - First determine which variables you need to solve the problem. In this case:

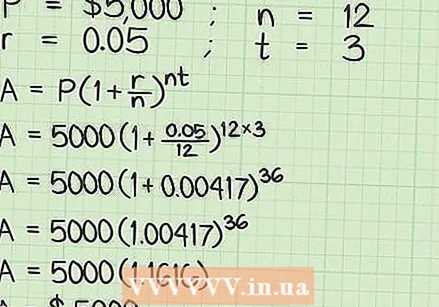

Apply the formula and calculate the compound interest. If you understand what needs to be done and which variables are needed, apply them to the formula to calculate the interest rate.

Apply the formula and calculate the compound interest. If you understand what needs to be done and which variables are needed, apply them to the formula to calculate the interest rate. - In the above problem, it looks like this:

Understand continuous compound interest. As you saw in the previous example, compound interest grows faster than simple interest by adding interest to the principal at specific times. Compiling quarterly is more valuable than annually. Compiling monthly is even more valuable than annual. The most profitable situation would be when interest rates are compounded constantly - that is, any time. As soon as interest can be calculated, it is added to the account and added to the principal. This is of course only a theoretical case.

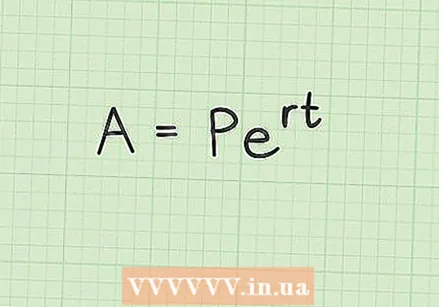

Understand continuous compound interest. As you saw in the previous example, compound interest grows faster than simple interest by adding interest to the principal at specific times. Compiling quarterly is more valuable than annually. Compiling monthly is even more valuable than annual. The most profitable situation would be when interest rates are compounded constantly - that is, any time. As soon as interest can be calculated, it is added to the account and added to the principal. This is of course only a theoretical case. - Using a little math, mathematicians have developed a formula for simulating interest that is compounded continuously and added to the bill. This formula, used to calculate accrued compound interest, is:

Know the variables for calculating interest. The recurring compound interest formula is very similar to the previous situations, but with a few minor adjustments. The variables for the formula are:

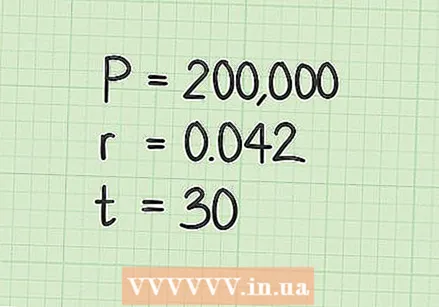

Know the variables for calculating interest. The recurring compound interest formula is very similar to the previous situations, but with a few minor adjustments. The variables for the formula are:  Know the details of your loan. Banks usually use recurring compound interest for mortgages. Suppose you want to borrow $ 200,000 at an interest rate of 4.2% for a 30-year mortgage. The variables you will use for this calculation are:

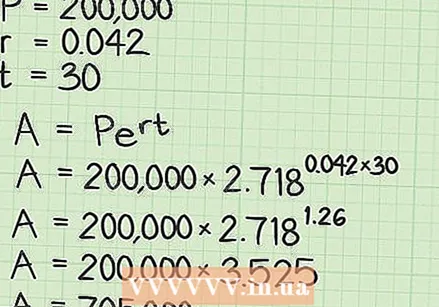

Know the details of your loan. Banks usually use recurring compound interest for mortgages. Suppose you want to borrow $ 200,000 at an interest rate of 4.2% for a 30-year mortgage. The variables you will use for this calculation are:  Use the formula to calculate the interest. Apply the values to the formula to calculate the amount of interest you will pay on the 30-year loan.

Use the formula to calculate the interest. Apply the values to the formula to calculate the amount of interest you will pay on the 30-year loan. - Note the tremendous value of continuous compound interest.

- Using a little math, mathematicians have developed a formula for simulating interest that is compounded continuously and added to the bill. This formula, used to calculate accrued compound interest, is:

- In the above problem, it looks like this:

- First determine which variables you need to solve the problem. In this case:

- For example: with a loan for one year,

- The formula for calculating the value (A) of the compound interest goes as follows: